Highlights

- Stablecoins are cryptos that offer price stability and derive its market value from an external reference.

- As Bitcoin continued to struggle, the overall stablecoin market cap hit the US$185,618,739,433 with total sales volume of US$76,270,268,921 on 24 February, according to CoinGecko.

- In fact, in just past 30 days, the total supply stablecoins was up by 5.78% and was placed at US$184.53 billion and volume of over US$947.59 billion, according to CryptoRank.

The Russia-Ukraine crisis has affected the cryptocurrency market severely, with several cryptos witnessing huge losses. In fact, the cryptocurrency market has been in a volatile state for quite some time and the latest development of Russia invading Ukraine has just worsened the situation with Bitcoin sinking to US$35266 at the time of drafting.

And not just Bitcoin, almost top 200 cryptos by market cap are registering red on 24 February. As Bitcoin continued to struggle, the overall stablecoin market cap hit the US$185,618,739,433 mark with total sales volume of US$76,270,268,921 according to CoinGecko. In fact, in just past 30 days, the total supply stablecoins was up by 5.78% and was placed at US$184.53 billion and volume of over US$947.59 billion according to CryptoRank.

Also read: Now you can buy NFTs at brick-and-mortar store. See how

Performance so far

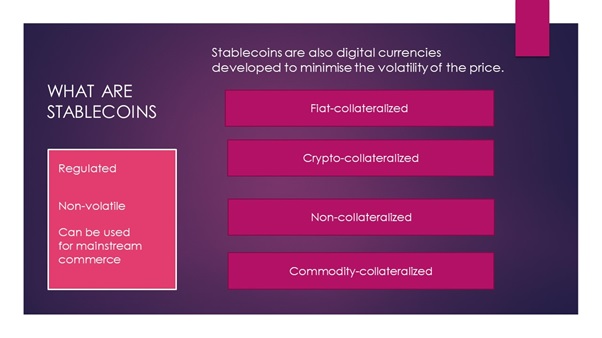

Stablecoins are cryptos that offer price stability and derive its market value from an external reference. Stablecoins are cryptos that offers price stability and derives its market value from an external reference. Stablecoins value is backed by assets, such as commodities, currencies etc. Over the years, they have gained popularity as they combine the features of safety and stability, unlike cryptos, which are volatile in nature.

© 2022 Kalkine Media®

In fact, stablecoins this year have done extremely well compared to other leading cryptos. According to the Arcane Research report, February has been favourable with leading stablecoins such as Tether, USD, Binance USD accounting for 9% of the total crypto market cap.

The Arcane Research further noted that Tether enjoys a 44% market share, followed by USD Coin (29%), and Binance USD (20%). In fact, in Venezuela, the stablecoin usage has helped citizens protect their livelihoods. The Reserve stablecoin helps the Venezuelans not only conduct their day-to-day purchasing, but its use cases are growing in the Latin American region.

Also read: How Manchester City’s metaverse plan can be a gamechanger

Questions around stablecoins

While this may sound like the perfect go-to digital asset in terms of crypto volatility, several questions have been raised about its risks. In fact, Securities and Exchange Commission Chairman Gary Gensler had called stablecoins “poker chips”, suggesting that in the long run, they will struggle to maintain enough collateral for the assets, posing a risk to the entire financial system’s stability.

In fact, UK and US regulators have taken a grim view of the stablecoin theory in terms of maintaining price stability. A US Treasury report suggested that stablecoins expose investors to fraud.

Conclusion

Overall, just like the crypto market has grown despite the risks, the recent report indicates that stablecoin market is growing against all odds. However, one needs to be very careful, especially in such a current volatile situation. In any given situation, the investors should do in-depth research before putting in their hard-earned money.