Ozan Ozerk is a globally well-known figure in fintech. He founded numerous successful financial institutions, including banking-as-a-service provider Openpayd, European Merchant Bank (EMBank) and Turkey’s fast-growing e-money institution Ozan Electronic Money (Ozan Elektronik Para).

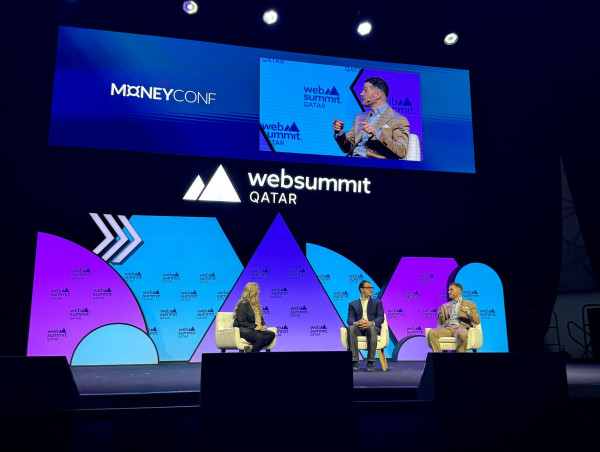

During the session, Dr Ozerk identified the areas of fintech where AI can be most helpful as customer onboarding, transaction monitoring and handling compliance and risk, which makes scalable growth attainable now, and not a big obstacle for fintechs. Fintechs overcome the increasing workload of client acquisition by using AI, either through AI-powered service providers or internally, to speed it up and reduce the risk of human or algorithmic errors.

Ozan Ozerk was cautiously optimistic about how AI could help us better manage our money. He posited that AI should and would successfully help direct us to the right financial products and better trading decisions, reducing the burden of individually processing a load of information along the way.

Yet he questioned how inclusive the process would be. Will the unbanked and underbanked masses be able to enjoy the benefits of AI in finance in a similar fashion? Financial institutions are regulated to have top-notch cybersecurity and effectively apply KYC/AML procedures. However, AI usage could further undermine the inclusivity of their services if it were not handled properly. Recognising the threat of AI being abused by criminal entities or persons, Ozerk is still concerned about a growing chasm of access, where “basically people might get excluded just because a robot told you they should not be banking with you.”

Dr Ozan Ozerk noted that all the links in the chain must be connected to deliver AI's full benefits to customers in terms of institutions and their technology. In international payments, various parties depend on each other to move money or assets across institutions. With the increased use of AI, companies that do not utilise AI may become bottlenecks.

Dr Ozan Ozerk embraced the expected changes in the workforce and talent pool that the extended use of AI would impose on fintechs, confident from a historical perspective that society would adapt successfully. He believes AI will be a big catalyst of much manual work being delegated to technology. So, more employees will be tasked to govern and utilise AI, performing new professions, occupying positions within each company, and performing new roles in society at large. AI may be especially beneficial for companies in countries with declining populations to maintain their competitive advantage.

Ozan Ozerk also dwelled on the challenges of pioneering AI in financial services, particularly because AI is still in a very early phase, with imprecise industry regulation and the technology yet unproven in many aspects. In their own applications, Ozerk’s approach is to constantly review the practices in non-regulated industries and assess whether to adapt them to fintech.

Dr Ozerk expressed his excitement about the future potential of AI and technology to level the competitive field between big, long-established financial institutions and younger contenders in the eyes of retail clients. Five years on, he is curious how they will choose financial services, whether the ones with the best engines, best robots, and best algorithms will win the day. At any rate, he expects the older and the younger institutions to face off in a much more challenging way than today.

Gizem Lallı

Ozan Electronic Money Institution

[email protected]

![]()