UK stock markets are likely to open lower on Tuesday, 22 December, following the weak global cues and recently disturbed domestic environment with the identification of a new strain of coronavirus. The European Union approving the Pfizer-BioNTech vaccine for the emergency usage could help the markets to gather some pace whereas the persisting Brexit trade deal dilemma is expected to retain the market-wide pessimism.

The benchmark index has been hovering near its 10-month highs of late and the GBP vs USD pair was oscillating around its 31-month peak. But the prolonged delay in obtaining a win-win situation with regards to a conclusive trade arrangement between the United Kingdom and the European Union has lowered the investors’ confidence.

European markets bleed

The freshly imposed curbs on international travel with over a dozen of countries banning the departure and arrivals to and from the United Kingdom and the immediate stoppage in the freight services has furthered the jittery amidst the market participants. On Monday, European markets witnessed a significant correction with all the major stock indices falling at least 1 per cent.

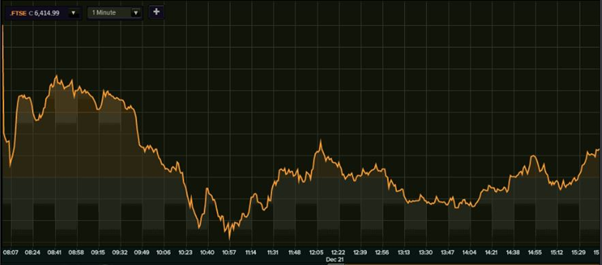

In Britain, the headline FTSE 100 index recovered marginally in the wee hours of closing. As per the London Stock Exchange data, the FTSE 100 that went down more than 3 per cent during the day finally ended 112.86 points or 1.73 per cent lower at 6,416.32. The wider share indices including the FTSE 250, FTSE 350, and FTSE All-Shares dropped 2.11 per cent, 1.80 per cent, and 1.78 per cent respectively at the close.

FTSE 100 (21 Dec)

(Source: Refinitiv, Thomson Reuters)

According to the data available with various stock exchanges, France’s CAC 40 ended at 5,393.34, down 134.50 points or, 2.43 per cent; Germany’s DAX settled at 13,246.30, down 384.21 points or, 2.82 per cent, Italy’s FTSE MIB finished at 21,410.51, down 565.61 points or, 2.57 per cent, Spain’s IBEX 35 concluded at 7,789.80 down 247.60 points or, 3.08 per cent, while the Switzerland’s SMI closed at 10,305.52 218.34 points or, 2.07 per cent.

GBP vs USD

The GBP to USD pair has seen a major spike in recent times with the value of pound sterling rocketing to a 31-month high level against the equivalent United States dollar. The US dollar has seen an extended weakness due to the lower-than-expected stimulus measures announced by the White House administration and the invariably spiralling coronavirus cases in the United States.

The greenback’s downfall against a basket of currencies has been a major reason for pound sterling’s appreciation in the present quarter. At around 0539 GMT, the pound sterling was hovering at 1.3393, down 0.52 per cent, Reuters data showed. Earlier on 18 December, the Bank of England fixed a spot exchange rate for the US dollar into pound sterling at 1.3485. In line with the dip in currency markets, the crypto-assets also took the beating with a unit of bitcoin trading at $22,799.67, down 4.25 per cent.

Commodity check

A global dejection for the equities is a prospective ground for the inclination towards the safe haven assets. The spot gold was trading at $1,880.38, up 0.22 per cent. A barrel of Brent crude was trading at $49.89, down 2.04 per cent, whereas the NYMEX crude oil was oscillating around $46.97, down 2.13 per cent, per barrel.