The microprocessor market is driven by the ever-increasing demand for powerful computing across various sectors like consumer electronics, AI, and IoT.

AUSTIN, TX, UNITED STATES, October 29, 2024 /EINPresswire.com/ -- Market Size & Industry Insights

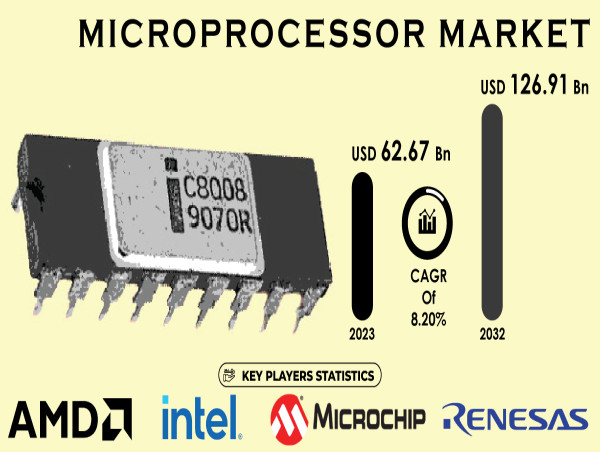

According to the S&S Insider, "The Microprocessor Market Size was USD 62.57 Billion in 2023 and expect and expected to reach USD 126.91 Billion by 2032 at CAGR about 8.20% during forecast period 2024-2032.”

The growing demand for robust computing capabilities in space has driven the popularity of Microchip's new spaceflight computer. NASA requires a processor with 100 times the processing power for upcoming missions, reflecting the increasing complexity and aspirations of space exploration. Modern spacecraft are increasingly dependent on high-performance computers to manage these advancements. Microchip's PIC64-HPSC stands out in this dynamic market due to its radiation-resistant design, AI capabilities, and industry-standard features. Choosing the right computer processor can be a daunting task, especially for gamers and creative professionals. Selecting the appropriate CPU is crucial for efficiently managing demanding tasks and multitasking. With a decade of experience in evaluating and comparing processors, TechRadar offers a detailed guide to help you choose the perfect CPU. Their thorough reviews consider budget, performance needs, and system compatibility, ensuring you get the best value.

Download Free Sample Report with Full TOC & Graphs @ https://www.snsinsider.com/sample-request/4354

KEY PLAYERS:

-Advanced Micro Devices

-Intel Corp

-STMicroelectronics

-Microchip Technology

-NXP Semiconductors

-Renesas Corp

-Qualcomm Inc.

-Texas Instruments

-NVIDIA Corp

-Analog Devices

-Broadcom

-Samsung

-Nuvoton Technology

-The Western Design Center

-SiFive

-Analog Devices

"Growth in the Microprocessor Market Driven by RISC Architecture and Industrial Applications: Key Trends Highlighted by India’s DIR-V Initiative and AMD’s Latest Chip."

In the architecture sector, the Reduced Instruction Set Computer (RISC) currently leads the Microprocessor Market with a 42% share as of 2023. The RISC segment is projected to experience the fastest growth during the forecast period, driven by the increasing adoption of 5G-capable mobile devices and several recent product launches. In April 2023, the Ministry of Electronics and IT (MoS IT) announced India’s plan to launch its own chipset by 2023-2024 under the Digital India RISC-V (DIR-V) initiative. This initiative aims to enhance domestic chip design in India and position the country as a key player in the global RISC-V open-source chip market.

Regarding applications, the industrial sector dominates the microprocessor market, accounting for 35% of the market share. Factories and industrial facilities are increasingly adopting advanced technologies such as AI assistants, cloud storage, and IoT devices, necessitating the use of more powerful microprocessor chips. To address this demand, AMD introduced a new high-speed chip for data centers in June 2023, named the Instinct MI300. This chip is particularly adept at supporting AI development projects and has the potential to compete with offerings from NVIDIA.

Connect with Our Expert for any Queries @ https://www.snsinsider.com/request-analyst/4354

KEY MARKET SEGMENTS:

By Architecture

-RISC

-CISC

-Hybrid

-Others

By Application

-Computer

-Mobile Devices and Tablets

-Industrial

-Consumer

-Automotive

-Government

By Size

-Less than 10nm

-10nm - 22nm

-More than 28nm

By Bit Size

-4, 8, 16 bits

-32 bits

-64 bits

By Core Count

-Less than 4 Cores

-8 Cores

-16 Cores

More than 32 Cores

Asia-Pacific is the leading region in the global microprocessor market, while North America is experiencing rapid growth.

The Asia-Pacific region holds half of the global microprocessor market share, driven by the rising demand for smartphones, laptops, luxury vehicles, and rapid digitalization alongside advanced technology adoption. China's emphasis on local chip development, spurred by trade tensions with the US and its 14th Five-Year Plan, further enhances the region's position. Additionally, initiatives like India’s DIR-V program contribute to Asia-Pacific's sustained leadership in the microprocessor market.

In contrast, North America is the fastest-growing segment, accounting for 20% of the market share. The region is highly competitive, fueled by the adoption of digital technologies, growth in IoT, advancements in autonomous vehicles, and increasing needs for high-performance computing. Compared to other regions, North America is technologically advanced, creating market opportunities for companies like Tesla Motors Inc. and Rivian Automotive Inc. to launch electric vehicles equipped with self-driving capabilities and lane assist, which require powerful microprocessor units (MPUs). The demand for microprocessors in North America is further amplified by the presence of major players such as Intel Corporation and AMD Inc.

Make an Inquiry Before Buying @ https://www.snsinsider.com/enquiry/4354

Recent Developments

-In March 2024, NVIDIA launched the Blackwell Platform, aimed at powering the next generation of AI. This platform introduces six groundbreaking technologies for accelerated computing, focusing on reducing the cost and energy consumption of running large language models by up to 25 times compared to its predecessors.

-In September 2023, Intel unveiled Meteor Lake, a new naming scheme for Intel Core processors that leverages Intel's 3D Packaging Technology to enhance performance and efficiency. These processors also include AI Boost features to optimize AI-related tasks.

-In June 2023, Qualcomm introduced the Snapdragon 4 Gen 2, an entry-level smartphone processor built on a 4nm process. This processor provides enhanced AI capabilities, improved GPU and CPU performance, and better connectivity for streaming and gaming.

Key Takeaways

Companies should focus on developing and promoting microprocessors tailored for specific applications in the Asia-Pacific region.

Governments in the Asia-Pacific area are actively supporting domestic chip manufacturing due to the ongoing chip shortage and its strategic importance.

Explore partnerships with local businesses and leverage government initiatives to facilitate chip manufacturing.

Table of Content – Analysis of Key Points

Chapter 1. Introduction

Chapter 2. Executive Summary

Chapter 3. Research Methodology

Chapter 4. Market Dynamics Impact Analysis

Chapter 5. Statistical Insights and Trends Reporting

Chapter 6. Competitive Landscape

Chapter 7. Microprocessor Market Segmentation, by Architecture

Chapter 8. Microprocessor Market Segmentation, by Size

Chapter 9. Microprocessor Market Segmentation, by Bit Size

Chapter 10. Microprocessor Market Segmentation, by Core Count

Chapter 11. Microprocessor Market Segmentation, by Application

Chapter 12. Regional Analysis

Chapter 13. Company Profiles

Chapter 14. Use Cases and Best Practices

Chapter 15. Conclusion

Continued…

Buy Single User License of Microprocessor Market Forecast Report @ https://www.snsinsider.com/checkout/4354

Akash Anand

SNS Insider Pvt. Ltd

+1 415-230-0044

[email protected]

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()