Core Banking Solution Market Research Report Information By, Component, Deployment, Organization Size, End User and Region

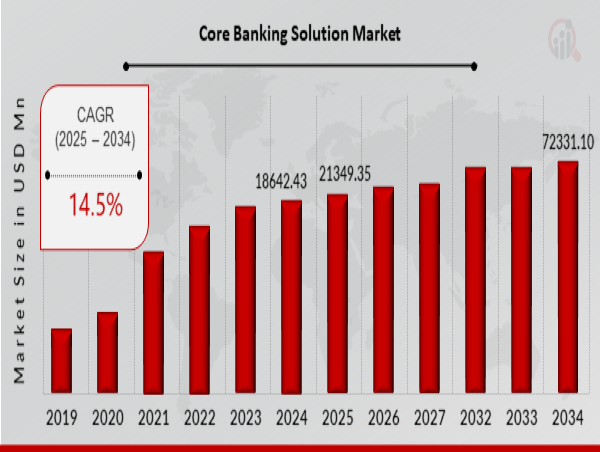

AZ, UNITED STATES, March 11, 2025 /EINPresswire.com/ -- The Core Banking Solution Market has experienced significant growth in recent years and is expected to expand substantially over the coming decade. In 2024, the market size was valued at USD 18,642.43 million and is projected to grow from USD 21,349.35 million in 2025 to an impressive USD 72,331.10 million by 2034, reflecting a strong compound annual growth rate (CAGR) of 14.5% during the forecast period (2025–2034). The growing demand for improved customer experience and the increasing need to manage banking operations from a centralized server are key drivers fueling market expansion.

Key Drivers of Market Growth

Enhanced Customer Experience

Banks and financial institutions are increasingly focusing on delivering seamless and personalized customer experiences. Core banking solutions enable real-time transaction processing, multi-channel accessibility, and improved customer service, driving adoption across the industry.

Centralized Banking Operations

The need for efficient, centralized banking operations has become crucial for financial institutions. Core banking solutions provide integrated platforms that enable banks to manage accounts, transactions, loans, and payments efficiently from a single system, ensuring operational efficiency and cost-effectiveness.

Advancements in Digital Banking & Fintech Integration

The rise of digital banking and the growing collaboration between traditional banks and fintech companies have propelled the adoption of core banking solutions. Technologies such as AI, blockchain, and cloud computing are enhancing banking operations, security, and compliance.

Regulatory Compliance & Risk Management

Stringent regulatory frameworks and compliance requirements are driving financial institutions to adopt robust core banking solutions. These systems help in automating regulatory reporting, risk assessment, and fraud detection, ensuring compliance with evolving financial regulations.

Cloud-Based & SaaS Adoption

Cloud-based core banking solutions are gaining traction due to their scalability, flexibility, and cost-efficiency. Banks are increasingly shifting from on-premises legacy systems to Software-as-a-Service (SaaS) models for improved agility and reduced infrastructure costs.

Integration of AI & Analytics

The adoption of AI-powered analytics in core banking solutions enables banks to gain valuable customer insights, optimize credit risk assessment, and enhance fraud detection mechanisms, improving overall decision-making.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/3208

Key Companies in the Core Banking Solution Market Include:

• JPMorgan Chase & Co.

• Citigroup Inc.

• Goldman Sachs

• BofA Securities

• Morgan Stanley

• UBS

• Credit Suisse Group AG

• Deutsche Bank AG

• The Hongkong and Shanghai Banking Corporation Limited

• Barclays

Browse In-Depth Market Research Report – https://www.marketresearchfuture.com/reports/core-banking-solutions-market-3208

Market Segmentation

To provide a comprehensive analysis, the Core Banking Solution Market is segmented based on component, deployment mode, end-user, and region.

1. By Component

o Software: Includes core banking platforms, payment processing, and loan management systems.

o Services: Implementation, consulting, support, and maintenance.

2. By Deployment Mode

o On-Premises: Preferred by large banks requiring full control over infrastructure.

o Cloud-Based: Increasing adoption due to cost efficiency and scalability.

3. By End-User

o Retail Banks: Growing digital banking adoption among consumers.

o Corporate Banks: Increasing demand for streamlined transaction processing.

o Cooperative & Community Banks: Need for cost-effective and flexible banking solutions.

4. By Region

o North America: Leading market driven by digital banking transformation and fintech collaborations.

o Europe: Rapid growth due to regulatory compliance demands and cloud adoption.

o Asia-Pacific: Increasing core banking adoption in emerging economies like India, China, and Southeast Asia.

o Rest of the World (RoW): Gradual adoption as financial institutions modernize legacy systems.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=3208

The global Core Banking Solution Market is set to witness remarkable growth, driven by digital transformation, regulatory compliance requirements, and the rising demand for centralized banking operations. As technology continues to evolve, financial institutions will focus on enhancing efficiency, security, and customer engagement through innovative core banking solutions. Ensuring seamless integration with emerging fintech solutions and maintaining regulatory adherence will be critical for sustained market expansion.

Related Report –

auto finance market

aviation leasing market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()