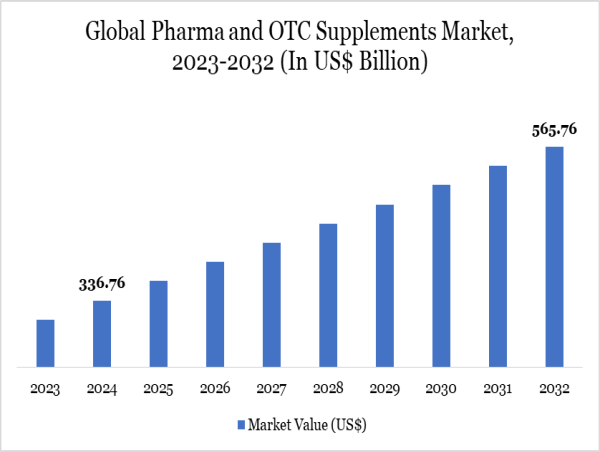

In 2025, the Pharma and OTC Supplements Market Size Growth at US$ 336.76 Billion and is expected to experience notable growth, reaching approximately US$ 565.76 Billion by 2032. This upward trend, marked by a robust CAGR of 6.70% from 2025 to 2032, is fueled by growing health consciousness among consumers and a rising preference for convenient, over-the-counter wellness products.

To Download Sample Report: https://www.datamintelligence.com/download-sample/pharma-and-otc-supplements-market

Market Value and Growth

As of 2025, the market is valued at well over $350 billion globally and is poised for strong, steady growth in the coming years. With rising disposable incomes, urbanization, and a more informed consumer base, annual growth rates are expected to average between 6% and 8%. This growth is being driven by demand across both established and emerging economies, from prescription alternatives to preventive care and daily wellness routines.

In April 2025, Mushrooms Inc. introduced a new range of wellness supplements, highlighting ingredients such as Organic Lion’s Mane to enhance cognitive function and Pomegranate to promote heart health crafted to support overall well-being and graceful aging.

In September 2024, Kourtney Kardashian unveiled GLP-1 Daily, an over-the-counter, plant-based supplement through her brand Lemme. Designed as a natural alternative to GLP-1 drugs like Ozempic, the formula features a blend of three powerful plant extracts: Eriomin lemon fruit, Supresa saffron, and Morosil red-orange.

Regional Outlook

North America

North America, especially the U.S. and Canada, continues to dominate the global landscape in both pharmaceutical and OTC supplement sectors. The U.S. has seen explosive demand for non-prescription products due to rising healthcare costs and a consumer shift toward self-care. Health stores, online retailers, and even grocery chains are heavily stocked with supplements ranging from daily multivitamins to specialized solutions for cognitive, joint, and digestive health.

Consumers here are more inclined to experiment with novel formats like gummies, patches, and effervescent tablets along with well-marketed wellness bundles. With a growing elderly population, demand for heart, bone, and immune-support products remains consistently high.

Asia-Pacific

Asia-Pacific is the fastest-growing market, with a major surge in countries like China, India, and Japan. Cultural familiarity with natural and plant-based remedies gives this region a unique blend of traditional and modern supplement consumption. Increased government focus on preventive healthcare is also playing a vital role in pushing OTC product acceptance.

E-commerce platforms in this region are thriving, and local brands are expanding aggressively catering to both the urban youth and the aging rural population. In Japan, trust, traceability, and regulatory adherence are key factors driving product choices.

Europe

Europe follows a balanced approach, with demand split between pharmaceutical-grade supplements and lifestyle wellness products. Regulatory oversight in this region ensures product transparency and clinical validation, which has helped build strong consumer trust. Key growth areas include gut health, women’s health, and cognitive performance.

Rest of the World

Latin America, the Middle East, and Africa are emerging as promising markets, though growth is tempered by cost barriers and distribution hurdles. However, urban centers in countries like Brazil, South Africa, and the UAE are catching up fast, largely driven by youth demographics and fitness influencers on social media.

Key Companies and Strategies

The market features a blend of pharmaceutical giants and nimble wellness startups. Large firms are expanding their OTC portfolios to meet rising consumer interest. Meanwhile, digital-first brands are leveraging influencer marketing, subscriptions, and direct-to-consumer delivery models to grow.

Pfizer Inc.

Nestlé S.A.

Abbott Laboratories Inc.

Procter & Gamble Company

GSK plc

Johnson & Johnson Ltd.

Sanofi S.A

Bayer AG

Merck & Co. Inc.

Church & Dwight

Market Segmentation:

By Product: Dietary Supplements, Cough & Cold Products, Gastrointestinal Products, Analgesics, Skin and Dermatology Care, Others

By Form: Tablets, Capsules, Powders, Liquids, Softgels, Ointments, Others

By Consumer Group: Infants, Children, Adults, Seniors

By Application: Digestive Health, Immune System Support, Cardiovascular Health, Bone and Joint Health, Cognitive and Mental Health, Skin, Hair & Nail Health, Eye Health, Sports & Fitness, Others

Latest News in the USA

In the United States, the year 2025 has already seen the launch of several AI-backed personalized supplement services that analyze lifestyle, DNA, or microbiome profiles to deliver tailor-made wellness regimens. Many pharmacies and major retailers have started integrating interactive kiosks that recommend OTC products based on consumer input.

There’s also a visible regulatory tightening, as federal agencies emphasize the need for accurate labeling and clinically-backed claims. This hasn’t slowed innovation in fact, it’s pushing companies to invest more in R&D, leading to the emergence of supplements that support stress, energy, metabolism, and sleep in more targeted ways.

Notably, American consumers are gravitating toward supplements that support longevity and healthy aging.Resveratrol, NMN, and adaptogens are gaining strong traction across both retail shelves and digital marketplaces.

Latest News in Japan

Japan’s OTC supplement market has experienced both scrutiny and innovation in 2025. Following heightened safety awareness from prior incidents in 2024, Japanese authorities have reinforced guidelines on health food labeling, particularly for products with functional claims. Companies now have stricter timelines for safety documentation, and many are reformulating products to ensure compliance.

Yet, this hasn't slowed growth. In fact, Japanese consumers have responded with renewed trust in reputable brands. Wellness-focused conglomerates are doubling down on research-backed products, particularly those targeting vision, bone strength, and metabolic health. Demand for eye health supplements has surged largely influenced by increased screen time among older adults.

New product launches in Japan are also leaning toward traditional ingredients with modern delivery methods. From green tea extract capsules to fermented soy enzyme powders, there’s a strong focus on blending heritage with innovation.

Multinational players continue to show interest in Japan’s mature and loyal consumer base, with partnerships being formed to bring both Japanese products abroad and global brands into Japan through trusted retail channels.

Conclusion

The Pharma and OTC supplements market in 2025 is vibrant, diverse, and rapidly evolving. It reflects how modern consumers armed with information and driven by convenience are reshaping how they manage their health. As personalization, digital platforms, and ingredient innovation continue to transform the industry, the line between pharma and wellness will blur even further. Whether in Tokyo or Texas, the common theme is clear: health is no longer just a treatment it's a lifestyle.

Stay informed with the latest industry insights—start your subscription now: https://www.datamintelligence.com/reports-subscription

Here are the Latest Reports By DataM intelligence

OTC Consumer Health Products Market Size

OTC Topical Drugs Market Size

Sai Kiran

DataM Intelligence 4Market Research

+1 877-441-4866

[email protected]

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()