The AI in Asset Management market has emerged as a transformative segment within the financial services industry, rapidly redefining how portfolios are managed, risks are assessed, and investment decisions are made. Artificial Intelligence (AI) technologies are increasingly being adopted by asset management firms to drive operational efficiencies, personalize investment strategies, and enhance overall decision-making processes.

Download Sample Report (Get Full Insights in PDF - 128 Pages) at:

https://www.marketresearchfuture.com/sample_request/26543

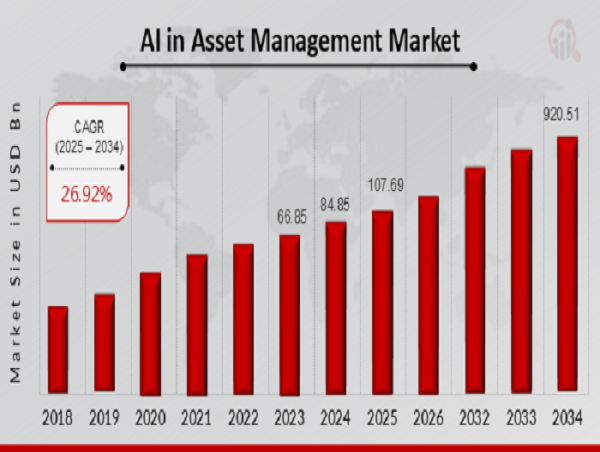

As financial markets grow in complexity and volatility, AI-powered tools offer the capability to process vast volumes of data in real-time, enabling asset managers to derive insights that would otherwise remain untapped using traditional methods. The global AI in Asset Management market is expected to witness substantial growth over the forecast period, driven by increased digital transformation initiatives, the proliferation of big data, and the rising demand for predictive analytics in portfolio optimization. As regulatory environments become more stringent and investor expectations continue to evolve, the integration of AI is no longer a luxury but a necessity for firms seeking a competitive edge.

Key Companies in the AI in Asset Management Market Include:

• State Street Corporation

• BlackRock

• Schroders

• Franklin Templeton Investments

• P. Morgan Asset Management

• Allianz Global Investors

• Rowe Price

• Invesco

• Amundi Asset Management

• Vanguard

• Fidelity Investments

• UBS Asset Management

• Morgan Stanley Investment Management

• Goldman Sachs Asset Management

• Northern Trust Asset Management

The AI in Asset Management market growth is populated by several key players who are at the forefront of technological innovation and strategic investment. Leading companies such as BlackRock, Charles Schwab, State Street Global Advisors, Fidelity Investments, JPMorgan Chase, and Vanguard are actively integrating AI and machine learning into their asset management services. These companies leverage AI to analyze customer data, detect patterns in financial markets, and automate routine processes like rebalancing portfolios and conducting compliance checks. In addition, technology giants including IBM, Microsoft, Google Cloud, and Amazon Web Services (AWS) are offering AI infrastructure and platforms tailored to financial services, thus enabling asset managers to deploy AI models more effectively.

Fintech startups such as Alpaca, SigFig, and Kensho are also playing a critical role by delivering AI-powered robo-advisory solutions, predictive analytics, and intelligent risk assessment tools that are reshaping the landscape of asset management.

The market for AI in Asset Management is segmented based on component, deployment mode, application, and end-user. By component, the market is divided into software, services, and hardware, with the software segment holding the largest share due to the growing use of AI algorithms for analytics and automation. In terms of deployment mode, cloud-based solutions are gaining prominence over on-premise systems because of their scalability, cost-effectiveness, and ease of integration. Based on application, the market is categorized into portfolio management, risk management, compliance and reporting, trading, and others. Among these, portfolio management and risk management are the dominant applications, as AI tools significantly enhance the precision and efficiency of these functions. Regarding end-users, the market serves asset management firms, banks, hedge funds, pension funds, and retail investors, with institutional investors representing the largest share due to their higher adoption rate of advanced AI technologies for large-scale asset management.

