🌍 LNG Carrier Market Overview: Navigating the Energy Transition

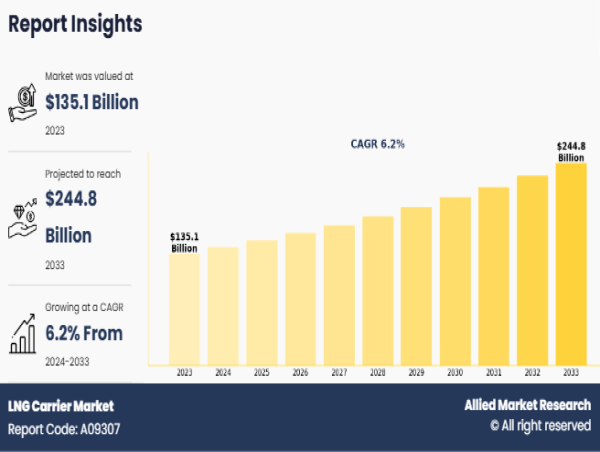

The LNG carrier market is witnessing a major transformation, driven by the global shift toward cleaner energy and the need for secure, long-distance fuel transportation. Valued at $135.1 billion in 2023, the market is projected to reach $244.8 billion by 2033, growing at a robust CAGR of 6.2% from 2024 to 2033.

LNG carriers are specially designed vessels that transport liquefied natural gas at cryogenic temperatures, maintaining LNG at approximately -162°C to ensure safe, efficient bulk movement across seas. These ships serve as a vital link between exporting nations such as the U.S., Qatar, and Australia, and energy-hungry markets like Japan, China, South Korea, and Europe.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/A09307

🔋 Market Drivers: The Push for Low-Carbon Fuels

1. Rising demand for clean energy: With nations pledging to reduce greenhouse gas emissions, LNG has emerged as a key transition fuel. It offers lower carbon emissions compared to coal and oil, making it a preferred choice for electricity generation and industrial applications.

2. Technological innovation in propulsion systems: The emergence of X-DF (low-pressure dual-fuel) engines is transforming fleet efficiency. These engines help vessels comply with IMO emission regulations and reduce methane slip, making them attractive for future-ready LNG shipping.

3. Expansion of energy infrastructure: Global investments in liquefaction plants, regasification terminals, and offshore gas fields are contributing to the growing demand for modern LNG carriers.

4. Floating LNG projects: FLNG units eliminate the need for land-based processing plants, lowering capital costs and enabling gas extraction from remote offshore locations. This flexibility is opening up new trade routes and boosting LNG carrier utilization.

⚠️ Market Challenges: Capital Intensity and Complexity

Despite optimistic projections, the LNG carrier market faces several constraints:

High initial investment: Constructing an LNG carrier can cost up to $250 million, significantly higher than conventional vessels due to the need for cryogenic containment, safety systems, and reliquefaction units.

Limited participation by small players: The technical sophistication and financial requirements of the market favor large shipping firms and government-backed players.

Geopolitical uncertainties: LNG prices are influenced by global politics, trade disruptions, and regional tensions, which can affect investment confidence.

Buy This Report (490 Pages PDF with Insights, Charts, Tables, and Figures): https://bit.ly/4l2wbMF

🌐 Regional Outlook: Asia-Pacific Leads the Charge

The Asia-Pacific region dominated the LNG carrier market in 2023, accounting for half of the global share, and is expected to continue leading through 2033. Countries like China, Japan, South Korea, and India are increasing LNG imports to meet rising energy demands and comply with stricter air quality standards.

Notably, the region is witnessing a shift from long-term supply contracts to spot trading, enhancing flexibility in LNG procurement. This dynamic strategy is reshaping LNG shipping patterns and driving higher demand for advanced, high-capacity vessels.

🛳️ Market Segmentation Insights

1. By Propulsion Type: The X-DF engine segment is expected to grow the fastest, with a CAGR of 7.2%, thanks to lower emissions and superior fuel efficiency.

2. By Containment Type: Membrane systems are dominating the market, offering lightweight construction, improved capacity utilization, and compatibility with modern re-liquefaction technologies.

3. By Carrier Capacity: Very Large LNG Carriers (180,000+ cubic meters) are emerging as the fastest-growing category. These carriers support long-haul routes and maximize per-trip gas volumes, boosting fuel efficiency and reducing cost-per-unit transported.

4. By Application: The transport segment leads the market, accounting for more than half of the global share. LNG carriers remain indispensable in connecting remote gas extraction zones with major consumption hubs.

🔧 Innovation Spotlight: The Rise of Wind-Assist Tech

In a notable advancement, new LNG carrier designs are incorporating wind-assisted propulsion systems. A recent prototype includes dual Wind Challenger sails, aiming to reduce fuel use and emissions further. These innovations highlight the market's responsiveness to both economic and environmental pressures.

Get a Customized Research Report: https://www.alliedmarketresearch.com/request-for-customization/A09307

🔄 Competitive Landscape

Key players in the LNG carrier market are investing in advanced shipbuilding techniques, digital monitoring systems, and low-emission propulsion. Leading companies include:

Samsung Heavy Industries

Hyundai Samho Heavy Industries

Mitsubishi Heavy Industries

Kawasaki Heavy Industries

BW Group

Golar LNG

Flex LNG

Knutsen Group

China Shipbuilding Trading Co.

Japan Marine United Corporation

These companies are actively developing next-gen vessels and forming joint ventures to expand their global footprint.

📈 Outlook: Navigating Toward a Greener Future

The LNG carrier market is at a pivotal moment. While it faces barriers in capital and regulation, ongoing advancements in containment, propulsion, and floating liquefaction technologies are creating a highly favorable environment for long-term growth.

With LNG acting as a bridge fuel toward a sustainable future, and Asia-Pacific driving demand through industrial expansion and policy reform, the next decade holds strong promise for the LNG shipping industry.

Trending Reports in Energy and Power Industry:

Liquid Hydrogen Micro Bulking Systems Market

https://www.alliedmarketresearch.com/global-liquid-hydrogen-micro-bulking-systems-market-A325779

LNG Carrier Market

https://www.alliedmarketresearch.com/lng-carrier-market-A09307

LNG Engine Market

https://www.alliedmarketresearch.com/lng-engine-market-A325619

Floating Liquefied Natural Gas (FLNG) Market

https://www.alliedmarketresearch.com/floating-liquefied-natural-gas-market-A15554

Floating Production Storage and Offloading (FPSO) Market

https://www.alliedmarketresearch.com/floating-production-storage-and-offloading-market-A07604

Bio-LNG Market

https://www.alliedmarketresearch.com/bio-lng-market-A187448

LNG Bunkering Market

https://www.alliedmarketresearch.com/lng-bunkering-market

FRP Vessels Market

https://www.alliedmarketresearch.com/frp-vessels-market-A10295

Planned LNG Market

https://www.alliedmarketresearch.com/planned-lng-market

Bunker Fuel Market

https://www.alliedmarketresearch.com/bunker-fuel-market

Marine Bunker Oil Market

https://www.alliedmarketresearch.com/marine-bunker-oil-market

Singapore Bunker Fuel Market

https://www.alliedmarketresearch.com/singapore-bunker-fuel-market-A14491

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

David Correa

Allied Market Research

+ 1800-792-5285

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()