Global Markets: Equity indices at the Wallstreet were trading in mix, with the S&P 500 index was quoting at 3,014.5, marginally above the yesterdayâs closing level, the Dow Jones Industrial Average Index declined 98.99 points or 0.36% and quoting at 27,250.20 and the technology benchmark index Nasdaq Composite added 66 points or 0.80% in dayâs session and quoting at 8,317.42 respectively, at the time of writing.

Global News: During a congressional hearing regarding the Russia investigation, former US Special Counsel Robert Mueller on Wednesday dismissed a claim by President Donald Trump that he had been totally exonerated and said he had not cleared him of obstruction of justice. US Federal Trade Commission ruled that Facebook will have to shell out a record $5 billion to resolve an investigation into privacy violations, an amount deemed too small by critics, and the company will restructure its approach to privacy. US Treasuries yields declined in line with yield in European government debt as it was reported that the Eurozone business growth was weaker than expected in July, fuelling expectations of an expansionary policy by European Central Bank.

European Markets: The Londonâs broader equity benchmark index FTSE 100 traded at 55.40 points or 0.73% lower at 7,501.46, the FTSE 250 index snapped 35.44 points or 0.18% higher at 19,787.78, and the FTSE All-Share Index ended 23.86 points or 0.58% lower at 4,100.36 respectively. Another European equity benchmark index STOXX 600 ended at 391.73, up by 0.19 points or 0.05 per cent.

European News: Boris Johnson took office as the latest British prime minister on Wednesday, entering office at one of the most challenging junctures in post-World War Two British history. He has repeatedly vowed to lead Britain out of the European Union on Oct. 31 with or without a deal, setting up for a showdown with the EU and potentially thrusting the country towards a constitutional crisis. Investors worried for economic growth after amid a potential no-deal Brexit and the effect of a global slowdown, sinking the British five-year government bond yields to their lowest since September 2017.

London Stock Exchange (LSE)

Top Performers Stocks: SPORTS DIRECT INTERNATIONAL PLC (SPD), APTITUDE SOFTWARE GROUP PLC (APTD), and INDIVIOR PLC (INDV) surged by 11.47 per cent, 9.09 per cent and 8.07 per cent respectively.

Top Laggards Stocks: ASTON MARTIN LAGONDA GLOBAL HOLDING (AML), PETRA DIAMONDS LD (PDL), and MARSTON'S PLC (MARS) decreased by 25.91 per cent, 22.67 per cent and 11.99 per cent respectively.

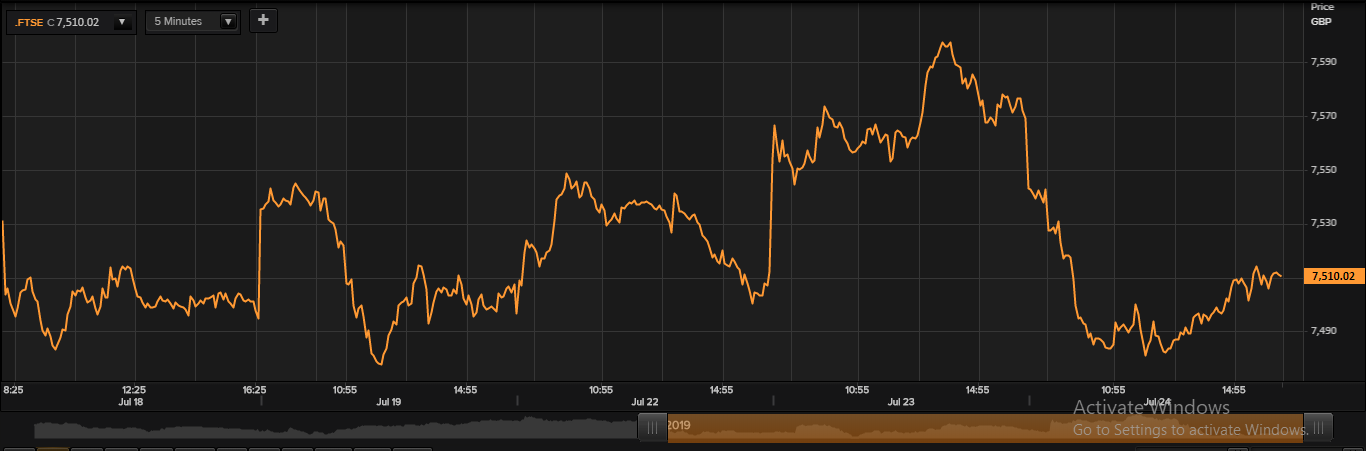

FTSE 100 Index

FTSE100 Index: 5-days Price Chart (as on July 24, 2019), after the market closed. (Source: Thomson Reuters)

Top Risers Stocks: ITV PLC (ITV), INFORMA PLC (INF) and TAYLOR WIMPEY PLC (TW.) rose by 6.59 per cent, 6.53 per cent and 3.86 per cent respectively.

Top Fallers Stocks: RIO TINTO PLC (RIO), STANDARD CHARTERED PLC (STAN) and BHP GROUP PLC (BHP) reduced by 4.60 per cent, 4.51 per cent and 4.00 per cent respectively.

Top Active Volume Leaders: LLOYDS BANKING GROUP PLC, VODAFONE GROUP PLC, and BP PLC.

Top Risers Sectors: Consumer Cyclicals (+0.92%), Technology (+0.82%) and Telecommunications Services (+0.44%).

Top Fallers Sectors: Basic Materials (-3.14%), Consumer Non-Cyclicals (-0.94%) and Financials (-0.91%).

Foreign Exchange and Fixed Income

FX Rates*: GBP/USD and EUR/GBP were exchanging at 1.2482 and 0.8919 respectively.

10-Year Bond Yields*: US 10Y Treasury and UK 10Y Bond yields were trading at 2.052% and 0.677% respectively.

*At the time of writing