Buy Now Premium Research Report -

https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=26543

Market dynamics shaping the AI in Asset Management space include a mix of growth drivers, opportunities, challenges, and restraints. A major growth driver is the increasing demand for real-time data analytics and predictive modeling in financial decision-making. With the exponential rise in unstructured financial data, AI offers a powerful solution to process, analyze, and derive meaningful insights for investment strategies. Another key factor driving growth is the need for enhanced risk assessment and fraud detection. AI-powered systems can detect anomalies and flag potential risks much earlier than conventional systems, thus reducing operational and compliance risks. Moreover, the growing preference for personalized financial services among investors is fueling the adoption of AI-driven advisory and portfolio management tools. On the flip side, the market faces challenges related to data privacy, algorithmic bias, and regulatory compliance. Additionally, the high cost of implementation and the scarcity of AI-skilled professionals pose significant restraints to widespread adoption, particularly among smaller firms.

Recent developments in the AI in Asset Management market outlook indicate strong momentum and continued innovation. In the past few years, major financial institutions have significantly increased their investment in AI capabilities. For instance, BlackRock launched its AI Lab to integrate machine learning and natural language processing into its investment strategies and risk models. Similarly, JPMorgan Chase has expanded its use of AI in trading and portfolio optimization through its LOXM platform. In another development, Fidelity Investments introduced a new AI-powered assistant for portfolio monitoring and financial advice. Moreover, the partnership between asset managers and tech firms is accelerating the pace of innovation—Microsoft and BlackRock’s alliance to offer retirement solutions using AI is a prime example. The increased focus on explainable AI (XAI) is another trend, ensuring that AI decisions are transparent and can be audited to meet regulatory standards. Venture capital funding for AI startups in the asset management domain has also surged, underlining growing investor confidence in this space.

Browse In-depth Market Research Report -

https://www.marketresearchfuture.com/reports/ai-in-asset-management-market-26543

Regionally, the AI in Asset Management market shows varying levels of adoption and growth across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads the market, attributed to the presence of major financial hubs like New York and Toronto, high investment in AI technologies, and strong regulatory frameworks supporting innovation. The U.S. in particular has witnessed robust adoption among asset managers, hedge funds, and investment banks. Europe follows closely, with countries such as the UK, Germany, and France integrating AI in financial services to improve transparency, meet regulatory compliance, and deliver customer-centric investment products.

The Asia Pacific region is expected to witness the fastest growth during the forecast period, driven by expanding financial markets, digital infrastructure development, and government initiatives to promote AI adoption. In countries like China, Japan, and Singapore, asset managers are increasingly using AI to capture new investment opportunities and manage diversified portfolios more efficiently. Latin America and the Middle East & Africa are gradually adopting AI in asset management, with growing fintech ecosystems and digital transformation in the banking sector acting as catalysts.

Explore MRFR’s Related Ongoing Coverage In ICT Domain:

Identity Theft Protection Services Market -

https://www.marketresearchfuture.com/reports/identity-theft-protection-services-market-23075

Weather App Market -

https://www.marketresearchfuture.com/reports/weather-app-market-26568

Blockchain Messaging App Market -

https://www.marketresearchfuture.com/reports/blockchain-messaging-app-market-28251

Integrated Workplace Management System Iwms Market -

https://www.marketresearchfuture.com/reports/integrated-workplace-management-system-market-28325

Crypto Currency Market -

https://www.marketresearchfuture.com/reports/cryptocurrency-market-31627

Generative AI in Construction Market -

https://www.marketresearchfuture.com/reports/generative-ai-in-construction-market-31663

Hyperconnectivity Market -

https://www.marketresearchfuture.com/reports/hyperconnectivity-market-31654

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Contact:

Market Research Future

(Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: [email protected]

Website: https://www.marketresearchfuture.com

Website: https://www.wiseguyreports.com/

Website: https://www.wantstats.com/

Sagar Kadam

Market Research Future

+1 628 258 0071

email us here

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()