The market growth is primarily driven by the increasing adoption of digital ordering and payment systems, necessitated by consumer demand for contactless, quick, and secure transactions, accelerated by the COVID-19 pandemic. The rise of cloud-based POS systems, offering real-time analytics and remote management capabilities, presents significant growth opportunities, allowing restaurants to streamline operations effectively.

🔴 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/restaurant-point-of-sale-terminal-market/request-sample/

The integration of mobile wallets and Near Field Communication (NFC) payments into POS systems caters to the evolving consumer preference for seamless transaction experiences.

Furthermore, the rapid expansion of the food delivery and takeout sector increases the need for versatile POS solutions that manage online orders and interface with third-party platforms efficiently. As digital transformation continues to gain traction within the restaurant industry, the demand for advanced POS systems that enhance customer experiences and operational processes is set to increase robustly.

Key Takeaways

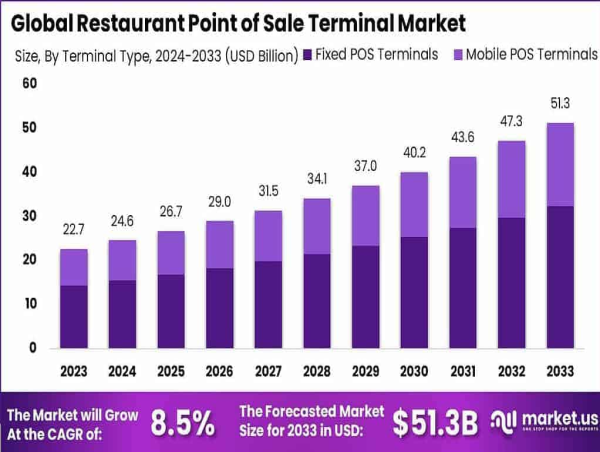

The Global Restaurant Point of Sale Terminal Market is projected to reach a valuation of USD 51.3 Billion by 2033, up from USD 22.7 Billion in 2023, reflecting a robust CAGR of 8.5% during the forecast period from 2024 to 2033.

In 2023, the Fixed POS Terminals segment asserted a dominant position within the market, accounting for more than 63.1% of the total market share.

The Front End segment also dominated the market in 2023, capturing over 70.5% of the Restaurant Point of Sale Terminal Market.

The Full-Service Restaurants (FSR) segment held a significant market share in 2023, commanding more than 43.9% of the total market.

Geographically, North America led the market in 2023, representing more than 36.0% of the market share, with revenues approximating USD 8.1 Billion.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://market.us/purchase-report/?report_id=126912

Experts Review

Industry experts highlight the robust potential for growth in the restaurant POS terminal market, driven by technological innovation and evolving consumer preferences. Key growth facilitators include government incentives for digital transformation and advancements in AI-driven POS systems, which offer personalized experiences and valuable data insights for restaurateurs.

The market presents numerous investment opportunities; however, the cost of adoption remains a notable risk, especially for small businesses. Consumer awareness and demand for seamless, secure payment options encourage widespread POS adoption. Technological impacts include improved data accuracy and operational efficiency, while challenges linger in data security and integration complexity.

Nonetheless, the regulatory environment in regions like North America supports POS adoption through strict compliance standards aimed at safeguarding consumer data. As cloud-based solutions become mainstream, the restaurant industry's digital transformation paves the way for enhanced operational capabilities and customer engagement strategies, setting the stage for considerable advancements in how businesses manage and execute service delivery.

🔴 𝐓𝐨 𝐆𝐚𝐢𝐧 𝐠𝐫𝐞𝐚𝐭𝐞𝐫 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/restaurant-point-of-sale-terminal-market/request-sample/

Report Segmentation

The report segments the restaurant POS terminal market by terminal type, application, and end-users. Terminal types are categorized into fixed and mobile POS terminals, with fixed terminals dominating due to their durability and comprehensive integration capabilities with various back-end systems.

Mobile POS terminals offer flexibility, appealing to establishments seeking efficiency in managing dynamic service environments. By application, POS systems are segmented into front-end and back-end operations. Front-end systems, which interface with customers, account for a major share owing to their pivotal role in order entry and payment processing, thereby enhancing customer satisfaction.

Back-end systems streamline internal processes such as inventory management and staff coordination. End-user categories include full-service restaurants (FSR), quick-service restaurants (QSR), and others. FSRs necessitate multifaceted POS systems to handle intricate workflow demands, leading to a market share of 43.9% in 2023.

FSRs demand systems robust enough to manage complex operations such as reservations, multi-course meals, and alcohol sales. QSRs benefit from POS systems that expedite service, manage high customer volumes, and support delivery and takeout. This comprehensive segmentation outlines the varied applications and demands within the restaurant industry, indicating the diverse potential for POS systems across different service formats.

