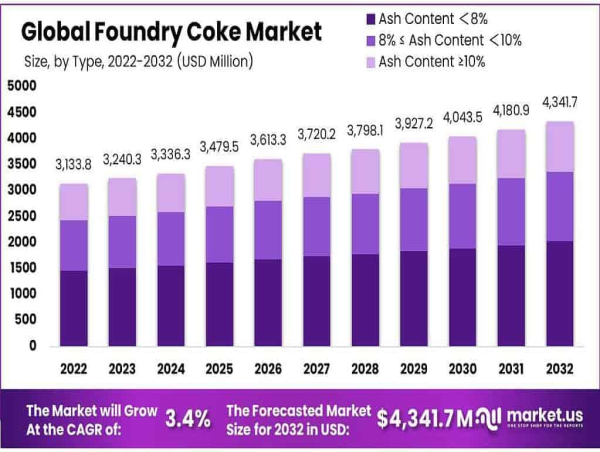

The Foundry Coke Market was valued at USD 3,133.8 million in 2022 and is expected to reach USD 4,341.7 million by 2032, registering a CAGR of 3.4% over the forecast period. Foundry coke, also known as hard coal coke, is used in foundries for melting metals such as iron, lead, tin, and copper due to its high carbon content and low ash percentage. It plays a critical role as a reducing agent and energy carrier in manufacturing processes. The market's growth is propelled by increased demand from sectors like automotive and construction, as well as government initiatives promoting industrial expansion.

Key Takeaways

• Market Growth: The Foundry Coke Market was valued at USD 3,133.8 Million in 2022 and is projected to reach USD 4,341.7 Million by 2032, with an estimated Compound Annual Growth Rate (CAGR) of 3.4%.

• Foundry Coke Definition: Foundry coke, also known as hard coal coke, is produced in non-recyclable coke ovens and is used in foundries for melting various metals like iron, lead, tin, copper, and zinc. It is known for its dense structure, high carbon content, low ash content, and high heat generation.

• Applications of Foundry Coke: Foundry Coke plays a crucial role in the manufacturing of crude iron, acting as a reducing agent, support matrix, and energy carrier. It is used in blast furnaces and smelting nonferrous metals like copper, lead, zinc, titanium, antimony, and mercury.

• Regional Dominance: The Asia-Pacific (APAC) region, including countries like China, Japan, and India, holds a dominant position in the global foundry coke market due to rapid industrialization and an expanding automotive sector.

👉 Request a free sample PDF report for valuable insights: https://market.us/report/foundry-coke-market/request-sample/

Experts Review

Government incentives and technological innovations are fostering growth in the foundry coke market. Investments in advanced technologies such as electrical induction furnaces are reducing emissions and improving energy efficiency, though they also pose risks by decreasing traditional coke demand. With regulations tightening around environmental impact, industry players are also focused on sustainable practices to meet consumer awareness demands and climate-related regulatory requirements. Investment prospects remain substantial despite these challenges, especially within emerging markets.

Report Segmentation

The market is segmented by type, application, and region. The Ash Content <8% segment leads due to its higher quality, capturing 46.7% of the market in 2022. Applications in automotive parts casting dominate with a 50.1% share, driven by the ongoing growth of the automotive industry. Regional analysis indicates the Asia-Pacific region as the dominant market, underpinned by rapid industrialization in countries like China and India, with North America holding a significant share due to its strong metallurgical coal reserves.

Drivers, Restraints, Challenges, and Opportunities

Key drivers include rising demand from end-use industries, increased infrastructure spending, and consumer wealth boosting automotive and residential sectors. Challenges exist in the form of shifting technologies and environmental regulations. Opportunities arise from industrializing economies, primarily in the Asia-Pacific region, and an evolving focus on sustainability, which holds the potential to drive innovation and market expansion.

Key Market Segments

Based on Type

• Ash Content <8%

• 8% ≤ Ash Content <10%

• Ash Content ≥10%

Based on Application

• Automotive Parts Casting

• Machinery Casting

• Material Treatment

👉 Buy Now to access the full report: https://market.us/purchase-report/?report_id=16586

Key Player Analysis

Prominent players like ArcelorMittal, Vedanta Resources Limited, and Drummond Company Inc. dominate the market through extensive production capacities and supply chains. These companies are actively expanding their operations and investing in sustainable technologies to adapt to market demands and regulatory pressures, maintaining their competitive edge.

Market Key Players

• ArcelorMittal

• Vedanta Resources Limited

• Drummond Company Inc.

• Nippon Coke & Engineering Company Limited

• Hickman Williams & Company

• Jiangsu Surun High Carbon Co. Ltd.

• Italiana Coke S.R.L.

• OKK Koksovny

• CARBO-KOKS

• Other Key Players

Recent Developments

Recent investments include Anglo-American's significant expansion of South African capacity and JSW Steel's planned foundry coke plant in India. ArcelorMittal is similarly scaling production capabilities to better access emerging markets like Brazil. These expansions reflect strategic efforts to meet rising global demand.

Conclusion

The Foundry Coke Market is on a steady growth trajectory, with critical drivers and emerging technologies shaping its future. As industries evolve towards sustainable practices, the market's strategic focus on innovation and capacity expansion will be vital in navigating regulatory challenges and capitalizing on new opportunities in emerging regions.

Lawrence John

Prudour

+91 91308 55334

[email protected]

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()