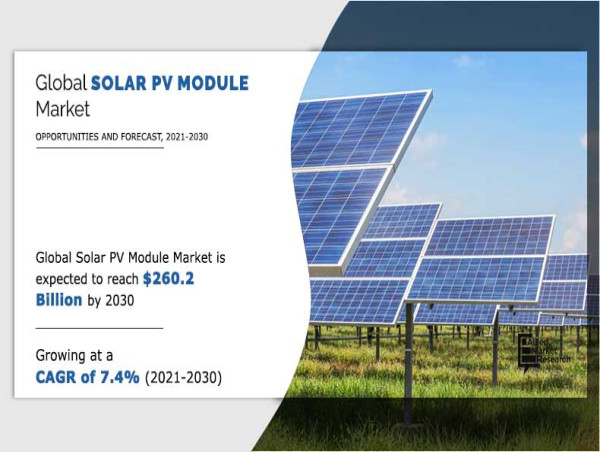

According to a new report published by Allied Market Research, the global solar PV module market size was valued at $127.9 billion in 2020, and is projected to reach $260.2 billion by 2030, growing at a CAGR of 7.4% from 2021 to 2030.

A solar PV module, is an assembly of photo-voltaic cells mounted in a framework for installation. Solar panels use sunlight as a source of energy to generate direct current electricity. A collection of PV modules is called a PV panel, and a system of PV panels is called an array. Arrays of a photovoltaic system supply solar electricity to electrical equipment.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/A11702

In 2020, Asia-Pacific dominated the global solar PV module market with around 57.5% share, in terms of revenue. In addition, it is also projected to grow at the highest CAGR of 7.7% in terms of value.

The major players studied and profiled in the global solar PV module industry report are BASF SE, Nan Ya Plastics Corporation, Exxon Mobil Corporation, Asian Paints Ltd., C-Chem Co. Ltd., I.G. Petrochemicals Ltd., Koppers Inc., Mitsubishi Gas Chemicals Co. Ltd., Polynt Spa, Stepan Company, Thirumalai Chemicals Ltd. and UPC Technology Corporation.

the global solar PV module market witnesses numerous opportunities, owing to rapid increase in development of renewable power in Asia-Pacific and LAMEA to cope up with the increase in electricity demand.

The market is driven by domestic content laws and rise in photovoltaic panel installation projects owing to expiration of federal investment tax credit (ITC).

In the developed economies such as the U.S., solar photovoltaic has proved to be an economic alternative at the time of peak power needs.

The success of distributed solar and rapidly reducing cost has led some U.S. utilities to establish their own solar installations such as residential and community projects.

Enquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A11702

Increase in the price of fossil fuels is expected to provide growth opportunities for the solar PV module market during the forecast period.

Rise in grid connection issues and interconnection delays and insufficient grid capacity posing hurdle for set up of new plants are expected to hamper the growth of the solar PV module market during the forecast period.

By product, the global solar PV module market is studied across monocrystalline, polycrystalline, cadmium telluride, amorphous silicon, and copper indium gallium diselenide. The monocrystalline segment accounted for the largest market share in 2020, owing to longevity, efficiency, operational cost, and embedded energy per panel.

The monocrystalline segment dominated the global solar PV module market with around 49.0% of the share in terms of revenue. In addition, it is also projected to grow at the highest CAGR of 7.8% in terms of value.

By technology, the global solar PV module market size is studied across thin film and crystalline silicon. The crystalline silicon segment dominated the global market with around 78.0% of the share in terms of revenue. In addition, it is also projected to grow at the highest CAGR of 7.7% in terms of value.

Buy This Report (492 Pages PDF with Insights, Charts, Tables, and Figures): https://bit.ly/3YLikQR

By mounting, the global solar photovoltaic module market is studied across ground mounted and roof top. The ground mounted segment emerged as the leader in 2020, owing to surge in installation of large-scale solar utility plants across the globe.

The ground mounted segment dominated the global solar PV module market with around 60.0% of the share in terms of revenue.

Roof top segment is projected to grow at the highest CAGR of 7.8% in terms of value.

By connectivity, the global solar PV module market is studied across on-grid and off-grid. The on-grid segment emerged as the leader in 2020, owing to favorable government incentive schemes including feed in tariffs and net metering.

The on-grid segment dominated the global market with around 87.6% of the share in terms of revenue. In addition, it is also projected to grow at the highest CAGR of 7.6% in terms of value.

By end-use, the global solar PV module market is studied across residential, commercial, and utility. The residential segment emerged as the leader in 2020, owing rise in number of utility-scale projects owing to rising demand for clean electricity.

Residential segment is projected to grow at the highest CAGR of 7.9% in terms of value.

Get a Customized Research Report: https://www.alliedmarketresearch.com/request-for-customization/A11702

The utility segment dominated the global solar PV module market with around 57.6% of the share in terms of revenue.

Trending Reports in Energy and Power Industry:

Solar Cell and Module Market

https://www.alliedmarketresearch.com/solar-cell-and-module-market-A207453

Perovskite Solar Cell Market

https://www.alliedmarketresearch.com/perovskite-solar-cell-market-A13745

Solar PV Module Market

https://www.alliedmarketresearch.com/solar-pv-module-market-A11702

Solar Energy Market

https://www.alliedmarketresearch.com/solar-energy-market

Solar Cell Market

https://www.alliedmarketresearch.com/solar-cell-market-A08602

Solar Tracker Market

https://www.alliedmarketresearch.com/solar-tracker-market

Bifacial Solar Market

https://www.alliedmarketresearch.com/bifacial-solar-market-A16957

Solar Charge Controller Market

https://www.alliedmarketresearch.com/solar-charge-controller-market-A09304

Airport Solar Power Market

https://www.alliedmarketresearch.com/airport-solar-power-market

Solar Photovoltaic Glass Market

https://www.alliedmarketresearch.com/solar-photovoltaic-glass-market

Rooftop Solar PV Market

https://www.alliedmarketresearch.com/rooftop-solar-pv-market-A124759

Concentrated Solar Power Market

https://www.alliedmarketresearch.com/concentrated-solar-thermal-market

Solar Motion Sensor Wall Light Market

https://www.alliedmarketresearch.com/solar-motion-sensor-wall-light-market-A47252

Solar Energy Storage Market

https://www.alliedmarketresearch.com/solar-energy-storage-market-A17238

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

David Correa

Allied Market Research

+ 1 800-792-5285

email us here

Visit us on social media:

Facebook

X

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()