US Markets: Wall Street started marginally higher on Monday, 15 November, with the Dow Industrials briefly crossing 36,200, making an intraday high at 36,236.07. The upsurge in S&P 500 was slightly lower than the Dow Jones Industrial Average as a number of technology stocks cracked. The higher opening of Nasdaq Composite was short-lived as the tech heavy barometer slipped into the negative territory after opening moderately higher as shares of Tesla continued to decline, alongside the marginal plunge in shares of Microsoft.

The heavyweight shares of Nvidia and Netflix also dragged the index, while the stock of Boeing Company added more than 3% after the Chicago-headquartered airplane and satellite maker received an order worth equivalent to over $704 million for two 777 Freighters.

With the euphoria around major corporate earnings coming to an end, the market participants are now eyeing the upcoming macroeconomic developments, as well as the prospective actions taken by the leading central banks across the world including the commentary by the US Federal Reserve, the Bank of England and European Central Bank. ECB Chief Christine Lagarde is slated to deliver a speech during the current week, any chances of counter-protective measures to contain the rising rate of inflation will be keenly eyed.

Global Stocks were up marginally on Monday

The Euro Area, alongside Britain is slated to unveil a slew of macroeconomic data portraying the jobs activity, level of unemployment, quarterly change in the gross domestic product and inflation numbers for France and Italy and EA. The US Census Bureau is scheduled to unveil the retail sales for the month of October. Among the large-cap corporations, Home Depot and Walmart will be announcing the quarterly report card.

The Dow Jones Industrial Average gained 77.76 points, or 0.22% to 36,178.07, the wider share indicator S&P 500 added 4.58 points, or 0.10% to 4,687.43, while the tech leader Nasdaq Composite shed 14.40 points, or 0.09% to 15,846.56.

US Market News: Other than Boeing, shares of Visa, McDonald’s, American Express, Chevron and Travelers Companies emerged as the lead gainers among the prestigious pack of 30 shares constituting the Dow Industrials, effectively providing the majority of positive points to the index. While, the stocks of Amgen, Salesforce.com, Microsoft, Caterpillar and UnitedHealth Group cracked, partly offsetting the gains.

Shares of Dollar Tree topped the Nasdaq Composite with the stock rocketing nearly 14%. The gains were followed by shares of Facebook, eBay, Lam Research, Zoom Video Communications, Qualcomm, Regeneron Pharmaceuticals, Ross Stores, Copart and PayPal gaine 1-3%. On the other hand, the shares of Splunk (down 10.15%), CrowdStrike Holdings, Tesla, Electronic Arts, JD.com, Netflix, Pinduoduo Inc, Baidu and Moderna shed 0.70% to 8%, effectively counterbalanced the positive points provided by the lead gainers.

UK Markets: London markets struggled to reach the positive territory with the headline index FTSE 100 treading water as investors prepare to witness the potential aftereffects of a series of key data points to ascertain the extent of recovery in the months after the July-September quarter. The domestic benchmark FTSE 100 dropped 10.59 points, or 0.14% to 7,337.32, whereas the mid-cap barometer FTSE 250 gaine 70.08 points, or 0.30% to 23,627.60.

A gain of little more than 1% in the shares of AstraZeneca helped the benchmark index to offset some of the losses after the market capitalistion leader crashed approximately 7% on Friday last week following the subdued profit outlook for the rest of the year.

FTSE 100 (1-year performance)

Source: REFINITIV

Market Snapshot

Top 3 volume leaders: Lloyds Banking Group, Vodafone Group and M&G

Top 3 sectoral indices: Banking, Finance Services and Insurance

Bottom 3 sectoral indices: Automotive, Industrial Metals and Industrial Transportation

Crude oil prices: Brent crude down 1.12% at $81.25/barrel; US WTI crude down 1.02% at $78.88/barrel

Gold prices: An ounce of gold traded at $1,864.35, down 0.22%

Exchange rate: GBP vs USD - 1.3433, up 0.15% | GBP vs EUR - 1.1764, up 0.46%

Bond yields: US 10-Year Treasury yield - 1.608% | UK 10-Year Government Bond yield - 0.9530%

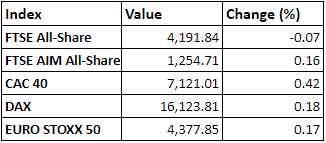

Markets @ 16:00 GMT