UK Market News: The stock market bounced back on Wednesday to hover near three-week high, with blue-chip index down by around 0.22% as oil and mining stocks leading the surge. The Office for National Statistics (ONS) has released inflation figures for June month, which indicates that Consumer Price Index (CPI) inflation has hit a fresh 40-years high of 9.4% as fuel and energy prices rocketed amid the cost-of-living squeeze. The BoE is expected to raise interest rate by 50 basis points in the August monetary policy meeting, which would take interest rates to 1.75% to 1.25%.

Royal Mail Plc (LON:RMG): The share of the postal service company, Royal Mail Plc fell by around 2.5%, with a day’s low of GBX 267.60. the company has reported it is losing £1 million a day amid union clashes. Its adjusted operating loss between April and June was £92 million and revenue fell by 11.5%.

WPP Plc (LON:WPP): The share of multinational communication company, WPP Plc jumped by over 1.5%, with a day’s high of GBX 865.60. This came after its US rival Omnicom Group reported second quarter earnings that beat analysts’ forecasts.

Costain Group Plc (LON: COST): The share of construction and engineering company, Costain Group Plc were up by 12.3%, with a day’s high of GBX 39.00. The company has reported higher than expected performance in the first half of the year, with revenue ahead of market expectations.

US Markets: The US market is likely to get a negative start, as indicated by future indices. S&P 500 future was down by 3.58 points or 0.06% at 3,934.61, while the Dow Jones 30 futures was down by 0.23% or 73.35 points at 31,753.70. The technology-heavy index Nasdaq Composite future was up by 0.21% at 12,274.44 (At the time of writing – 9:36 AM ET).

US Market News:

The share of an energy technology company Baker Hughes (BKR) tumbled by 6% in the premarket trading session, after the company reported second-quarter adjusted earnings of 11 cents per share, just half of what analysts had forecast.

The share of American multinational biotechnology company, Biogen (BIIB) gained 2.4% in premarket trading session, after reporting an adjusted profit of US$5.25 per share for the second quarter. It was above the consensus estimate of US$4.06.

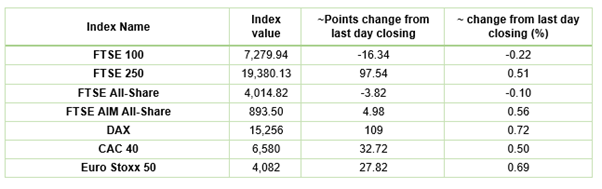

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 20 July 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), JD Sports Fashion Plc (JD.), Barclays Plc (BARC).

Top 3 Sectors traded in green*: Energy (0.74%), Consumer Cyclicals (0.40%) and Utilities (0.18%).

Top 3 Sectors traded in red*: Healthcare (-0.95%), Financials (-0.84%), Consumer Non-Cyclicals (-0.52%)

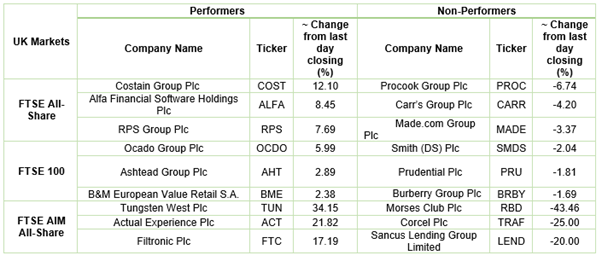

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $105.44/barrel and $98.84/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,706.65 per ounce, down by 0.26% against the prior day closing.

Currency Rates*: GBP to USD: 1.1986; EUR to USD: 1.0207.

Bond Yields*: US 10-Year Treasury yield: 2.965%; UK 10-Year Government Bond yield: 2.0800%.

*At the time of writing