"Forging Tomorrow: Exploring Trends, Innovations, and Applications in the Sheet Metal Market - Driving Efficiency and Precision Across Industries."

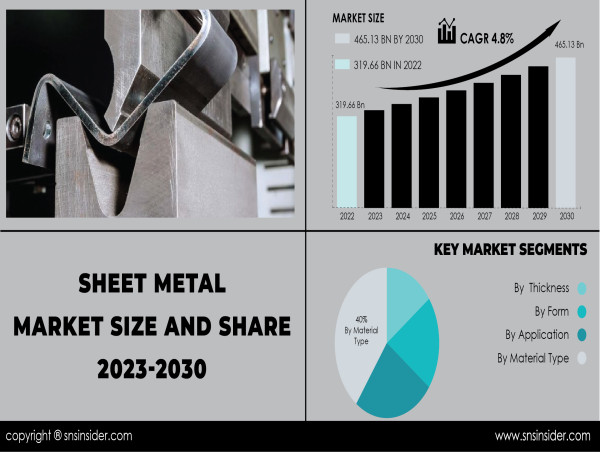

TEXES, AUSTIN, UNITED STATES, March 26, 2024 /EINPresswire.com/ -- The Sheet Metal Market was valued at USD 319.66 billion in 2022 and USD 465.13 billion in 2030, with a CAGR of 4.8% predicted from 2023 to 2030. The sheet metal market is experiencing quite a transformation these days, thanks to advancements in manufacturing and changes in industry demands. Sheet metal, known for its versatility and strength, is used in so many things – from buildings to cars to machinery. As industries look for ways to be more efficient and cost-effective, the demand for high-quality sheet metal is only increasing, driving a lot of innovation in the market.

One big trend in the sheet metal industry is the adoption of new fabrication techniques and materials. With technologies like laser cutting and 3D printing, manufacturers can create incredibly precise and complex designs faster than ever before. Plus, new lightweight alloys are opening up even more possibilities for sheet metal in industries like aerospace and automotive. Sustainability is also becoming a major focus in the sheet metal market. With growing concerns about the environment, there's a push for greener alternatives and recycling initiatives. Sheet metal is already pretty eco-friendly since it can be recycled indefinitely, but advancements in coatings and treatments are making it even more durable and long-lasting. As companies strive to be more environmentally conscious, sheet metal is becoming an increasingly attractive option for a wide range of applications.

Get Sample Report of Sheet Metal Market @ https://www.snsinsider.com/sample-request/1474

Some of the Key Players Included are:

• Ryerson Holding Corporation

• Classic Sheet Metal, Inc.

• Ironform Corporation

• Kapco Metal Stamping

• All Metals Fabricating Inc.

• Marlin Steel Wire Products LLC

• Mayville Engineering Company, Inc.

• Metcam, Inc.

• Moreng Metal Products, Inc.

• Noble Industries, Inc.

• O’Neal Manufacturing Services.

• Osh Cut LLC

• Standard Iron & Wire Works, Inc.

• The Metalworking Group

• BTD Manufacturing

• Dynamic Aerospace and Defense Group (Hydram Engineering)

• Marlin Steel Wire Products LLC

• Noble Industries Inc.

• and Others

Market Report Scope & Overview

The sheet metal market stands as a cornerstone within the broader realm of manufacturing, providing essential materials and components for a vast array of products across numerous sectors. Characterized by its versatility and efficiency, sheet metal fabrication involves the shaping and manipulation of thin metal sheets to create various structures and products. With applications ranging from automotive and aerospace to construction and electronics, the scope of the sheet metal industry is extensive and ever-expanding.

At its core, the sheet metal market encompasses processes such as cutting, bending, and assembling metal sheets to precise specifications. Advanced technologies such as computer numerical control (CNC) machining and laser cutting have revolutionized the field, enabling greater precision, efficiency, and customization in production. Additionally, advancements in materials science have introduced new alloys and composites, further expanding the industry's capabilities.

