UK Market: The UK stock market started the week on a weaker note amid forecasts of the economy hitting record inflation. At about 1 pm GMT+1, the benchmark FTSE 100 index was trading 0.25% lower, while the mid-cap-focused FTSE 250 slipped over 1.5%. This came as Citigroup's economists predicted that UK inflation is on course to hit 18% next year due to the surge in energy prices. The country's energy regulator Ofgem is to announce the price cap this week, which will be applicable from October.

Vodafone Group Plc (LON: VOD): Shares of the telecom giant slipped over 1% after it agreed on the potential sale of its Hungarian business for €1.8 billion to 4iG Public and Corvinus Zrt, a Hungarian state holding firm.

National Grid Plc (LON: NG.): Shares of the British utility firm gained nearly 1% during the day after it announced that households with a smart meter installed could be rewarded for turning off power-heavy appliances during peak hours in winters. The move may ease the strain on the power grid and prevent blackouts.

Wizz Air Holdings Plc (LON: WIZZ): Shares of the airline slumped almost 9% after it said its chief financial officer Jourik Hooghe will step down from the position. The role will be taken over by Ian Malin, who'll join the carrier on 1 October 2022.

US Markets: The US market is likely to start the week in red, as indicated by the futures indices. S&P 500 future was down by 55.26 points or 1.29% at 4,228.48, while the Dow Jones 30 future was down by 0.86% or 292.30 points at 33,706.74. The technology-heavy index Nasdaq Composite future was also down by 2.01% or 260.13 points, at 12,705.21. (At the time of writing – 8:43 am ET).

US Markets news

Shares of the leading healthcare platform Signify Health (SGFY) jumped 37.5% in the premarket trading session as the war for its potential bidding escalated. The company is to hold a board meeting on Monday to discuss the bids, news agency Reuters reported.

Shares of the housewares retailer Bed Bath & Beyond (BBBY) slumped 10.2% in the premarket trading session after news emerged that investor Ryan Cohen had sold his shares in the company.

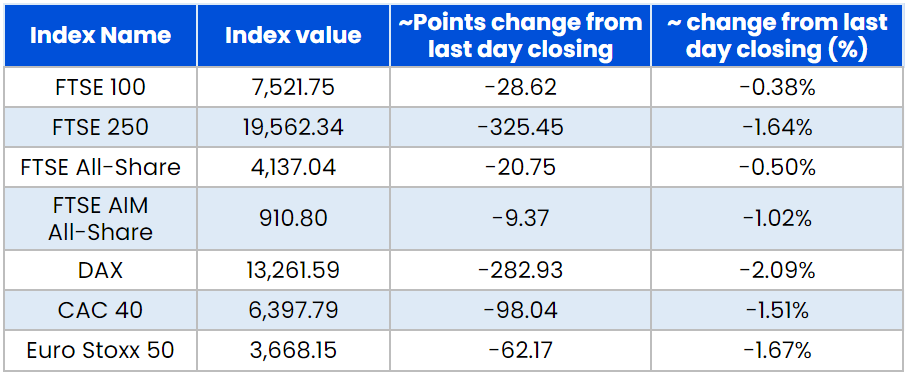

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 22 August)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Vodafone Group Plc (VOD), BP Plc (BP)

Top 3 sectors traded in red*: Real Estate (-2.00%), Consumer Cyclicals (-1.59%), Technology (-1.20%)

Top 3 sectors traded in green*: Healthcare (0.91%), Utilities (0.45%), Energy (0.19%)

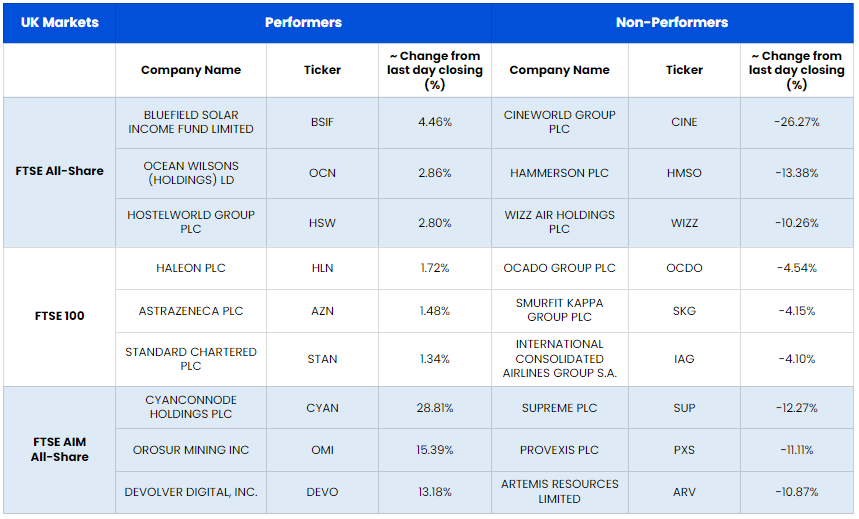

London Stock Exchange: Stocks Performance (at the time of writing):

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $96.15/barrel and $90.33/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,742.25 per ounce, down by 1.17% against the prior day closing.

Currency Rates*: GBP to USD: 1.1820; EUR to USD: 1.0002.

Bond Yields*: US 10-Year Treasury yield: 2.965%; UK 10-Year Government Bond yield: 2.5060%.

*At the time of writing

_08_22_2022_07_43_24_014211.jpg)