Business overview: Smith & Nephew PLC

London-based Health Care Equipment Company, Smith & Nephew Plc (LON: SN.) is engaged in the business of manufacturing and distribution of healthcare devices for application in orthopaedic reconstruction and trauma, sports medicine and advanced wound management. A global leader tag helps the company to increase its visibility and maintain its competitive position. The group has been a global medical technology company since the last 160 years.

The key offerings of the group are hip and knee implants, products for correcting bone deformities and stabilise chronic fractures. The company is an industry leader in hip & knee implants, sports medicine and advanced wound management markets. A strong market position increases the confidence of customers in the companyâs products and establishes its brand image, which makes it easier to introduce new products.

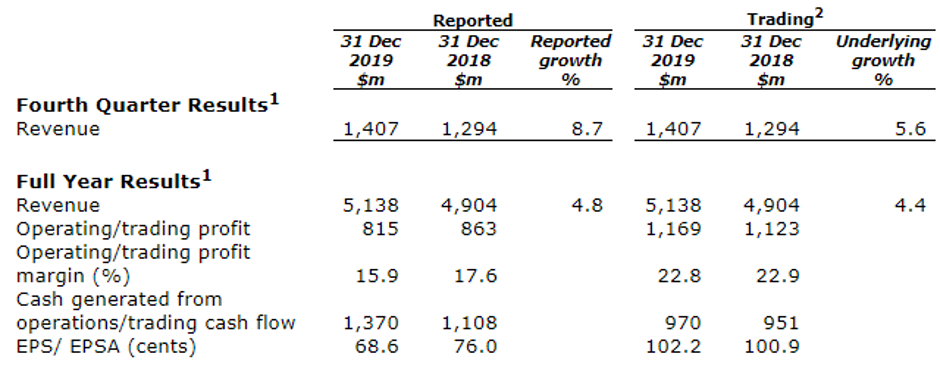

Smith & Nephew reported Q4 & FY19 results

(Source: Companyâs filings, London Stock Exchange)

On 20th February 2020, the global medical technology business reported results for the period ended 31st December 2019. The companyâs revenue growth (underlying) was of 4.4 per cent to $5,138 million in the fiscal year 2019 as compared to $4,904 million in the fiscal year 2018. The companyâs revenue growth (underlying) was up by 5.6 per cent to $1,407 million in the fourth quarter of the fiscal year 2019 as compared to $1,294 million in the fourth quarter of the fiscal year 2018. The reported operating profit of the company was recorded at $815 million in the fiscal year 2019 as compared to $863 million in the fiscal year 2018. Led by Sports Medicine & ENT (7 per cent), and Emerging Markets (16.1 per cent), all global franchises and regions positively contributed to growth. The cash generated from operations was $1,370 million in the financial year 2019 as compared to $1,108 million in the financial year 2018. The annual dividend of the company was up by 4 per cent to 37.5 cents per share.

The Underlying revenue growth is expected to be in the range of 3.5 per cent to 4.5 per cent in the financial year 2020. The companyâs trading profit margin is expected to be greater than achieved in FY19. The expected Tax rate on trading results is likely to be in the range of 18.5 per cent to 19.5 per cent in the financial year 2020. The outlook assumes normalisation of COVID-19 outbreak situation in early Q2 FY20.

Smith & Nephew PLC -Stock price performance

(Source: Thomson Reuters)

While writing (as on 21st February 2020, at 09:32 AM GMT), Smith & Nephew PLCâs shares were trading at GBX 1,936 per share. The companyâs market capitalisation was around £17.37 billion.

Smith & Nephew PLCâs shares have clocked a high of GBX 2,023.00 (as on 20 February 2020) and a low of GBX 1,417.00 (as on 28 February 2019) in the past year.

At the time of writing, the stockâs volume before the market close stood at 416,291. Stock's average daily traded volume for 5 days was 2,180,748.40; 30 days- 1,648,933.27 and 90 days â 1,963,681.82. The companyâs stock beta (180 days) was 0.46, which makes it less volatile as against the benchmark index. It has a dividend yield of 1.44 per cent.

The stockâs average daily traded volume for 5 days surged by 32.25 per cent as against 30 days average traded volume. At the time of writing, the shares of the company were trading above the 30-days and 60-days SMA.

