UK Market News: The UK stock market fell on Friday, with the blue-chip FTSE 100 Index, which comprises global companies including miners and energy giants, dropping by almost a percent, with most of the sectoral indices in the red. The British Airways owner, International Consolidated Airlines Group, led the push in the blue-chip index, while a recession warning from the Bank of England also weighed on sentiment. The BoE had raised its inflation forecast to over 10% this year, its highest since 2009.

International Consolidated Airlines Group S.A. (LON: IAG): The share of the multinational airline holding company was down by around 7%, with a day’s low of GBX 125.88. The company reported a bigger than expected first-quarter operating loss of £624 million and scaled back plans to ramp up short-haul capacity at Heathrow airport.

4Imprint Group Plc (LON: FOUR): The share of the UK-based direct marketer of promotional merchandise was up by around 9%, with a day’s high of GBX 2,925. The company announced it expects operating profit for the full year 2022 to be above previously forecasted as revenues are on track to break above its long-awaited US$1 billion milestone.

SDI Group Plc (LON:SDI): The share of the optical products company was up by around 14%, with a day’s high of GBX173.50. The company announced it expects revenue and profits to exceed the previous expectations. It has anticipated pre-tax profit to grow to £10.5 million from £7.4 million in 2021.

US Markets: The US market is likely to have a sharply negative start, as implied by the futures indices. S&P 500 future was down by 153.30 points or -3.56% at 4,146.87, while the Dow Jones 30 futures was down by 3.12% or 1,063.09 points at 32,997.97. The technology-heavy index Nasdaq Composite future was down by 0.80% at 12,758.55 (At the time of writing – 8:50 AM ET).

US Market News:

Shares of the sports equipment company, Under Armour (UAA) were down by 12.5% in the premarket trading session after the company posted an adjusted first-quarter loss of 1% share, as compared with a profit estimate of 6% share. The company also lowered its outlook for full-year profit as it absorbs the impact of higher costs and supply chain disruptions.

Shares of the multinational managed healthcare and insurance company, Cigna (CI) were up after it reported an adjusted quarterly profit of US$6.01 per share, compared with a US$5.18 consensus estimate. It also reported higher revenue as compared to analyst forecasts, driven by strong growth in its pharmacy benefits management business, among other factors.

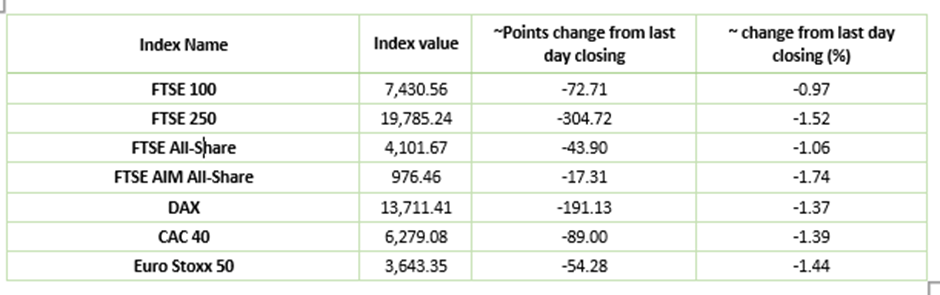

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 06 May 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), International Consolidated Airlines Group S.A. (IAG) and BP Plc.

Top 3 Sectors traded in green*: Energy (0.98%).

Top 3 Sectors traded in red*: Real Estate (-4.75%), Technology (-3.69%) and Consumer Cyclicals (-2.97%)

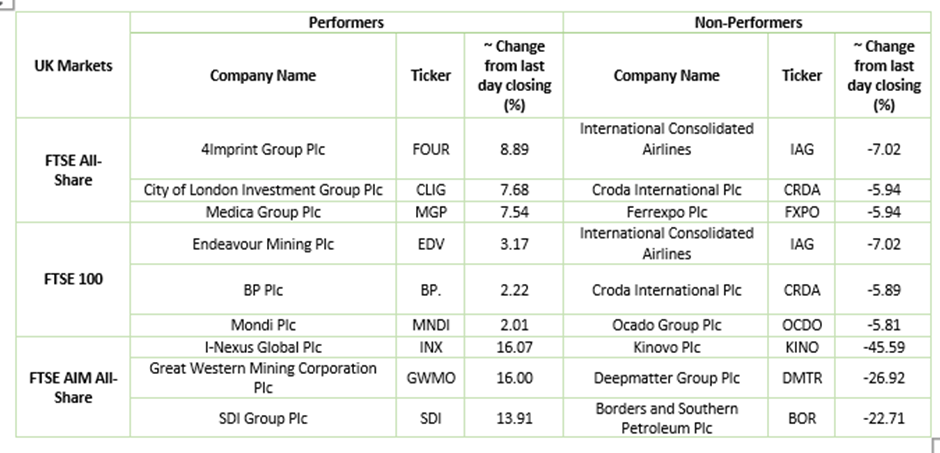

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $113.13/barrel and $110.33/barrel, respectively.

Gold Price*: Gold price was quoted at US$ 1,883.91 per ounce, up by 0.43% against the prior day’s closing.

Currency Rates*: GBP to USD: 1.2338; EUR to USD: 1.0574.

Bond Yields*: US 10-Year Treasury yield: 3.089%; UK 10-Year Government Bond yield: 1.9590%.

*At the time of writing

.jpg)