Neobanking Market Research Report Information By, Account Type, Application, and Region

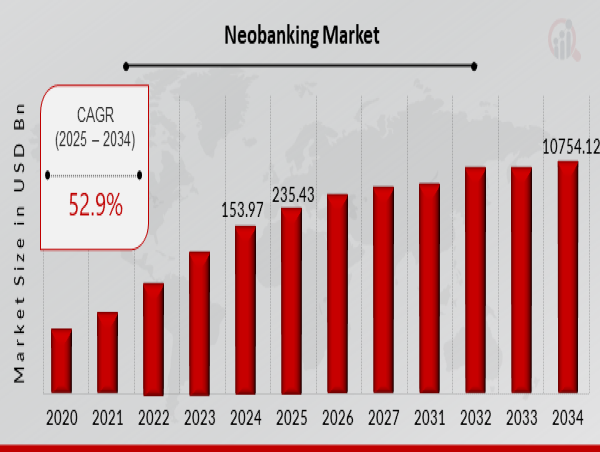

NE, UNITED STATES, March 11, 2025 /EINPresswire.com/ -- The Neobanking Market has witnessed rapid growth in recent years and is expected to expand significantly over the coming decade. In 2024, the market size was valued at USD 153.97 billion and is projected to grow from USD 235.43 billion in 2025 to an impressive USD 10,754.12 billion by 2034, exhibiting a strong compound annual growth rate (CAGR) of 52.9% during the forecast period (2025–2034). The market growth is driven by factors such as convenience and accessibility, reduced fees, personalized and innovative services, fast account opening, global expansion, financial inclusion, and evolving regulatory frameworks.

Key Drivers of Market Growth

Convenience and Accessibility

Neobanks offer seamless digital banking experiences with 24/7 access via mobile and web platforms, eliminating the need for physical branches and enhancing user convenience.

Reduced Fees and Cost-Effectiveness

By operating without traditional banking infrastructure, neobanks significantly lower operational costs, enabling them to offer competitive pricing, low or zero transaction fees, and higher interest rates on deposits.

Personalized and Innovative Services

AI-driven financial solutions, automated savings tools, budgeting insights, and tailored lending options differentiate neobanks from traditional banks, attracting a tech-savvy customer base.

Fast Account Opening and Onboarding

Neobanks provide instant, hassle-free digital onboarding, utilizing e-KYC (electronic Know Your Customer) and biometric verification, streamlining the account setup process.

Global Expansion and Borderless Banking

With the rise of digital nomads, expatriates, and cross-border e-commerce, neobanks facilitate multi-currency accounts, international transfers, and seamless global transactions.

Financial Inclusion

Neobanks bridge the gap for unbanked and underbanked populations by offering accessible banking solutions without the need for physical infrastructure.

Partnerships and Ecosystem Integration

Collaboration with fintech companies, payment providers, and third-party financial services enhances neobank offerings, creating a comprehensive financial ecosystem.

Evolving Regulatory Environment

Supportive regulatory policies, open banking frameworks, and digital banking licenses are enabling neobanks to scale rapidly while ensuring compliance and security.

Changing Consumer Preferences

Millennials and Gen Z customers prefer digital-first banking experiences, driving the demand for neobanking solutions that offer speed, transparency, and flexibility.

Data Security and Privacy

Neobanks leverage advanced encryption, biometric authentication, and AI-driven fraud detection to safeguard customer data and enhance trust in digital banking.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/12100

Key Companies in the Neobanking Market Include:

• Passport Card

• Assicurazioni Generali S.P.A.

• Staysure

• American International Group, Inc

• Trailfinders Ltd

• AXA

• com

• Zurich

• Aviva

• Just Travel Cover

Browse In-Depth Market Research Report – https://www.marketresearchfuture.com/reports/neobanking-market-12100

Market Segmentation

To provide a comprehensive analysis, the Neobanking Market is segmented based on service type, end-user, and region.

1. By Service Type

o Payments & Money Transfers

o Savings & Checking Accounts

o Loans & Credit Services

o Investment & Wealth Management

o Insurance Services

2. By End-User

o Retail Customers

o SMEs (Small and Medium Enterprises)

o Large Enterprises

o Freelancers & Digital Nomads

3. By Region

o North America: Leading market with early adoption of digital banking and fintech advancements.

o Europe: Strong presence of neobanks, driven by open banking regulations and financial innovation.

o Asia-Pacific: Rapid growth due to increasing smartphone penetration, fintech investments, and supportive regulatory frameworks.

o Rest of the World (RoW): Emerging markets experiencing gradual adoption due to rising financial inclusion initiatives.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=12100

The global Neobanking Market is poised for remarkable growth, fueled by digital transformation, evolving consumer expectations, and financial inclusivity. As neobanks continue to innovate with AI-driven financial services, seamless cross-border banking, and enhanced security, their role in reshaping the future of banking will become increasingly significant. Ensuring compliance, data protection, and strategic partnerships will be crucial for sustained industry success.

Related Report –

banking credit analytic market

banking encryption software market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()