WH Smith Plc

WH Smith Plc (LON:SMWH) is a UK based company that is into the retail business. The company was incorporated in the year 1792 and is headquartered in Swindon, the United Kingdom. The company operates worldwide in the United Kingdom, the Middle East, Australia, South-East Asia and India being the major markets. The company has two core businesses being the Travel business & High Street business. The Travel business operates 867 units and offers news, books & convenience for travelling customers. It operates mainly in airports, railways stations, hospitals, workplaces and motorway service areas. The High Street business sells a variety of products which are divided into categories: Stationary, Books, and News and Impulse and few entertainment products in some stores. The business has 607 stores across the UK. The company has 14,000 employees primarily in the UK.

The shares of the company are listed for trading on the London Stock Exchange in its main premium market. There the shares are identified and traded under the ticker name SMWH. There the shares of the company also form part of the FTSE 250 index.

Trading Update.

The company on 22 January 2020 came out with a trading update on its performance in the first 20-week period of the current financial year of 2019-20.

- The revenues earned by the company during the period have shown an increase of 7 per cent.

- Like-for-like revenue was down 1% for the 20-week period.

- During the period the company also saw the successful acquisition of Marshall Retail Group (MRG). with the integration process with the rest of company coming along smoothly.

Performance on the London Stock Exchange

Source â Thomson Reuters

At the close of trading on 22 January 2020 the shares of the company were trading on the London Stock Exchange for GBX 2,520.00.

The shares of the company during the past 52 weeks of trading at the London Stock Exchange have registered a 52-week high of GBX 2,660.00 while also registering a 52-week low of GBX 1,836.00. The company has a market capitalisation of £ 2.89 billion on the London Stock Exchange at the time of writing this report.

Outlook

The companyâs travel business has continued to grow through the period, and the company is all set to open its new flagship Pharmacy format at Heathrow Airport terminal 2 during summer of 2020.

The company expects the trading season for the next year to be smooth and it also expects to meet the earnings expectations of the market for the year.

Energean Oil & Gas Plc

Energean Oil & Gas Plc (LON:ENOG) is a United Kingdom domiciled oil and gas exploration and production company. The companyâs activities include exploration, production and development of oil and natural gas properties. Energeanâs gas platform includes onshore plant with storage, offshore loading, desulphurisation and power generation facilities. The company operates its offices in Greece, Cyprus, Israel, the UK, Montenegro and Egypt.

The shares of the company are listed for trading on the London Stock Exchange in its main premium market. There the shares are identified and traded under the ticker name ENOG. There the shares of the company also form part of the FTSE 250 index.

Trading Update.

The company on 23 December 2019 came out with a trading update on the Edison E&P sale and purchase agreement that it had initiated with the from Edison SpA on 4 July 2019.

- The transaction is subject to approvals from governments of various countries where Edison E&Pâs assets are located. Approvals from all except from the Algerian government is pending.

- Though the company is hopeful that approval from the Algerian government would come without any difficulty it is prepared to close the deal without the Algerian assets.

Performance on the London Stock Exchange

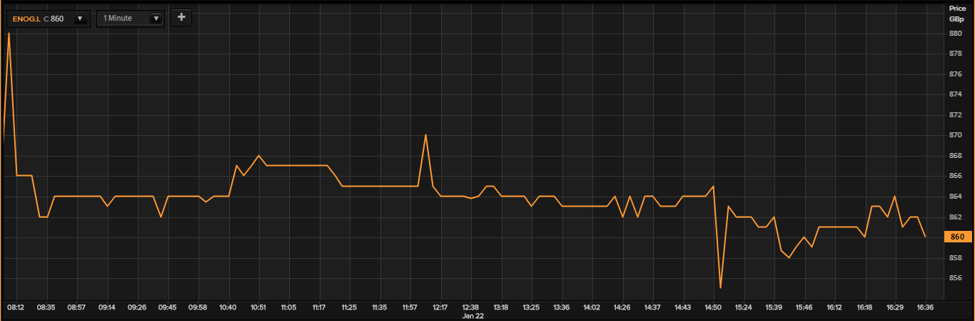

Source â Thomson Reuters

At the close of trading on 22 January 2020 the shares of the company were trading on the London Stock Exchange for GBX 860.00.

The shares of the company during the past 52 weeks of trading at the London Stock Exchange have registered a 52-week high of GBX 1,092.00 while also registering a 52-week low of GBX 606.00. The company has a market capitalisation of £1.52 billion on the London Stock Exchange at the time of writing this report.

Outlook

The Edison E&P deal is important for the company as it entail significant long-term value creation for the company. The dis-inclusion of the Algerian asset will not be a material drawdown on the value of the transaction.

Pets at Home Group Plc

Pets at Home Group Plc (LON:PETS) is a United Kingdom domiciled pet products and services company. The group is a retailer of pet products, pet food, and other pet related services. The company markets its products for cats, dogs, fish, birds, and other pets through pet retail stores.

The shares of the company are listed for trading on the London Stock Exchange in its main premium market. There the shares are identified and traded under the ticker name PETS. There the shares of the company also form part of the FTSE 250 index.

Trading Update.

The company on 22 January 2020 came out with a trading update on its Q3 Financial performance for FY 20.

- The total group revenue of the company during the period increased by 7.9 per cent to stand at £255.9 million.

- The Like -for -Like of the group for the period grew by 7.2 per cent.

- The guidance for FY20 remains unchanged.

Performance on the London Stock Exchange

Source â Thomson Reuters

At the close of trading on 22 January 2020 the shares of the company were trading on the London Stock Exchange for GBX 290.00.

The shares of the company during the past 52 weeks of trading at the London Stock Exchange have registered a 52-week high of GBX 300.60 while also registering a 52-week low of GBX 125.00. The company has a market capitalisation of £1.45 billion on the London Stock Exchange at the time of writing this report.

Outlook

The performance of the company for the quarter has been as per expectations and the company is all set to meet its guidance for the full year.

Sage Group Plc

Sage Group Plc (LON:SGE) is a UK based provider of integrated accounting, payroll and payments solutions, and is headquartered in Newcastle upon Tyne, United Kingdom. Its accounting solutions are Sage One, Sage Live and Sage X3; its payments solutions are Sage Pay and Sage Payments; and its payroll solutions are Sage One Payroll, Sage 50 Payroll and Sage X3 People.

The shares of the company are listed for trading on the London Stock Exchange in its main premium market. There the shares are identified and traded under the ticker name SGE. There the shares of the company also form part of the FTSE 100 index.

Trading Update.

The company on 22 January 2020 came out with a trading update on the performance of the company for the quarter ending on 31 December 2019.

- The organic revenue of the company for the period grew by 6.7 per cent over the previous corresponding quarter to stand at £465 million.

- Revenues on account of SSRS and processing for the quarter dropped by 15.8 per cent to stand at £55m.

- Recurring revenue growth was driven principally by North America and Northern Europe

Performance on the London Stock Exchange

Source â Thomson Reuters

At the close of trading on 22 January 2020 the shares of the company were trading on the London Stock Exchange for GBX 763.00.

The shares of the company during the past 52 weeks of trading at the London Stock Exchange have registered a 52-week high of GBX 826.00 while also registering a 52-week low of GBX 617.00. The company has a market capitalisation of £8.32 billion on the London Stock Exchange at the time of writing this report.

Outlook

The company has had a strong start for the year with 10.7 per cent growth registered in its recurring revenues. The company is hopeful to meeting its full year expectation.