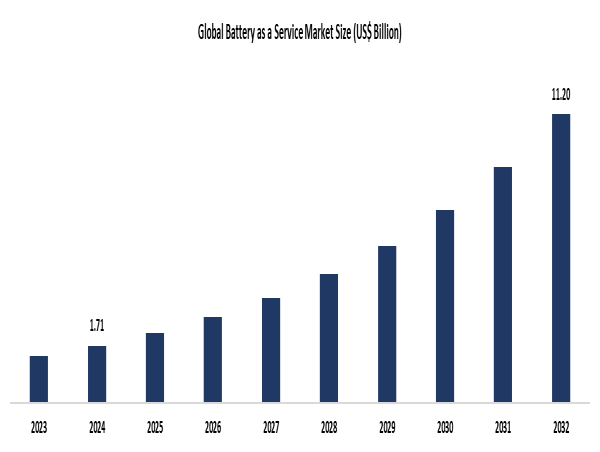

The Battery-as-a-Service (BaaS) Market Size was valued at USD 1.71 Billion in 2024 and is projected to surge to USD 11.20 Billion by 2032, expanding at a compound annual growth rate (CAGR) of 26.50% between 2025 and 2032.

As electric mobility and renewable integration continue to rise globally, the BaaS model is gaining traction fast. It is projected that the market will see double-digit growth over the coming years, backed by advances in battery technology, government support, and expanding EV infrastructure.

To Download Sample Report: https://datamintelligence.com/download-sample/global-battery-as-a-service-market

Market Value and Growth Outlook

By 2025, the BaaS market is expected to exceed a multi-billion-dollar valuation. The flexibility of the model, combined with widespread EV adoption, is driving this rapid growth. Battery-swapping stations, modular battery systems, and pay-per-use platforms are becoming more common, especially in regions where urban density and energy concerns demand faster, more adaptable solutions.

The growth outlook for BaaS is especially strong in metropolitan areas where vehicle downtime is costly and convenience is king. As businesses and consumers seek cleaner, more cost-effective ways to power their transport and equipment, Battery-as-a-Service stands out as an efficient solution that doesn’t sacrifice performance or scalability.

Regional Insights

Asia-Pacific

Asia-Pacific, particularly China, leads the global BaaS movement. Cities with dense populations and high electric vehicle penetration are ideal for BaaS rollouts. In India and Southeast Asia, battery swapping has become a reliable solution for last-mile delivery vehicles, scooters, and tuk-tuks. As demand for affordable and quick-charging options grows, BaaS platforms are stepping up to fill that need.

Japan, although traditionally more conservative in battery adoption, is rapidly catching up. With the rise of smart cities and electrified public transportation systems, the demand for flexible battery solutions is on the rise.

North America

North America is showing strong signs of catching up. The United States, in particular, is seeing growing demand from commercial fleets and shared mobility providers. With climate goals becoming more aggressive and funding allocated to clean energy initiatives, infrastructure for BaaS is becoming more feasible. Fleet operators benefit especially from this model, as they can keep their vehicles running longer without worrying about battery degradation.

Europe

Europe continues to prioritize clean mobility through strict emissions regulations. While BaaS is not yet as mainstream here as in Asia, interest is growing. Nations such as Germany, Norway, and the Netherlands are actively adopting battery leasing and swap systems, particularly for ride-sharing vehicles and last-mile delivery fleets. The continent’s emphasis on recycling and green infrastructure makes BaaS a natural fit for future energy models.

Latest News of USA

In the United States, 2025 is expected to be a big year for BaaS advancements. A major electric truck fleet operator recently announced plans to transition a large portion of its battery logistics to a subscription-based model. This shift will help reduce downtime and extend battery use across its fleet.

Meanwhile, battery startups are collaborating with energy providers to develop station networks in high-density zones. Pilot projects are being launched in California and Texas, aiming to test how fast-swap stations perform in real-world conditions. These trials are laying the groundwork for future expansion across other states.

Growing interest from ride-sharing companies is also driving the adoption of battery-as-a-service solutions. Companies are experimenting with BaaS to reduce charging wait times, which can improve overall service efficiency. By the end of 2025, it’s expected that more major cities will introduce battery-swapping pilot programs across both private and public vehicle fleets.

Latest News of Japan

Japan is taking bold steps to integrate BaaS into its wider smart city plans. Several government-backed projects are underway to establish energy-efficient neighborhoods powered in part by modular battery systems. These systems allow both homes and vehicles to draw from a common energy pool sometimes sourced from rented batteries.

Automakers in Japan are also shifting focus. Some of the country’s biggest automotive brands have partnered with battery solution providers to roll out services for small EVs and scooters. This is particularly important in cities like Tokyo and Osaka, where limited parking space and strict emissions rules make compact EVs and BaaS services especially attractive.

In rural areas, BaaS is being tested for agricultural equipment and transport, giving farmers access to electric power without needing to invest in expensive, long-term battery systems. Japan’s strong focus on robotics and automation could see BaaS expand into non-transport areas too, including emergency energy supplies and remote workstations.

Key Companies in the Market

Ample

Bounce Infinity

Esmito Solutions Pvt Ltd

Gogoro

Immotor

NIO Power

Numocity

Octillion

Sun Mobility Private Limited

Upgrid Solutions Private Limited

Market Segmentation:

By Battery Capacity: Bellow 10 KWH, 10–50 KWH, 51-100 KWH, More than 100 KWH

By Vehicle Type: Two-Wheelers, Three-Wheelers, Passenger Vehicles, Commercial Vehicles

By Service: Battery Subscription, Pay-Per-Use

By End-Users: Private, Commercial

The industry is competitive but collaborative. Partnerships between automakers, energy companies, and tech startups are common, helping to accelerate adoption and infrastructure build-out.

Conclusion:

Battery-as-a-Service is more than just a trend it’s a response to the growing demand for flexible, affordable, and sustainable power solutions. As EV adoption rises and energy storage becomes more crucial, BaaS offers a forward-looking, cost-effective solution that benefits individuals, businesses, and the environment alike.

With active growth in the USA and Japan, and momentum building in other global markets, the next few years will likely see BaaS shift from niche to norm. Companies that invest early in this model could find themselves leading the energy revolution.

Here are the Latest Reports By DataM Intelligence:

Lithium-Ion Battery Testing Equipment Market Size

Electric Vehicles Battery Recycling Market Size

Sai Kiran

DataM Intelligence 4Market Research

+1 877-441-4866

email us here

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()