U.S. metallurgical coke industry analysis highlights growth opportunities, key players, and market trends shaping the sector's future through 2034.

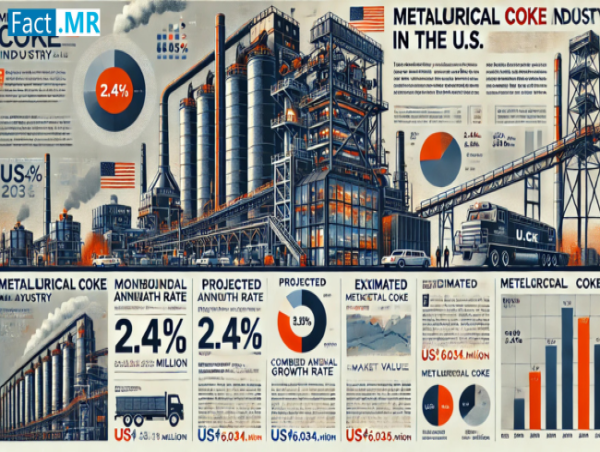

ROCKVILLE, MD, UNITED STATES, February 4, 2025 /EINPresswire.com/ -- According to a recent study by Fact.MR, the U.S. metallurgical coke market is valued at USD 4,937.5 million in 2024. The market is projected to grow at a CAGR of 2.4%, reaching USD 6,034.5 million by 2034.

The U.S. metallurgical coke sector is expected to benefit from growth opportunities in emerging economies, driven by the availability of scrap metal, which significantly impacts demand within the steel industry. Steelmakers often face a key decision between utilizing scrap metal or metallurgical coke in their production processes, with this choice heavily influenced by the prevailing conditions in the scrap metal market.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=9388

What Is Restraining the Demand for U.S. Metallurgical Coke?

“Shift Towards Electric Arc Furnaces Impeding Industry Growth”

The growing adoption of electric arc furnaces (EAFs) in the steelmaking sector is significantly affecting the demand for metallurgical coke. EAFs are considered a more sustainable alternative to traditional blast furnaces, primarily utilizing scrap metal as the main input. By relying on electricity as the heat source, EAFs reduce the dependency on metallurgical coke.

EAFs operate by melting down scrap steel, which can include recycled materials from sources like end-of-life vehicles, demolished buildings, and industrial scrap. This process minimizes the need for primary raw materials such as iron ore and metallurgical coke. In contrast to traditional blast furnaces, which use metallurgical coke for both heat and as a reducing agent, EAFs generate the necessary heat through electricity, further limiting the use of metallurgical coke.

Region-wise Insights

According to a newly published study by Fact.MR, a market research and competitive intelligence provider, the Southeast U.S. is expected to capture a 15.8% share of the U.S. metallurgical coke industry by 2034. With its strategic access to ports and robust transportation infrastructure, the region is well-positioned to become a key exporter of steel and related products.

The Southeast U.S. is projected to account for 15.8% of the U.S. market by 2034. Large-scale infrastructure projects, including the construction of highways, bridges, and public facilities, often require substantial amounts of steel, further driving the demand for metallurgical coke in the region.

Category-wise Insights

The demand for U.S. metallurgical coke is expected to see significant growth in the high ash content segment. Metallurgical coke with higher ash content can be blended with other materials to meet specific requirements, offering a cost-effective solution for certain applications without compromising performance.

The high ash content segment is projected to account for 52.2% of the U.S. metallurgical coke industry by 2034. Advances in coke production technologies are expected to facilitate the use of higher ash content coal while still meeting the quality standards needed for specific applications. Enhanced processing methods will improve the efficiency of coke production from raw materials with higher ash content.

Competitive Landscape

Key players in the U.S. metallurgical coke industry are employing various strategies to achieve their goals. These strategies include fostering innovation, enforcing stringent quality control measures, forming strategic partnerships, optimizing supply chain management, and consistently advancing products and technologies.

Company Portfolio

SunCoke Energy: Specializing in the production of metallurgical coke for steelmaking, SunCoke Energy also operates cokemaking facilities and provides related services across the U.S.

Mechel: A global mining and metals company, Mechel is involved in coal mining and metallurgical coke production, with operations in the U.S. and other international markets.

Other prominent players in the industry include ArcelorMittal, Shamokin Filler Co., Inc., AK Steel, ERP Compliant Coke, Tonawanda Coke, Hickman, Williams & Company, Mechel PAO, and China Risun Group Limited.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=9388

Segmentation of the U.S. Metallurgical Coke Industry Research

By Ash Content :

Low Ash Content

High Ash Content

By Application :

Fuel

Reducing Agent

Drilling

Conductive Flooring

Permeable Support Material

By Region :

Northeast

Southeast

Midwest

Southwest

Check out More Related Studies Published by Fact.MR:

Petroleum Coke Market: Size is set to reach US$ 25.27 billion in 2022 and further expand at a CAGR of 9.6%, to reach a valuation of US$ 63.10 billion by the end of 2032.

Needle Coke Market: Size to expand at a CAGR of 3.7% and will reach a valuation of US$ 5.86 billion by the end of 2032 from US$ 4.07 billion in 2022.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: [email protected]

Follow Us: LinkedIn | Twitter | Blog

S. N. Jha

Fact.MR

+1 628-251-1583

[email protected]

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()