NEW CASTLE, DELAWARE, UNITED STATES, March 18, 2024 /EINPresswire.com/ -- The research on the growth of the "Remittance Market" from 2023 to 2030 offers valuable insights into present trends, hurdles, market risks, and limitations faced by key vendors. This comprehensive report encompasses geographical segmentation, current demand trends, in-depth growth rate analysis, industry revenue, and a detailed examination of the Compound Annual Growth Rate (CAGR). Additionally, this report on the Remittance market delivers both qualitative and quantitative analyses, including company profiles, investment prospects, strategic development strategies, industry size, and global market share assessments.

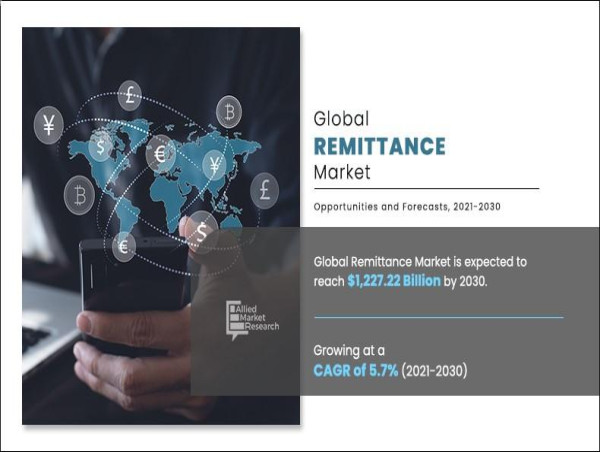

Allied Market Research published a report, titled, "Remittance Market By Application (Consumption, Savings, and Investment), Remittance Channel (Banks, Money Transfer Operator, and Others), and End User (Business and Personal): Global Opportunity Analysis and Industry Forecast, 2021-2030". According to the report, the global remittance industry was estimated at $701.93 billion in 2020, and is anticipated to hit $1.23 trillion by 2030, registering a CAGR of 5.7% from 2021 to 2030.

Drivers, Restraints, and Opportunities

Surge in cross-border transactions & mobile-based payment channels, lowered cost & transfer time, and increase in adoption of banking & financial services fuel the growth of the global remittance market. On the other hand, lack of awareness regarding digital remittance and slowdown in the Asia-Pacific region impede the growth to some extent. However, technological innovations and increase in penetration of smartphones & the internet create new opportunities in the industry.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐓𝐡𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐎𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.alliedmarketresearch.com/request-sample/3948

COVID-19 Scenario:

The outbreak of Covid-19 paralyzed the economy of the majority of countries, especially during the initial phase, thereby impacting the global remittance market negatively.

A fall in remittance flows also imposed economic, fiscal, and social burdens across the world.

However, the market is projected to recoup soon.

The Consumption Segment to Dominate By 2030

Based on application, the consumption segment accounted for nearly three-fifths of the global remittance market share in 2020, and is anticipated to rule the roost by 2030. A huge sum of money is remitted every month by the workers to their home country for food, clothing, and other expenditures. This factor drives the growth of the segment. The investment segment, however, would cite the fastest CAGR of 8.1% throughout the forecast period. This is due to the fact that it helps developed countries regenerate new revenue stream by investing the remitted money in different investment schemes, which boosts the GDP of the country.

The Banks Segment to Maintain the Dominant Share

Based on remittance channel, the banks segment held nearly half of the global remittance market revenue in 2020, and is expected to lead the trail by 2030. The fact that banks are joining forces to develop cross-border real-time services propels the segment growth. The money transfer operator segment, on the other hand, would manifest the fastest CAGR of 8.1% from 2020 to 2030. This is because an array of digital-only players such as WorldRemit, Xoom, Transfer Wise, and InstaReM enable direct global money transfers sent from and received through mobile wallets held on personal devices.

Asia-Pacific, Followed By LAMEA, Europe, and North America, Garnered the Major Share in 2020

Based on region, Asia-Pacific, followed by LAMEA, Europe, and North America, held the major share in 2020, generating nearly half of the global remittance market. The same region would also grow at the fastest CAGR of 6.4% by 2030. This is attributed to rapidly advancing technologies, evolving customer expectations, and changing regulatory setting in the region.

𝐈𝐧𝐪𝐮𝐢𝐫𝐲 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠- https://www.alliedmarketresearch.com/purchase-enquiry/3948

Key Players in the Industry

Citigroup Inc.

XOOM

JPMorgan Chase & Co.

RIA Financial Services Ltd.

TransferWise Ltd.

MoneyGram International Inc.

Bank of America

UAE Exchange

Wells Fargo

Western Union Holdings Inc.

𝐆𝐫𝐚𝐛 𝐭𝐡𝐞 𝐨𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐲 !!! 𝐋𝐈𝐌𝐈𝐓𝐄𝐃-𝐓𝐈𝐌𝐄 𝐎𝐅𝐅𝐄𝐑 - 𝐁𝐮𝐲 𝐍𝐨𝐰 & 𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝟏𝟓 % 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐨𝐧 𝐭𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭 :- https://www.alliedmarketresearch.com/checkout-final/d91b1f3fbd3905dfb4e33508cb61cabd

Key Benefits For Stakeholders

The study provides an in-depth analysis of the remittance market forecast along with the current trends and future estimations to explain the imminent investment pockets.

Information about key drivers, restraints, & opportunities and their impact analysis on the global remittance market is provided in the report.

Porter's five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

The quantitative analysis of the market from 2021 to 2030 is provided to determine the market potential.

𝐌𝐨𝐫𝐞 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Extended Warranty Market https://www.alliedmarketresearch.com/extended-warranty-market

AI in BFSI Market https://www.alliedmarketresearch.com/artificial-intelligence-in-BFSI-market

Consumer Credit Market https://www.alliedmarketresearch.com/consumer-credit-market-A68827

BFSI in IT Market https://www.alliedmarketresearch.com/bfsi-in-it-market-A11751

Budgeting Software Market https://www.alliedmarketresearch.com/budgeting-software-market-A11766

U.S. Insurance Brokerage for Employee Benefits Market https://www.alliedmarketresearch.com/us-insurance-brokerage-for-employee-benefits-market-A278701

Spain Health Insurance Third-Party Administrator Market https://www.alliedmarketresearch.com/spain-health-insurance-third-party-administrator-market-A264461

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 [email protected]

https://pooja-bfsi.blogspot.com/

https://www.quora.com/profile/Pooja-BFSI

https://medium.com/@psaraf568

David Correa

Allied Market Research

+1 5038946022

email us here

![]()