Summary

- Wish is the 31st billion-dollar listing this year which is about the hit the US market.

- The company raised US$1.1 billion via the issue of 46 million shares at US$24 per share.

- The use of proceeds from the offer is up to the discretion of the management.

After the successful launch of Airbnb and DoodDash’s billion-dollar IPOs, now its time for the Online retailer, Wish to hit the market. The company is coming out with an IPO of US$1.1 billion, making it the 31st IPO this year to exceed the billion-dollar mark in the US.

Image Source: Shutterstock

The company has priced its IPO on the higher end of the range, at US$24 per share at which the parent company ContextLogic had sold 46 million shares. After the IPO, the company achieves a market capitalization of US16.4 billion.

Read More: DoorDash (NYSE:DASH) makes a smashing debut, shares soar ~86% on day one

About the company

The company is quite popular in the e-Commerce space among the value buyers. The whole focus of the company is on the affordability of its products with the target audience of the value-conscious buyers. The company is looking the serve the global marketplace with its affordable offerings.

Image Source: ContextLogic Inc. SEC update, dated 20 November 2020

Wish uses data-driven technologies to deliver personalized shopping experience.

Financial Overview

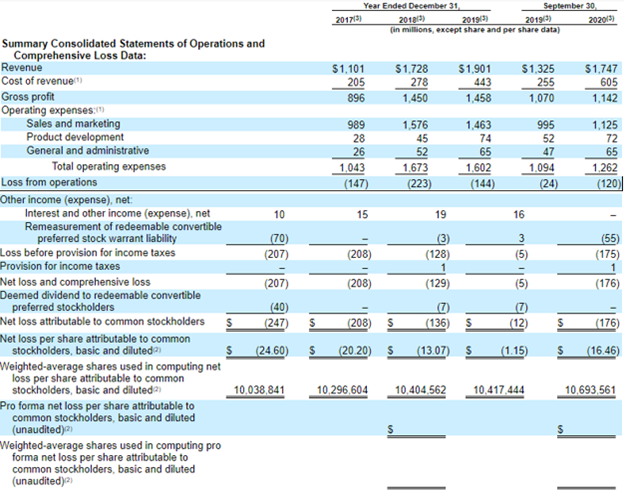

In the last three years, the company has delivered consistent growth in revenues from US$1.1 billion in 2017 to US$1.9 billion in 2019. The current year has taken a hit due to the coronavirus pandemic, despite that, the company has garnered US$1.7 billion of revenue till 30 September 2020.

Image Source: ContextLogic Inc. SEC update, dated 20 November 2020

Due to high operating expenses, the company is yet to deliver a profitable year.

Use of the proceeds

The primary purpose of the offer is to increase financial flexibility, which includes the working capital. The company intends to use the net proceeds towards operating and sales &marketing expenses, capital expenditure, and to fund the future growth of the business.

The company is also open to acquiring complementary businesses, products or services in the future from the proceeds. The management also maintains total discretion in utilizing the funds.

.jpg)