Investment Banking Market Research Report Information By, Type, End User, Enterprise Size, and Region

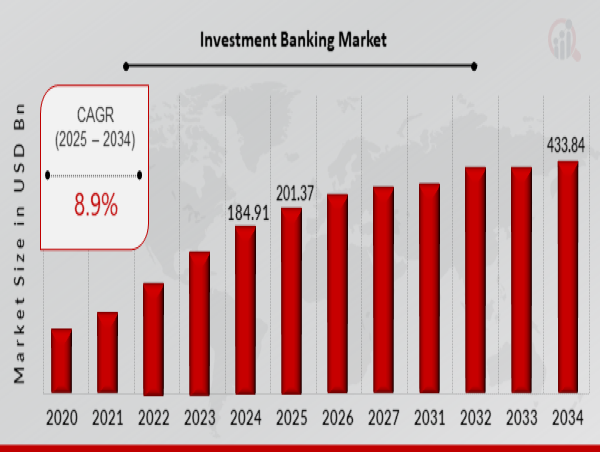

NJ, UNITED STATES, March 11, 2025 /EINPresswire.com/ -- The Investment Banking Market has experienced steady growth in recent years and is expected to expand significantly over the coming decade. In 2024, the market size was valued at USD 184.91 billion and is projected to grow from USD 201.37 billion in 2025 to an estimated USD 433.84 billion by 2034, reflecting a compound annual growth rate (CAGR) of 8.9% during the forecast period (2025–2034). Expanding business financial issues, increasing capital requirements, and the rising demand for expert financial guidance among corporate entities are the key drivers enhancing market growth.

Key Drivers of Market Growth

Rising Capital Requirements & Corporate Financing Needs

The increasing need for capital to fund mergers, acquisitions, and business expansion is fueling the demand for investment banking services. Companies require structured financial solutions to support growth, driving the market forward.

Growing Demand for Financial Advisory Services

As businesses navigate complex financial landscapes, investment banks provide essential advisory services, including risk management, capital restructuring, and strategic decision-making. The increasing need for professional expertise is propelling market expansion.

Surge in Mergers & Acquisitions (M&A) Activities

The rise in global M&A transactions, driven by market consolidation and strategic partnerships, is significantly boosting investment banking operations. Firms seek investment banks' assistance in deal structuring, due diligence, and valuation analysis.

Technological Advancements in Investment Banking

The integration of AI, blockchain, and data analytics in investment banking is enhancing operational efficiency, risk assessment, and transaction processing. Digital transformation is enabling faster decision-making and improving client experiences.

Regulatory Changes & Compliance Requirements

Stricter financial regulations and compliance mandates are driving investment banks to adopt advanced risk management solutions. Compliance with global financial laws ensures stability and transparency in investment banking operations.

Expansion of Private Equity & Venture Capital Investments

The increasing flow of investments into private equity and venture capital markets is creating opportunities for investment banks to manage fundraising, underwriting, and advisory services for startups and established businesses.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/11815

Key Companies in the Investment Banking Market Include:

• Atom Bank PLC

• Fidor Bank Ag

• Monzo Bank Limited

• Movencorp Inc.

• Mybank

• N26

• Revolut Ltd.

• Simple Finance Technology Corporation

• Ubank Limited

• Webank, Inc.

Browse In-Depth Market Research Report – https://www.marketresearchfuture.com/reports/investment-banking-market-11815

Market Segmentation

To provide a comprehensive analysis, the Investment Banking Market is segmented based on service type, industry vertical, and region.

1. By Service Type

o Mergers & Acquisitions (M&A) Advisory

o Underwriting Services

o Trading & Sales

o Asset Management

o Risk Management & Financial Advisory

2. By Industry Vertical

o Financial Institutions

o Healthcare & Pharmaceuticals

o Technology & Media

o Energy & Utilities

o Real Estate & Infrastructure

o Manufacturing & Industrial

3. By Region

o North America: Leading market due to high financial activity and advanced investment banking services.

o Europe: Growth driven by strong financial hubs such as London, Frankfurt, and Paris.

o Asia-Pacific: Rapid expansion due to economic growth in China, India, and Southeast Asia.

o Rest of the World (RoW): Gradual development with increasing investment banking penetration.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=11815

The global Investment Banking Market is set to witness remarkable growth, driven by increasing capital requirements, financial advisory demand, and evolving technological advancements. As investment banks continue to adapt to regulatory changes and digital transformation, the industry is expected to become more efficient, client-focused, and risk-resilient. Ensuring compliance, leveraging AI-driven analytics, and expanding into emerging markets will be crucial for sustained industry growth.

Related Report –

b2b legal service market

https://www.marketresearchfuture.com/reports/b2b-legal-service-market-42539

b2c legal service market

https://www.marketresearchfuture.com/reports/b2c-legal-service-market-42525

b2c payment market

https://www.marketresearchfuture.com/reports/b2c-payment-market-29051

bancassurance market

https://www.marketresearchfuture.com/reports/bancassurance-market-23854

bank kiosk market

https://www.marketresearchfuture.com/reports/bank-kiosk-market-22832

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()