Texas Plans has announced the release of a new guide aimed at helping Texas residents understand and navigate the health exchange subsidy income chart. This guide is designed to assist individuals and families in maximizing their health insurance benefits and avoiding common errors.

Simplifying Health Insurance Subsidies

The new guide from Texas Plans addresses the complexities of income calculations related to health insurance subsidies. The aim is to reduce financial errors and ensure residents receive the full benefit of available subsidies.

The full article on Texas health insurance subsidies provides detailed insights and practical steps to optimize benefits. Read the full article here.

Key Components of the Income Chart

Income Levels and Subsidies:

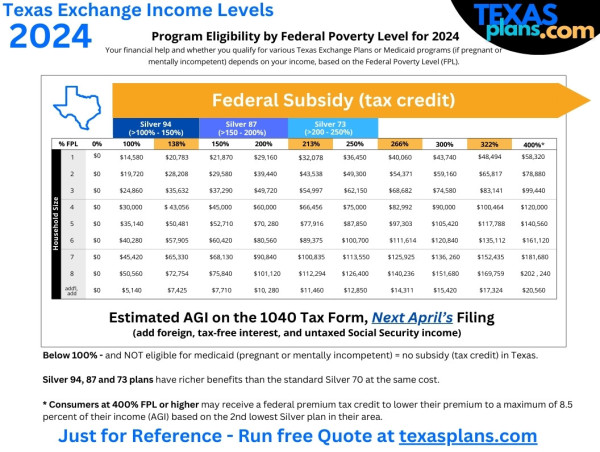

The guide outlines various income levels and the corresponding subsidies available for Texas residents, highlighting how subsidies can significantly reduce monthly health insurance premiums.

Silver Plan Variations:

Information on different versions of Silver plans, including Silver 70, Silver 73, Silver 87, and Silver 94, is provided, with explanations of their deductibles, copays, and out-of-pocket costs.

Federal Poverty Level (FPL):

The chart starts at 100% of the federal poverty level, and subsidies are adjusted based on income relative to this benchmark. There is no longer a hard cutoff at 400% of the FPL.

Medicaid Eligibility:

The guide helps identify eligibility for Medicaid, while noting additional state-specific requirements.

Practical Steps for Using the Income Chart

The guide provides a structured approach to using the income chart.

Estimating Adjusted Gross Income (AGI):

The guide explains how to estimate AGI for the current year, a crucial step for determining subsidy eligibility.

Defining Household Composition:

Clarifications on who qualifies as part of a household for subsidy calculations are included, based on those who file together on a 1040 tax form.

Managing Variable Income:

Strategies for handling fluctuating incomes, whether from self-employment or other sources, are discussed to avoid falling into the Medicaid trap.

Avoiding Common Pitfalls

Errors in income estimation can lead to significant financial consequences. The guide emphasizes the importance of accurate income reporting and offers tips to avoid common mistakes.

Free Assistance and Quoting Tool

Texas Plans provides a free quoting tool that integrates the income chart, helping users visualize how different income levels affect subsidy and plan options. Licensed agents are available to offer personalized assistance at no cost, ensuring optimal health insurance benefits.

Dennis Jarvis

TexasPlans.com

+1 800-320-6269

[email protected]

![]()