Inflation rate in the United Kingdom fell to its lowest for more than three years in December. The development has raised speculation in the financial circle that interest rates could be cut.

Let us delve deep into the issue and figure out what exactly does it mean for the nationâs economy on the whole.

Inflation Rate

Inflation is generally said to be the constant rise in prices of products and services over a long period. This is primarily due to the devaluation of the currency, or reduction in the purchasing power of consumers through that particular currency. For example, in the United Kingdom in the 1980s, if you had to spend £1 to buy a product, you will have to pay way more than £1 to buy the same product today. Hence, inflation primarily causes a rise in the prices of products and services over a period of time and increases the cost of living for households.

The inflation rate is the rate of increment or decrement in prices during a certain period, normally a month or a year. The rate reveals, how rapidly or slowly, prices of products and services rose in the market during that particular period.

Economists believe that not all inflation is bad. On the macroeconomic level, some inflation is a good parameter for the economy on the whole. A nominal rate of inflation is viewed as roughly lying between 2 per cent to 3 per cent on a yearly basis. The objective for inflation (which is estimated by the Consumer Price Index, or CPI) is to outpace the development of the underlying economy which is generally gauged by using the parameter of Gross Domestic Product (GDP) or Gross Value Added (GVA) during the year. Bank of Englandâs (BOE) current aim of inflation was keeping it at 2 per cent, which it has not been able to meet as per the current data.

Consumer Price Indices and Inflation Figures

Consumer Price Indices are significant markers of how the United Kingdom economy is performing. The indices are utilised in a large number of ways by the administration and government, organisations and society in general. They can influence interest rates, tax structures, salaries, state incentives, annuities and pensions, maintenance, contracts and numerous different payments. They mainly also show the effect of inflation on family finances and budgets.

Consumer Price Inflation is the rate at which the costs of the goods and services purchased by householdsâ surge or go down. It is assessed by measuring the consumer price indices. One approach to comprehend a price index is to think about an enormously big shopping container that includes every one of the products and services purchased by a family. The price index gauges change to the total expenses from this container. Most of the Office for National Statistics (ONS) price indices are published on a monthly basis.

Factors that impact Inflation Rates

Economists are of the view that the following are the major factors that can have an impact on the inflation rates in an economy:

- The Money Supply â One of the biggest reasons for Inflation in the economy is when the money supply exceeds economic growth. When money supply increase in an economy, especially beyond what the economic growth is, it reduces the value of money, leading to the devaluation of the currency. This also puts more money in the hands of the consumers, who tend to pay higher prices for products and services, eventually leading the inflation to rise.

- Macroeconomic Debt Levels â A rise in Debt level for the state (or economy), causes the government to take action on two fronts to repay the debt. One option is to increase taxes or raise the money supply. Increasing taxes obviously leads to a devaluation of currency and an increase in taxes leads to the businesses to increase prices for their products, which causes inflation in the economy.

- Demand-Pull Effect â This effect basically states that when the wages rise in an economic system, it leads to increase in demands of products, which further leads to increase in the prices of those products.

- Cost-Push Effect â As per this theory, when the companyâs cost base increases, they are forced to push these increase in costs to the consumers by increasing the prices of their products to generate an equivalent amount of profit, which gradually builds up and increases the inflation rates.

- Interest Rates â One of the most important factors that impacts the inflation rates is Interest rates, when interest rates are down, people borrow more money, which allows them to spend more money on goods and services, leading to a rise in inflation, while on the other hand, an increase in interest rates makes people borrow less money, which means they would have lesser money to spend, and hence would result in a decline in the inflation rates. Central banks across the world use this methodology to push or pull inflation rates towards their targets.

The Latest news on the Consumer Price Inflation in the United Kingdom

On 15th January 2020, the Office of National Statistics (ONS) released its monthly review of the Consumer Price Inflation in the United Kingdom for the month of December.

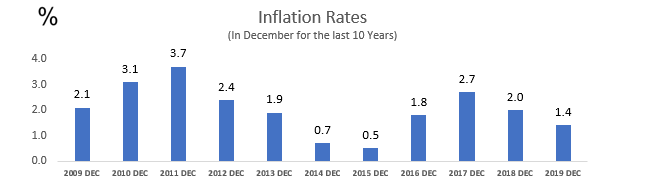

Source: Office for National Statistics (ONS)

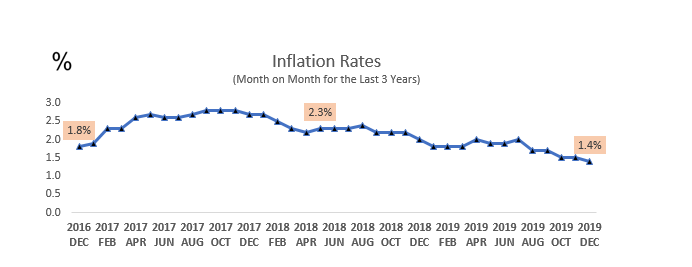

Source: Office for National Statistics (ONS)

The report primarily highlighted that Consumer Prices Index including owner occupiersâ housing costs 12 month inflation rate was measured at 1.4 per cent in the month of December 2019, a fall of from 1.5 per cent, that was measured in the month of November 2019. As per the report, Utilities, as well as fuels, were the major contributors towards CPIH 12-month inflation rate in the month of December. Clothing and accommodation services provider saw the biggest decline in terms of their contribution. This was previously anticipated by experts because of the poor performance of retail sector and closing down of a number of high street brands, as well as due to the festivities; the consumers did not spend much on accommodation or travel during the period. This marks the weakest performance in terms of Inflation Rates by the UK economy in the last three years, falling to the rate of 1.4 per cent for the first time during this period.

There are a number of reasons why the consumers are currently not spending, the top of which is the risk around Brexit which is causing the consumers to be wary of any impact that a hard deal or a no- deal scenario might cause in the future. Another important factor during the period was the snap election announcement, which made the consumers around the economic policies of the new government, causing a major economic weakness during the Christmas and New Year festivities.

Now, the ball is in the Bank of Englandâs court, and it is up to them to create a stimulus in the economy so that consumers can start spending again and the demand for products and services could increase. Experts believe that the Bank of England could announce an interest rate cut sometime soon, which could enable the consumers as well as the businesses to borrow money easily, hence increasing the spending capacity, which could lead to an increase in demands as well, especially in the retail sector.

Conclusion

Itâs very clear that December, as well as 2019 as a whole, has been a difficult period for the United Kingdomâs economy, being marked by a below-average as the inflation fell to a three-year low. However, economists and various other industry experts believe that this can be an end to the tough environment, primarily because of two major reasons; the first would be the countryâs formal exit from the European Union by 31st January 2020, which is looking imminent, after a deal was agreed between 10 Downing Street and the European administrators in the month of December. It will be a major boost in consumer confidence. Another factor is the improvement in the geo-economic environment, as the phase one of the trade deal between United States of America and China has been agreed, which will also ease out the business environment for various Multinational Corporations in the UK. Also, with investors being attracted to some of the sectors in the UK, such as Automotive and Technology, are the biggest reasons behind a positive outlook towards the United Kingdom economy in 2020.

_07_02_2025_00_23_12_199043.jpg)