Surging Automotive and Construction Sectors Propel Global Sheet Metal Market Growth

The sheet metal market is witnessing substantial growth globally, primarily driven by several key factors. One of the prominent growth drivers is the burgeoning automotive industry, which heavily relies on sheet metal for manufacturing vehicle bodies, chassis, and other components. With the increasing demand for lightweight vehicles to enhance fuel efficiency and reduce emissions, the adoption of advanced sheet metal materials such as aluminum and high-strength steel is on the rise. Additionally, the construction sector is fueling market growth as sheet metal finds extensive applications in roofing, cladding, and structural components due to its durability, flexibility, and cost-effectiveness. Moreover, the growing trend of green building construction is further propelling the demand for sustainable sheet metal solutions, driving market expansion.

However, despite the promising growth prospects, the sheet metal market faces several constraints that could impede its growth trajectory. One significant restraint is the volatility in raw material prices, particularly steel and aluminum, which directly impacts manufacturing costs and profit margins for industry players. Additionally, stringent environmental regulations aimed at reducing carbon emissions and promoting sustainability pose challenges for the sheet metal market, as manufacturers need to invest in eco-friendly production processes and materials. Despite these challenges, the market presents lucrative opportunities for growth, particularly in emerging economies where rapid industrialization and urbanization are driving demand for sheet metal across various end-use sectors.

Sheet Metal Market Segmentation

By Form

• Bend Sheet

• Punch Sheet

• Cut Sheet

• Other

By Material Type

• Stainless steel

• Aluminum

• Brass

• Tin

• Titanium

• Zinc

• Others

By Thickness

• < 1 mm

• 1-6 mm

• > 6mm

By Application

• Automotive & Transportation

• Building & Construction

• Industrial Machinery

• Oil & Gas

• Commercial

• Others

Make Enquiry About Sheet Metal Market @ https://www.snsinsider.com/enquiry/1474

Impact of Recession

Amidst the ongoing recession, the sheet metal market experiences both positive and negative impacts. On one hand, the recession typically leads to decreased consumer spending and investment, resulting in reduced demand for sheet metal products across various industries such as automotive, construction, and manufacturing. This downturn in demand can lead to lower production volumes, layoffs, and decreased revenues for sheet metal manufacturers and suppliers. Conversely, during economic downturns, governments and central banks often implement stimulus measures such as infrastructure projects and tax incentives to stimulate economic activity. These initiatives can drive demand for sheet metal products used in construction and infrastructure development, thus providing some relief to the market.

Impact of Russia-Ukraine War

The Russia-Ukraine war has significant implications for the sheet metal market, albeit predominantly negative. As geopolitical tensions escalate, disruptions in the global supply chain are inevitable, impacting the availability of raw materials crucial for sheet metal production. The instability in these regions can lead to supply shortages, price volatility, and logistical challenges for sheet metal manufacturers, thereby hindering production efficiency and increasing operational costs. Furthermore, the uncertainty stemming from the conflict may dampen investor confidence and consumer sentiment, leading to reduced spending and investment in industries reliant on sheet metal products. Moreover, escalating trade tensions and sanctions may further exacerbate the challenges faced by market players, potentially impeding international trade and market access.

Regional Analysis

In analyzing the sheet metal market regionally, it is crucial to consider the diverse factors influencing market dynamics across different geographical areas. Various regions exhibit distinct trends and drivers shaping the demand for sheet metal products. For instance, developed economies such as North America and Europe may experience moderate growth due to ongoing infrastructure projects and technological advancements driving demand in sectors like automotive and aerospace. Conversely, emerging economies in Asia-Pacific, particularly China and India, are poised to witness robust growth fueled by rapid industrialization, urbanization, and infrastructure development initiatives. However, factors such as regulatory frameworks, trade policies, labor costs, and environmental concerns also play a significant role in shaping regional market dynamics.

Conclusion

SNS Insider's report on the sheet metal market covers various critical aspects shaping the industry's trajectory. The report delves into market trends, drivers, challenges, and opportunities, providing stakeholders with valuable insights to make informed decisions. Key areas of focus include technological advancements in sheet metal fabrication processes, emerging market trends, regulatory developments, competitive landscape analysis, and strategic recommendations for market participants.

Buy the Latest Version of Sheet Metal Market Report 2023-2030@ https://www.snsinsider.com/checkout/1474

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Akash Anand

SNS Insider

+1 415-230-0044

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

![]()