Real-time Graph Database player Ultipa selected as Banking Tech Awards 2023 top finalist in Tech of the Future -- AI & Data

PLEASANTON, CA, USA, November 30, 2023 /EINPresswire.com/ -- Real-time & HTAP graph database player Ultipa has been shortlisted as a top finalist for the 2023 Banking Tech Awards -- Tech of the Future (AI & Data).

The 24th Annual Ceremony of the Banking Tech Awards will be held at Royal Lancaster Hotel in London, UK. According to the judging committee: "These outstanding finalists have made an impact with their innovative solutions, exceptional customer service, and unwavering dedication to making banking safer and more convenient for everyone. They represent the brightest minds in the industry and are shaping the future of banking technology in their own unique ways. Winning a Banking Tech Award is a testament to the institution's technology investments and team's skills, commitment, creativity and execution. For software providers, this recognition is a valuable endorsement of their products and services, and a prized acknowledgement of their skills, leadership, vision, inspiration and dedication to the industry's betterment."

Ultipa was nominated as the top finalist in the Tech of the Future -- AI & Data category, where Ultipa has competed with other major brand names like S&P Global, E&Y, etc.

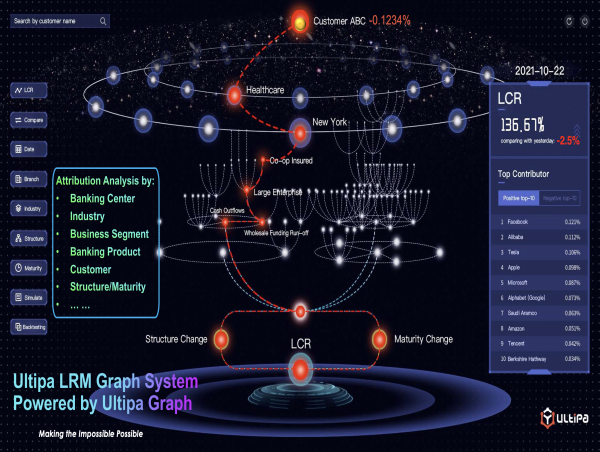

Ultipa proudly presented its Real-time LRM System w/ Graph XAI, which essentially is to leverage Ultipa's patent-powered real-time graph database for instant and online liquidity risk management, including but not limited to key innovations like 1). Real-time attribution analysis to the finest data granularity, which was previously impossible with traditional RDBMS (relational database management system) like Oracle; 2). Online, graphical and interactive user experience, which was previously headless and offline (batch-processing based) if using Oracle-like solutions; The elevation of the user-experience is significant in that users won't have to wait overnight (T+1) for retrieval of crucial business performance data, and with added benefits of white-box explainability (Graph XAI); 3). Accurate and Robust -- the Ultipa's LRM system is NOT only thousands of times faster than Oracle-like systems, but also more accurate and robust, in terms of how liquidity indicators are calculated and reported per regulatory compliance needs.

Ultipa's Graph XAI-powered LRM system has been commercially deployed with multiple large retail and commercial banks -- all these banks have previously suffered on multiple fronts in terms of liquidity (risk) management -- 1). Hard to be compliant with regulations: such as slow to calculate key regulated financial indicators like LCR (Liquidity Coverage Ratio), which, for a large bank, needs to report on daily (or even intraday) basis, but may take T+N (multiple) days if using Oracle-like RDBMS or big-data systems. The collapse of SVB in 1H of 2023 is a typical case of failure of diligent/in-time liquidity risk management. Should they use Ultipa's LRM solution to monitor their liquidity status timely and proactively, they might have avoided triggering the bank-run. 2) No attribution-analysis: because liquidity management involves tons of data and many tables, which run very slowly over RDBMS, therefore the banks are like walking in the dark and not knowing the KPIs/performances of various metrics.

Ultipa's Director of Global Partnership, Yuri Simione, said: "Many financial institutions have long suffered from the inability to quickly and instantly calculate liquidity indicators, therefore not able to look at many other financial indicators in a connected, unified and holistic view, right now, many of them are being looked at in siloed ways. On the one hand, it's hard and expensive to satisfy external regulatory/compliance needs, on the other hand, it's unproductive and costly for internal management. Ultipa's graph-powered LRM solution is readily available to address these dilemmas and offers 75% lower TCO and intraday liquidity risk management capabilities."

Interested in learning more about Ultipa's innovations in the banking and financial services sector? Feel free to reach out to Ultipa at: https://www.ultipa.com or Email: [email protected]

Richard J.

ULTIPA, INC.

[email protected]

Visit us on social media:

LinkedIn

YouTube