Key Market Segments

By Terminal Type

Fixed POS Terminals

Mobile POS Terminals

By Application

Front End

Back End

By End-User

Full-Service Restaurants (FSR)

Quick Service Restaurants (QSR)

Other End-Users

🔴 𝐆𝐞𝐭 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 (𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲) @ https://market.us/purchase-report/?report_id=126912

Drivers, Restraints, Challenges, and Opportunities

Drivers: Increasing consumer preference for contactless and efficient payment methods propels POS adoption. The rise of digital transactions and growing demand for enhanced dining experiences underscore the need for sophisticated POS solutions that streamline operations and improve customer engagement.

Restraints: High initial costs of purchasing and implementing advanced POS technologies can hinder adoption, especially among small to medium-sized restaurant owners. This financial barrier includes expenses for hardware, software, integration, and continuing upgrades, posing significant challenges.

Challenges: Data security remains a critical challenge, as POS systems handle sensitive customer data. Ensuring robust security and compliance with evolving regulations imposes additional complexities for restaurants adopting digital payment systems.

Opportunities: The transition to cloud-based POS systems offers vast opportunities, providing scalability, real-time data access, and reduced upfront costs. The development of AI-driven POS solutions enhances customer personalization and operational insights, enabling restaurants to optimize both service and back-end processes. As digital transformation trends persist, there is substantial potential for growth in markets adopting these technological advancements, presenting lucrative opportunities for stakeholders looking to innovate and expand within the restaurant industry.

Key Player Analysis

The market for restaurant POS terminals is highly competitive, with key players like Panasonic Corporation, Oracle Corporation, and VeriFone, Inc. leading the charge. Panasonic's recent product launches, such as the Stingray® JS9900, highlight its commitment to providing versatile solutions that enhance operational efficiency.

Oracle Corporation leverages its robust software solutions to streamline restaurant operations, focusing on comprehensive cloud integration and data analytics capabilities. VeriFone, Inc. distinguishes itself through innovative payment solutions tailored for retail and restaurant environments. Companies like Toast, Inc. and NCR Corporation capitalize on the demand for mobile POS solutions, enhancing user experience and engagement.

These industry leaders continually explore avenues for growth through product innovation, strategic partnerships, and expansion into emerging markets, ensuring their sustained leadership in the dynamic POS market. Collectively, these companies drive the digital transformation agenda within the hospitality sector, supporting restaurants' operational needs in an evolving marketplace.

Top Key Players in the Market

Panasonic Corporation

Oracle Corporation

VeriFone, Inc.

Block, Inc.

Toast, Inc.

NCR Corporation

Lightspeed

PAX Global Technology Limited

Revel Systems

TouchBistro Inc.

Other Key Players

Recent Developments

Recent advancements in the restaurant POS terminal market underscore the industry's focus on innovation and efficiency. In March 2024, Panasonic introduced the Stingray® JS9900 Kiosk Series, designed to boost operational efficiency for fast-casual and quick-service restaurants. These new offerings emphasize modularity and versatility, enhancing user experiences.

In January 2024, ParTech, Inc. launched the PAR Wave, a state-of-the-art all-in-one touch panel for the hospitality sector. This technology integrates performance and security into a modern design, addressing the industry's evolving demands. PAX Global Technology also launched the A920 smart mobile POS terminal, merging Android tablet functionalities with powerful payment processing capabilities, and targeting dynamic retail and hospitality markets.

These developments indicate a strong trend toward integrating advanced technologies that support versatile and efficient restaurant operations. By focusing on performance enhancements and customer satisfaction, these innovations reflect the market's ongoing adaptation to technological advancements and consumer expectations.

Conclusion

The restaurant POS terminal market is poised for sustained growth, driven by increasing demands for efficiency and customer satisfaction in the hospitality industry. While challenges such as high costs and data security persist, the integration of cloud-based and AI-driven solutions presents significant opportunities.

As restaurants continue their digital transformation, advanced POS systems will play a crucial role in enhancing operations and customer experiences. The market's projected growth highlights its dynamic nature and potential for further innovation, setting the stage for strategic developments that align with consumer preferences and evolving restaurant needs in the coming years.

➤ 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬

Digital Twin in Aerospace and Defence Market - https://market.us/report/digital-twin-in-aerospace-and-defence-market/

Online Exam Proctoring Market - https://market.us/report/online-exam-proctoring-market/

Multi-Channel Network (MCN) Market - https://market.us/report/multi-channel-network-mcn-market/

Commercial Payment Cards Market - https://market.us/report/commercial-payment-cards-market/

3D Printing Market - https://market.us/report/3d-printing-market/

AI In Fintech Market - https://market.us/report/ai-in-fintech-market/

Air Charter Broker Market - https://market.us/report/air-charter-broker-market/

Legal Process Outsourcing Market - https://market.us/report/legal-process-outsourcing-market/

AI-Powered Video Editing Software Market - https://market.us/report/ai-powered-video-editing-software-market/

Virtual Tour Market - https://market.us/report/virtual-tour-market/

Lawrence John

Prudour

+91 91308 55334

[email protected]

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()