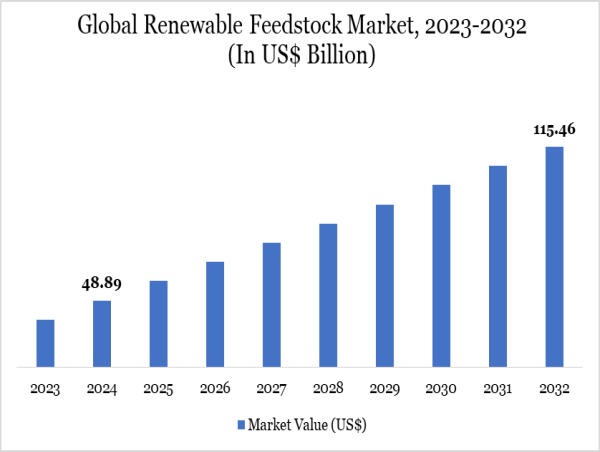

The Renewable Feedstock Market Size was valued at US$ 48.89 Billion in 2024 and is projected to grow significantly, reaching approximately US$ 115.46 Billion by 2032. This reflects a strong compound annual growth rate (CAGR) of 11.34% from 2025 to 2032.

By 2025, the renewable feedstock market is expected to witness robust growth, with projections indicating a significant jump in valuation. This growth is being powered by the increasing deployment of biofuels (especially sustainable aviation fuel), the growing use of renewable inputs in chemical manufacturing, and the ongoing innovations in material science that enable industries to adopt greener raw materials.

To Download Sample Report: https://datamintelligence.com/download-sample/renewable-feedstock-market

Industry Developments

In January 2025, Bayer and Neste entered into a memorandum of understanding (MoU) to expand the cultivation of winter canola as a biomass feedstock for producing renewable fuels, including sustainable aviation fuel and renewable diesel.

Earlier, in March 2024, Repsol and Bunge announced a strategic alliance in Spain aimed at strengthening the supply chain for renewable fuels. This partnership will support Repsol’s goal of generating up to 1.7 million tons of renewable fuel by 2027 by improving access to low-carbon intensity feedstocks.

Regional Trends and Outlook

North America

North America, particularly the United States, has emerged as a leader in renewable feedstock innovation. The region benefits from abundant agricultural resources, strong research infrastructure, and supportive government policies. Biofuel production is a major focus area, with renewable diesel and sustainable aviation fuel (SAF) gaining traction. The use of camelina, soybean oil, and even tallow in large-scale fuel projects is increasingly common.

Moreover, clean energy incentives and evolving climate legislation have spurred investments in the renewable materials ecosystem. Several states are expanding their clean fuel programs, which in turn boosts demand for renewable feedstock. However, challenges like feedstock availability, competition from food uses, and global supply chain disruptions continue to pose hurdles.

Europe

Europe has consistently led the way in advancing the bioeconomy, with strong initiatives supporting renewable and bio-based industries. Countries like Germany, France, and the Netherlands are promoting large-scale use of renewable raw materials across industries from energy to plastics to consumer goods. The EU’s Green Deal serves as a key policy framework driving the expansion of bio-based industries across the region.. Innovation in biorefineries, algae-based production, and advanced waste processing is central to Europe’s feedstock strategy.

Asia-Pacific

The Asia-Pacific region is witnessing rapid growth in the renewable feedstock sector, especially with increasing use of biomass resources. Countries such as China, India, and Indonesia are making strides in turning agricultural waste and forestry residues into usable fuel and energy. Additionally, there is growing industrial interest in integrating renewable feedstocks into plastic and textile production chains. In markets like South Korea and Japan, where natural resources are limited, bio-based imports and recycling initiatives are gaining momentum.

Key players:

Neste

ADM

Cargill, Incorporated

UPM Biofuels

Gevo

Stora Enso

The Scoular Company

Montana Renewables, LLC

TotalEnergies

BASF SE

Market Segmentation

By Source: Agricultural Residues, Forestry Residues, Municipal Waste, Aquatic Biomass, Others

By Application: Biofuels, Bio-based Chemicals, Lubricants, Cosmetics and Personal Care, Others

By End-User: Residential, Commercial, Industrial, Others

Latest News – USA

As of 2025, the U.S. renewable feedstock industry has entered a period of intense activity. Multiple projects focusing on SAF and renewable diesel are now either operational or in advanced stages of development. One major refinery is reportedly working on producing over 60 million gallons of SAF annually, aiming to supply airlines, shipping firms, and government fleets.

However, some challenges are surfacing. A few renewable diesel refineries have had to pause operations due to high feedstock costs and unclear federal policies. Domestic producers are also expressing concerns about cheaper imports of used cooking oil from overseas markets, especially as these imports begin to undercut local farming-based feedstock systems.

Still, collaborations between the petroleum sector and biofuel firms are growing. Shared lobbying efforts are pushing for clearer rules around fuel blending mandates beyond 2025. Meanwhile, farmers are exploring energy crops like pennycress and camelina to enter the growing green feedstock market.

Latest News – Japan

Japan, though limited in natural biomass resources, is embracing the renewable feedstock transition through technology and partnerships. One recent development includes the use of renewable materials in the production of PET bottles through a joint effort among Japanese beverage companies and international bio-material firms. These PET bottles, made from renewable intermediates, are now being tested for mainstream commercial use.

On the energy side, Japan is investing in hydrogen strategies that integrate renewable carbon sources. Industrial byproducts are being explored as feedstock to create hydrogen blends for use in data centers, vehicles, and backup power. While the renewable feedstock supply remains largely import-driven, the country is setting ambitious goals to reduce dependency on fossil-derived imports in the next decade.

Experts Insights:

The renewable feedstock market is poised for major growth as industries across the globe shift toward cleaner, sustainable alternatives. With advancements in technology, stronger policy support, and growing awareness among both businesses and consumers, the reliance on bio-based raw materials is expected to become a core component of the global economy.

From fuel to packaging to consumer goods, renewable feedstocks are no longer niche; they're going mainstream. And in the next few years, we’re likely to see further expansion, innovation, and collaboration shaping a more resilient and climate-aligned supply chain.

Here are the Latest Reports By DataM intelligence

Renewable Energy Certificate Market Size 2025-2032

Renewable Energy Market Size

Sai Kiran

DataM Intelligence 4Market Research

+1 877-441-4866

[email protected]

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()