In the past 1 month, Smith & Nephew PLCâs shares have delivered a positive return of 4.74 per cent. Also, on a YTD (Year-to-Date) time interval, the stock surged by approximately 7.99 per cent and was up by 19.79 per cent in the last three months.

Share's RSI (Relative Strength Index) for the 30-days, 14-days and 9-days was recorded at 62.13, 69.56 and 76.45 respectively. Also, the stockâs 3-days RSI was recorded at 95.99.

Â

Business overview: Taseko Mines Ltd

The North American focused copper producer and developer, Taseko Mines Ltd (LON:TKO) has substantial assets in both Canada and the United States.

The world-class Gibraltar Copper Mine, the Company's flagship asset, has an expected life of 19 years with 2.6 billion pounds of copper deposits and 594 million tons of mineral reserves. Gibraltar Copper Mine has a skilled and efficient workforce, and access to modern amenities & infrastructure which complements its low-cost structure.

The Florence Copper Project in Arizona, owned by Taseko Mines, has the potential to transform Taseko's production profile, and could possibly redefine the cost structure and can reduce per-unit costs of the company in the approaching years. The Florence Copper Project has an expected life of 20 years with post taxation net present value (NPV) of US$670 million calculated at 8 per cent and an internal rate of return (IRR) of 40 per cent. The companyâs share trade under the ticker symbol TKO and is listed on the Main Market of London Stock Exchange.

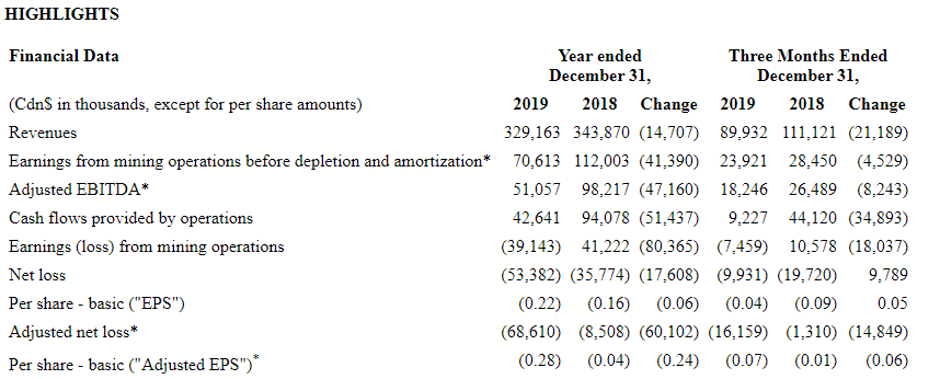

(Source: Companyâs filings, London Stock Exchange)

On 21st February 2020, Taseko Mines released financial results for the period ended 31st December 2019. The companyâs revenue decreased to C$ 329,163 thousand in the fiscal year 2019 from C$ 343,870 thousand in the fiscal year 2018. The Net loss of the company for the year 2019 stood at C$53.4 million. The companyâs earnings from mining activities (excluding depletion and amortization) were C$70.6 million in the fiscal year 2019. The companyâs Adjusted EBITDA stood at C$51.1 million during 2019. The companyâs capital expenditures for the year 2019 totalled at C$50.8 million, and the Cash flows from operations was C$42.6 million. The companyâs Cash balance was $53 million as on 31st December 2019, $8 million higher than the Cash balance held at the end of FY18.

The companyâs revenue was recorded at C$ 89,932 thousand in the fourth quarter of the fiscal year 2019. The companyâs fourth quarter earnings from mining activities (excluding depletion and amortization) were C$23.9 million, and Adjusted EBITDA was C$18.2 million.

Taseko Mines Ltd -Stock price performance

(Source: Thomson Reuters)

While writing (as on 21st February 2020, at 09:36 AM GMT), Taseko Mines Ltdâs shares were trading at GBX 42.50 per share. The companyâs market capitalisation was around £80.99 million.

Taseko Mines Ltdâs shares have clocked a high of GBX 50.00 (as on 10 January 2020) and a low of GBX 32.64 (as on 29 November 2019) in the past year. Stock's average daily traded volume for 5 days was 5,807.20.

On a YTD (Year-to-Date) time interval, the stock surged by approximately 30.77 per cent. However, in the last one month, the stock has plunged 10.54 per cent. Share's RSI (Relative Strength Index) for the 30-days, 14-days and 9-days was recorded at 60.26, 36.25 and 16.07 respectively.