Liraglutide Market Overview

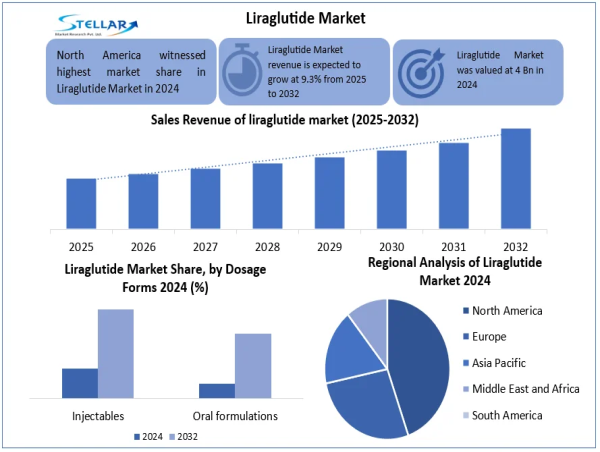

Liraglutide Market size is growing at a substantial pace due to the increasing prevalence of type 2 diabetes and obesity worldwide. Liraglutide, an agonist of the GLP-1 receptor, is indicated for the treatment of both metabolic diseases and is known to have efficacy in reducing HbA1c and body weight, and cardiovascular benefits. Lifestyle-related diseases are increasing, particularly in industrialized countries, and the need for long-acting antidiabetic and weight reduction medicines, like liraglutide, is expanding. Owing to a well-established clinical profile, growing telehealth distribution, and climbing biosimilar availability, the market is expected to cross USD 8.91 billion by 2032 and is progressing at a CAGR of 9.3% from 2025 to 2032.

To know the most attractive segments, click here for a free sample of the report: https://www.stellarmr.com/report/req_sample/liraglutide-market/2691

Liraglutide Market Dynamics

Drivers

Metabolic Health Crisis: With over 1 billion people worldwide affected by obesity and/ or type 2 diabetes (WHO), liraglutide's dual application in the management of both diseases makes it a crucial tool against this growing epidemic.

Telehealth Expansion: Somewhat for better and somewhat for worse, this has democratized access to liraglutide (as long as customers can afford a digital health platform like Hims & Hers), which now has an average patient cost that’s about 85% lower than the next generation of GLP-1 therapies. This has brought down the cost and widened the reach, especially for those who are underserved or live in rural areas.

Biosimilar Launches: From Hikma’s U.S. march to the first generic of the liraglutide in 2024 and Biocon and Juno’s deal in Canada, the therapy is within reach for a broader cohort of people. These are an agnosticism, and as the market steward, lowers the cost of treatment for patients globally.

Restraints

Side Effects and FDA Warnings: Liraglutide is associated with gastrointestinal issues in over 90% of pediatric patients and increased pancreatitis risk, which may deter adoption.

Injectable Format Dependency: Although liraglutide is clinically effective, the requirement to administer via injection may be a barrier to use for those with needle phobia. This dependence could compromise long-term compliance, as well as limit market expansion in non-invasive treatment-seeking populations.

Opportunities

Digital Health Integration: Integration with mobile apps, wearables, and remote monitoring to drive compliance, tailored dosing, and long-term success of diabetes and obesity therapies.

Expansion in Emerging Markets: Growth Biocon’s MHRA nod for UK launch of biosimilars route opens up high burden, cost-conscious markets for penetration- Saxenda/Victoza.

Liraglutide Market Segment Analysis

By Brand:

Victoza (dominant, 60% market share in 2024)

Saxenda

Generics (fastest-growing segment)

By Dosage Form:

Injectables (dominant due to proven bioavailability)

Oral formulations (under development)

By Distribution Channel:

Hospital Pharmacies (largest share in 2024)

Retail Pharmacies & Drug Stores

Online Pharmacies

Others

By Application:

Diabetes Treatment (largest segment)

Obesity Management

Others.

Liraglutide Market Regional Insights

The Liraglutide Market exhibits a strong regional presence in major global markets. Emerging North America is based on a well-developed healthcare infrastructure, rising prevalence of type 2 diabetes and obesity, and increased accessibility to GLP-1 therapies. US-based telehealth platforms are reaching the market through generic liraglutide priced at a substantial discount. In Europe, for example, UK, German, and French regulators approve both Victoza and Saxenda (and the MHRA’s nod for Biocon generics would imply a further flux of cheaper competitors). Asia-Pacific is the fastest-growing region. However, India and China's demand is increasing due to urbanization and diabetes prevalence. Injectable GLP-1 innovation is led by Japan and South Korea. In the Middle East & Africa, increasing obesity-related diabetes and government healthcare sector support will lead to liraglutide access in countries such as Egypt, Turkey, and South Africa. South America, where growth is consistent supported by increased domestic pharma manufacture coupled with the demand for cost-efficient diabetes care (Brazil and Argentina in the lead).

To know the most attractive segments, click here for a free sample of the report: https://www.stellarmr.com/report/req_sample/liraglutide-market/2691

Liraglutide Market Competitive Landscape

Key Players:

North America:

Novo Nordisk (Victoza, Saxenda), Teva, Hikma, Eli Lilly, Agmen, Sanofi

Europe:

GlaxoSmithKline, Sandoz, Ipsen, Adalvo, Roche

Asia-Pacific:

Biocon, Huadong Medicine, Glenmark, Madura, Siam Bioscience

Middle East & Africa:

Aspen Pharmacare, SEDICO, Arven Pharma

South America:

Hypera Pharma, EMS, CFR Pharma, Tecnoquímicas

Strategic Developments

Novo Holdings acquired Catalent for $16.5 billion in 2024, scaling up GLP-1 production capacity.

Biocon’s UK launch of gVictoza and gSaxenda positions it as a key biosimilar supplier in Europe.

Juno-Biocon partnership in Canada aims to democratize access to obesity and diabetes care.

Summary

The global Liraglutide Market, valued at USD 4 billion in 2024, is projected to reach USD 8.91 billion by 2032, growing at a CAGR of 9.3%. This rapid growth is attributed to the increasing incidence of obesity and type 2 diabetes across the globe, and the growing demand for low-cost treatment alternatives at telehealth services. Important events such as biosimilar launches by Hikma and Biocon are increasing access and competition. However, side effects and the in situ injectable form of the drug raise the issue of patient compliance. The market is dominated by North America, and the fastest-growing region is currently Asia-Pacific, due to urbanization and increasing health awareness.

Related Reports:

Veterinary Pain Management Market: https://www.stellarmr.com/report/veterinary-pain-management-market/2682

Vertigo Treatment Market: https://www.stellarmr.com/report/vertigo-treatment-market/2681

Pulmonary Edema Market: https://www.stellarmr.com/report/pulmonary-edema-market/2673

Ureteral Obstruction Market: https://www.stellarmr.com/report/ureteral-obstruction-market/2614

Pleurisy Market: https://www.stellarmr.com/report/pleurisy-market/2612

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

[email protected]

Lumawant Godage

Stellar Market Research

+ +91 9607365656

email us here

Visit us on social media:

LinkedIn

Instagram

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()