Personal Loans Market Research Report Information By, Type, Age, Marital Status, Employment Status, and Region

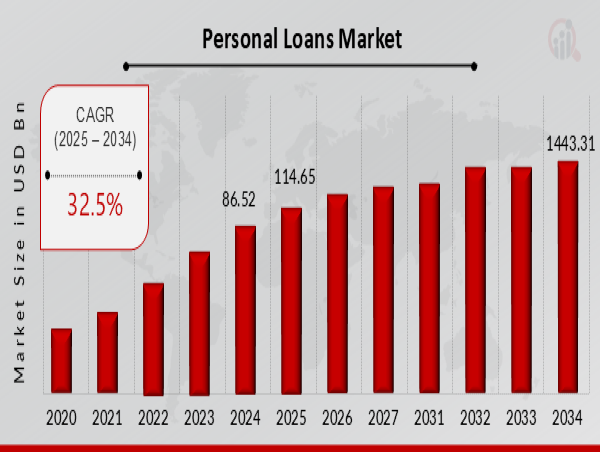

DE, UNITED STATES, March 10, 2025 /EINPresswire.com/ -- The Personal Loans Market Size was valued at USD 86.52 billion in 2024. The Personal Loans Market is projected to grow from USD 114.65 billion in 2025 to USD 1443.31 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 32.5% during the forecast period (2025 - 2034). Personal loans are drawing more customers due to low interest rates and increasing borrowing limits, which are key drivers of market expansion.

Key Drivers of Market Growth

Rising Demand for Consumer Credit

The increasing need for short-term financial assistance and debt consolidation is boosting the demand for personal loans. Consumers are leveraging personal loans for home renovations, medical expenses, and emergency funds.

Low Interest Rates and Flexible Repayment Options

Financial institutions are offering competitive interest rates and flexible repayment options, making personal loans more attractive to borrowers. This trend is driving higher adoption rates among individuals.

Digitalization and Fintech Innovations

The rise of digital lending platforms and fintech companies has streamlined the loan application and approval processes. AI-driven risk assessment and instant loan disbursement are contributing to market growth.

Increasing Borrowing Limits

Financial institutions are offering higher loan amounts due to improved credit scoring models and data analytics. This enables borrowers to access larger funds for various personal needs.

Government Initiatives and Financial Inclusion

Governments worldwide are encouraging financial inclusion, leading to greater access to credit facilities. Policies supporting microfinance and digital lending are expanding the personal loans market.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/12020

Key Companies in the Personal Loans Market Include:

• Social Finance, Inc.

• American Express

• DBS Bank Ltd

• Avant, LLC

• Barclays Plc

• Prosper Funding LLC

• Wells Fargo

• Truist Financial Corporation

• Lendingclub Bank

• Goldman Sachs

Browse In-Depth Market Research Report – https://www.marketresearchfuture.com/reports/personal-loans-market-12020

Market Segmentation

To provide a comprehensive analysis, the Personal Loans Market is segmented based on type, provider, purpose, and region.

1. By Type

• Secured Personal Loans: Backed by collateral, offering lower interest rates.

• Unsecured Personal Loans: No collateral required, higher interest rates due to increased risk.

2. By Provider

• Banks: Traditional financial institutions providing a range of personal loan products.

• Credit Unions: Member-focused institutions offering competitive loan rates.

• Online Lenders: Digital platforms enabling quick loan approvals.

• Peer-to-Peer (P2P) Lending Platforms: Connecting borrowers with individual investors.

3. By Purpose

• Debt Consolidation: Merging multiple debts into a single loan for easier repayment.

• Home Improvement: Funding home renovation and remodeling projects.

• Medical Expenses: Covering unexpected medical and healthcare costs.

• Education: Financing tuition fees and academic expenses.

• Emergency Expenses: Quick access to funds for unforeseen financial needs.

4. By Region

• North America: Leading market with strong financial institutions and high consumer credit demand.

• Europe: Rapid growth driven by digital lending and regulatory support.

• Asia-Pacific: Expanding financial inclusion and increasing middle-class population fueling market growth.

• Rest of the World (RoW): Emerging economies witnessing a rise in personal loan adoption.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=12020

The global Personal Loans Market is poised for exponential growth, driven by digital transformation, favorable interest rates, and evolving consumer needs. As financial institutions and fintech companies continue to innovate, the market will witness enhanced accessibility, increased loan disbursement, and improved borrower experiences. Ensuring responsible lending practices and regulatory compliance will be crucial for sustaining this rapid expansion.

Related Report –

banking wearable market

https://www.marketresearchfuture.com/reports/banking-wearable-market-31255

banknote market

https://www.marketresearchfuture.com/reports/banknote-market-23952

bitcoin payment market

https://www.marketresearchfuture.com/reports/bitcoin-payment-market-31252

blockchain in retail banking market

https://www.marketresearchfuture.com/reports/blockchain-in-retail-banking-market-31352

cancer insurance market

https://www.marketresearchfuture.com/reports/cancer-insurance-market-23920

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()