UK Market News: The UK stock market suffered a sharp sell-off on Monday, with the blue-chip FTSE 100 Index declining around 2%. Worries about interest rates and a tightening lockdown in China deepened investors’ fears that the global economy is rapidly heading for a slowdown. Glencore, Anglo, American and Rio Tinto were some of the index’s largest fallers.

Rightmove Plc (LON: RMV): The share of the UK-based real estate website was down by around 6%, with a day’s low of GBX518.80. The company announced the step down of its CEO, Peter Brooks-Johnson, after over 16 years with the company and five years as CEO.

Ideagen Plc (LON: IDEA): The share of the compliance-based information management software supplier rose by around 46.09%, with a day’s high of GBX 355.00. the company announced that it has agreed to a takeover by private equity firm Hg Pooled Management in an all-cash deal valuing the company at £1.09 billion.

Tower Resources Plc (LON: TRP): The share of the independent oil and gas company fell by around 27%, with a day’s low of GBX0.23. The company announced an update on activity in respect of its Thali Production Sharing Contract (PSC), in the Rio Del Rey sedimentary basin offshore Cameroon.

US Markets: The US market is likely to have a negative start, as suggested by the trading in futures indices. S&P 500 future was down by 23.53 points or 0.57% at 4,123.34, while the Dow Jones 30 futures was down by 0.30% or 98.60 points at 32,899.37. The technology-heavy index Nasdaq Composite future was down by 1.22% at 12,693.54 (At the time of writing – 8:50 AM ET).

US Market News:

Share of the software company that specializes in big data analytics, Palantir Technologies (PLTR) plunged 15.1% in the premarket trading session after the company reported a profit of 2 cents per share, compared to 4 cents a share consensus estimate. The company issued a softer-than-expected current-quarter revenue forecast.

Share of the electric vehicle automaker and automotive technology company, Rivian (RIVN) plummeted by 15.6% in the premarket trading session after it announced Ford Motor is selling 8 million of its 102 million share stake in the company. The move comes as the insider lockup period for selling the stock expires.

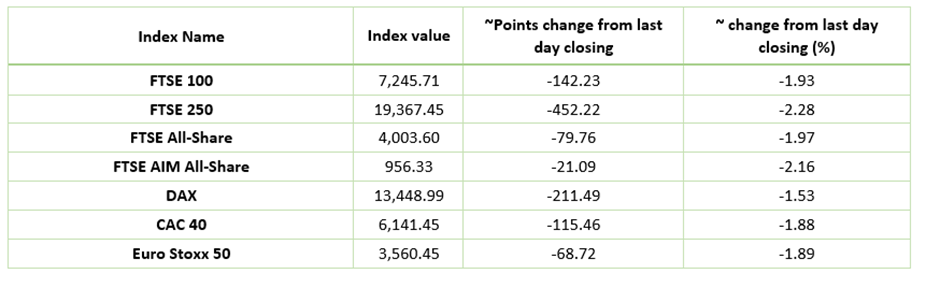

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 9 May 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), BP Plc (BP.) and International Consolidated Airlines Group S.A.

Top 3 Sectors traded in red*: Basic Material (-3.46%), Real Estate (-2.08%), Consumer Cyclicals (-2.08%)

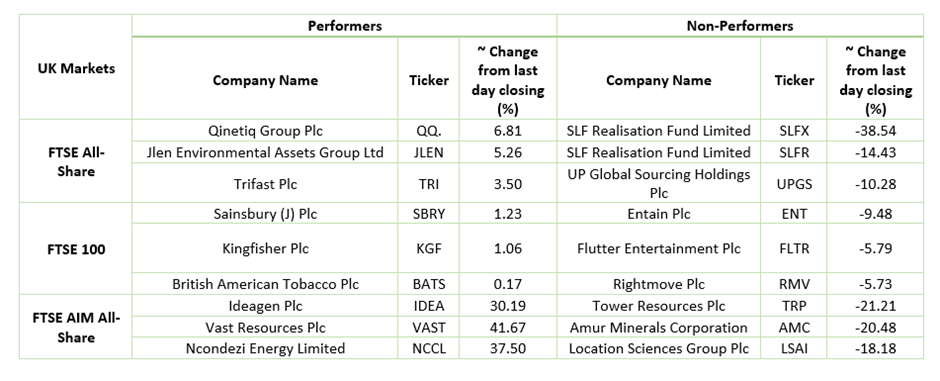

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $109.22/barrel and $106.40/barrel, respectively.

Gold Price*: Gold price was quoted at US$ 1,858.15 per ounce, down by 1.29% against the prior day’s closing.

Currency Rates*: GBP to USD: 1.2354; EUR to USD: 1.0544.

Bond Yields*: US 10-Year Treasury yield: 3.177%; UK 10-Year Government Bond yield: 2.0750%.

*At the time of writing