Heavy Construction Equipment Rental Market Size, Share, Competitive Landscape and Trend Analysis Report

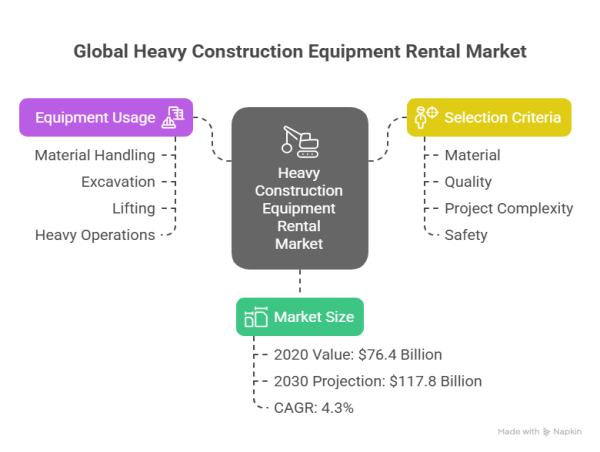

WILMINGTON, DE, UNITED STATES, June 26, 2025 /EINPresswire.com/ -- According to a new report published by Allied Market Research, titled, “𝐇𝐞𝐚𝐯𝐲 𝐂𝐨𝐧𝐬𝐭𝐫𝐮𝐜𝐭𝐢𝐨𝐧 𝐄𝐪𝐮𝐢𝐩𝐦𝐞𝐧𝐭 𝐑𝐞𝐧𝐭𝐚𝐥 𝐌𝐚𝐫𝐤𝐞𝐭," The Heavy Construction Equipment Rental Market size was valued at $76.4 billion in 2020, and is estimated to reach $117.8 billion by 2030, growing at a CAGR of 4.3% from 2021 to 2030.

Heavy construction equipment machineries are used for various operations such as material handling, excavation, lift and different other heavy operations. It is a service that is used for providing the construction equipment on rent to the end users. For taking equipment on rent, the contract is signed for a certain amount of time. In addition, the contract mentions the terms and conditions regarding the precautions and usage of the equipment. The construction equipment is majorly used for the heavy operation in construction mining sites. There are variety of the heavy construction equipment available in the market according to the need and use as per the project complexity.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞@ https://www.alliedmarketresearch.com/request-sample/A16394

Mining activities in different developing nations such as Latin America and Africa drive growth of the heavy construction equipment rental market. Governments in different countries are investing on construction of roads, airports, railway, airports, and other infrastructural projects. Thus, this requires use excavators, loaders and different other heavy equipment. In March 2021, the U.S. President introduced infrastructural plan by investing about $2 trillion. The plan had infrastructural construction projects that includes transportation, broadband, electric grid and residential & commercial constructions.

Thus, these factors are expected to create new opportunities for the market. In addition, high operational cost and maintenance cost could be saved by renting the equipment for required period of time. Moreover, high amount of investment needed in order to purchase the equipment could be avoided by renting the construction equipment. Thus, such factors propel the market growth.

However, dearth of skilled labors is a major factor that restrains the heavy construction equipment rental market growth. Moreover, saturation in the construction and mining industry in developed nations is another factor that hampers growth of the market.

In addition, the outbreak of COVID-19 led to halt in logistic and manufacturing activities across the globe that has led to interruption of supply chain, which hinders growth of the heavy construction equipment rental market share. However, this situation is expected to improve as governments are relaxing norms around the world to resume business activities.

On the contrary, manufacturers are developing advanced equipment, which are economical and sustainable. For instance, in March 2021, Doosan Infracore launched 100-ton excavator, which uses smart power control and electronic integrated hydraulic system. It has in-house designed fuel optimization system to improve fuel efficiency and deliver ideal job performance with loss-free power and speed. Moreover, integration of IoT is expected to help to overcome shortage of skilled labors and enhanced safety of operators and end users. These factors are anticipated to offer remunerative opportunities for expansion of the global heavy construction equipment rental industry during the forecast period.

𝐄𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠@ https://www.alliedmarketresearch.com/purchase-enquiry/A16394

The heavy construction equipment rental market analysis is on the basis of equipment, end user, application, and region. By equipment, the market is classified into earthmoving equipment, material handling equipment, heavy construction vehicles, and others. By end user, it is classified as infrastructure, construction, mining, oil & gas, manufacturing, and others. By application, ithe market is categorized into excavation & demolition, heavy lifting, tunneling, material handling, and recycling & waste management. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, South Korea, India, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

COMPETITION ANALYSIS

The major players profiled in the heavy construction equipment rental market include Ashtead Group plc. (Sunbelt Rentals Ltd), Boels Rental, H&E Equipment Services, Haulotte Group, Herc Rentals Inc., Kanamoto Co., Ltd., Loxam (Ramirent), Sarens n.v./s.a., Sumitomo Corporation (Sunstate Equipment Company) and United Rentals, Inc.

KEY FINDINGS OF THE STUDY

• The report provides an extensive analysis of the current and emerging global heavy construction equipment rental market trends and dynamics.

• Depending on equipment, the earthmoving equipment segment was the largest revenue generator in 2020.

• By end user, the construction segment generated the highest revenue in 2020.

• By application, the excavation & demolition segment dominated the market in 2020.

• Region wise, North America is anticipated to dominate the global heavy construction equipment rental market opportunities throughout the forecast period.

• The global heavy construction equipment rental market forecast from 2021 to 2030 is included in the report.

𝐔𝐩𝐝𝐚𝐭𝐞 𝐎𝐧 𝐃𝐞𝐦𝐚𝐧𝐝@ https://www.alliedmarketresearch.com/request-for-customization/A16394

David Correa

Allied Market Research

+ 1800-792-5285

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()