Global Markets*: On hopes of monetary stimulus, stocks in the United States were trending higher, with the broader index S&P 500 extended up by 6.33 points or 0.22% to 2,985.04, the Dow Jones Industrial Average Index added 92.50 points or 0.35% to 26,889.96, and the Nasdaq Composite index increased about 12.85 points or 0.16% to 8,117.48, respectively.

Global News: After the new Saudi energy minister, Prince Abdulaziz bin Salman, confirmed that the country would not undertake a radical change in policy, oil prices rose on Monday, as he indicated a global deal to cut oil output by 1.2 million barrels per day would survive. Since 2016, during autumn, as the mortgage rates have contracted to their lowest levels, Fannie Mae stated on Monday that the US consumer sentiment about buying a home ticked up in August. After expectations of monetary stimulus from central banks increased due to mixed global economic data, equity opened higher for the fourth straight session on Monday.

European Markets: The Londonâs broader equity benchmark index FTSE 100 traded at 46.53 points or 0.64% lower at 7,235.81, the FTSE 250 index snapped 27.07 points or 0.14% lower at 19,678.45, and the FTSE All-Share Index ended 22.02 points or 0.55% lower at 3,976.16 respectively. Another European equity benchmark index STOXX 600 ended at 386.06, down by 1.08 points or 0.28 per cent.

European News: The spokesman for Prime Minister Boris Johnson said that at the end of business on Monday, the British parliament will be suspended until the middle of next month, calling for MPs to vote for a snap election which Mr Johnson will call on Monday as the PM will not sanction any more delays to Brexit. In his visit to Ireland, Mr Johnson said that he undeterred by an attempt by MPs to block a no-deal Brexit in the parliament, while Irish PM Leo Varadkar said that if there is to be any chance of averting a no-deal Brexit, the PM must propose specific alternatives on the future of the Irish border. The Office for National Statistics reported on Monday that the British economy picked up more than expected in July, as economic output in July alone was 0.3% higher than in June.

London Stock Exchange (LSE)

Top Performers*: INTU PROPERTIES PLC (INTU), LUCECO PLC (LUCE) and CAPITAL & REGIONAL PLC (CAL) are top performers of the day and up by 10.03%, 9.77% and 6.61% respectively.

Worst Performers*: HOCHSCHILD MINING PLC (HOC), PENDRAGON PLC (PDG) and FULLER, SMITH & TURNER PLC (FSTA) are the top three laggards of the day and down by 5.58%, 4.91% and 4.88% respectively.

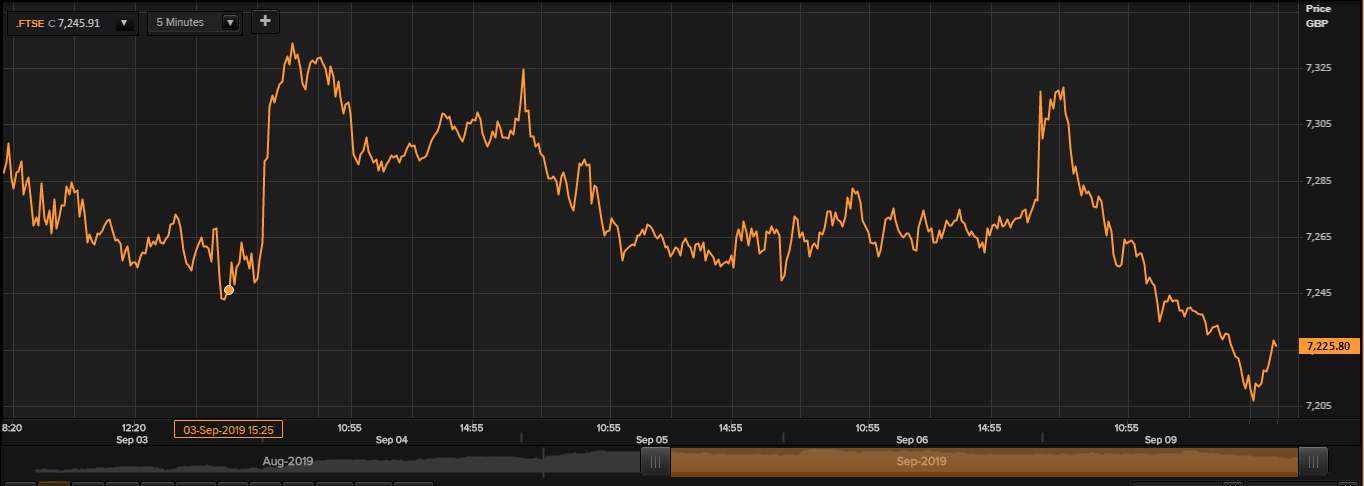

FTSE 100 Index

FTSE 100 Index Chart: 5-days Price Performance (as on September-09-2019), before the market closed. (Source: Thomson Reuters)

Performers*: AVIVA PLC (AV.), CARNIVAL PLC (CCL) and PRUDENTIAL PLC (PRU) are the top three gainers in todayâs session and up by 2.61%, 2.16% and 1.99% respectively.

Laggards*: RENTOKIL INITIAL PLC (RTO), ASTRAZENECA PLC (AZN), and COCA-COLA HBC AG (CCH) are top laggards at the FTSE 100 index and down by 3.93%, 3.60% and 3.56% respectively.

Active by Volume*: LLOYDS BANKING GROUP PLC (LLOY), BARCLAYS PLC (BARC), and BT GROUP PLC (BT.A).

Top Performing Sectors*: Financials (+0.47%), and Energy (+0.42%).

Worst Performing Sectors*: Healthcare (-2.97%), Consumer Non-Cyclicals (-1.90%), and Utilities (-1.73%).

FX Rates (at the time of writing): GBP/USD and EUR/GBP were trading at 1.2353 and 0.8950 respectively.

10-Year Bond Yields (at the time of writing): US 10Y Treasury and UK 10Y Bond yields were exchanging at 1.615% and 0.584% respectively.

*At the time of writing