Rapid advancements in AI & IoT & rise in investment by various companies in system integration solutions during covid-19 had a positive impact on the market.

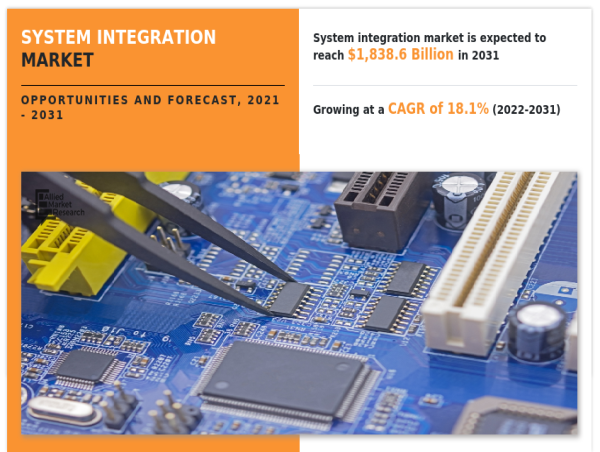

PORTLAND, OR, UNITED STATES, September 23, 2024 /EINPresswire.com/ -- According to the report published by Allied Market Research, the global system integration market size generated $351.8 billion in 2021, and is projected to reach $1,838.6 billion by 2031, growing at a CAGR of 18.1% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape, and regional landscape. The report is a useful source of information for new entrants, shareholders, frontrunners, and shareholders in introducing necessary strategies for the future and taking essential steps to significantly strengthen and heighten their position in the market.

Increase in the adoption of cloud computing, surge in demand for low-cost and energy-efficient production processes, and growth of the small and medium enterprises in various countries across the globe are expected to drive the growth of the global system integration market. Rapid advancements in artificial intelligence (AI) and Internet of things (IoT) and rise in investment by various companies in system integration solutions during the pandemic had a positive impact on the market.

Download Sample Report (Get Full Insights in PDF - 325 Pages) at: https://www.alliedmarketresearch.com/request-sample/A31344

COVID-19 Scenario:

1. The outbreak of COVID-19 has had a positive impact on the growth of the global system integration market, owing to the prevalence of lockdowns in various countries across the globe.

2. Lockdowns resulted in increased system integration among businesses and companies because it has offered several opportunities to digitize and expand the business across regions by adopting technologies such as cloud, Artificial Intelligence (AI), and IoT.

3. With the considerable control achieved over the pandemic, various sectors such as retail, manufacturing, and automotive, are expected to witness rising investments as system integration solutions grow in prominence across different business functions.

4. The market is further expected to grow exponentially with the rise in internet penetration and surge in investment in the sector.

The report offers detailed segmentation of the global system integration market based on service type, enterprise size, industry vertical, and region. The report provides a comprehensive analysis of every segment and their respective sub-segment with the help of graphical and tabular representation. This analysis can essentially help market players, investors, and new entrants in determining and devising strategies based on the fastest-growing segments and highest revenue generation that is mentioned in the report.

Based on service type, the infrastructure integration segment held the largest market share in 2021, holding nearly half of the global market, and is expected to maintain its leadership status during the forecast period. The data integration segment, on the other hand, is expected to cite the fastest CAGR of 20.8% during the forecast period.

For Report Customization: https://www.alliedmarketresearch.com/request-for-customization/A31344

Based on enterprise size, the large enterprises segment held the largest market share in 2021, holding nearly three-fourths of the global market, and is expected to maintain its leadership status during the forecast period. The SMEs segment, on the other hand, is expected to cite the fastest CAGR of 20.4% during the forecast period.

Based on industry, the BFSI segment held the dominating market share in 2021, holding nearly one-fifth of the global market, and is expected to maintain its leadership status during the forecast period. The healthcare segment, on the other hand, is expected to cite the fastest CAGR of 22.2% during the forecast period.

Based on region, the market across North America held the largest market share in 2021, holding more than one-third of the global market, and is expected to maintain its leadership status during the forecast period. The Asia-Pacific region, on the other hand, is expected to cite the fastest CAGR of 20.4% during the forecast period.

The key players analyzed in the global system integration market report include Accenture, Capgemini SE, Cisco System Inc., Fujitsu, Cognizant, Delloite, IBM Corporation, Infosys, Tata Consultancy Services, Tech Mahindra Limited, Oracle Software, HCL Technology, Tesco Controls, Burrow Global, INTECH, Crystalloids Inc, Mangrovia Blockchain Solutions.

Buy Now & Get Exclusive Report at: https://www.alliedmarketresearch.com/system-integration-market/purchase-options

The report analyzes these key players in the global system integration market. These market players have made effective use of strategies such as joint ventures, collaborations, expansion, new product launches, partnerships, and others to maximize their foothold and prowess in the industry. The report helps analyze recent developments, product portfolio, business performance, and operating segments by prominent players in the market.

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP, based in Portland, Oregon. AMR provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

AMR launched its user-based online library of reports and company profiles, Avenue. An e-access library is accessible from any device, anywhere, and at any time for entrepreneurs, stakeholders, researchers, and students at universities. With reports on more than 60,000 niche markets with data comprising 600,000 pages along with company profiles on more than 12,000 firms, Avenue offers access to the entire repository of information through subscriptions. A hassle-free solution to clients’ requirements is complemented with analyst support and customization requests.

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll-Free: 1-800-792-5285

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

[email protected]

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

David Correa

Allied Market Research

+1 800-792-5285

email us here

Visit us on social media:

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()