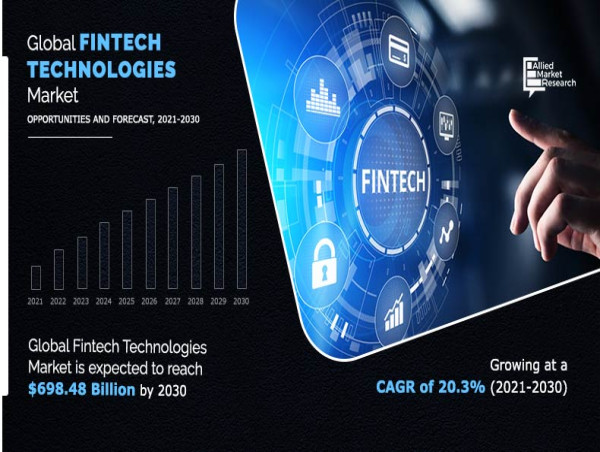

NEW CASTLE, DELAWARE, UNITED STATES, December 13, 2023 /EINPresswire.com/ -- According to the report published by Allied Market Research, the global fintech technologies market size was valued at $110.57 billion in 2020, and is projected to reach $698.48 billion by 2030, growing at a CAGR of 20.3% from 2021 to 2030. The report offers a detailed analysis of changing market trends, top investment pockets, regional landscape, major segments, value chain, and competitive scenario.

Convenience services & maintenance of transparency in terms of financial inclusions and integration of advanced technologies drive the growth of the global fintech technologies market. However, privacy & security concerns with massive shift of consumer data and conflicting regulations across different jurisdictions hinder the market growth. On the other hand, expansion of offerings in developing economies with growth in the middle-class segment, rise in literacy level, rapid urbanization, and increase in tech-savvy youth generation presents new opportunities in the coming years.

Request Sample Report: https://www.alliedmarketresearch.com/request-sample/5024

COVID-19 Scenario:

The demand for fintech technologies increased with surge in usage and adoption of online & digitalized financial products among consumers across the world. In addition, fintech providers have been consolidating their capital and funding for technologies from investors and lenders.

Fintech innovations are coming into picture to reduce the cost of services, making financial institutions possible to reach more people and eliminate the need for face-to-face interactions during the pandemic.

The report offers detailed segmentation of the global fintech technologies market based on deployment mode, application, technology, end user, and region. Based on deployment mode, the on-premise segment accounted for the highest market share in 2020, contributing to nearly three-fifths of the total share, and is projected to maintain its leadership status during the forecast period. However, the cloud segment is expected to register the highest CAGR of 21.3% from 2021 to 2030.

Interested to Procure the Data? Inquire Here @: https://www.alliedmarketresearch.com/purchase-enquiry/5024

Based on end user, the banking sector contributed to the highest market share in 2020, accounting for more than half of the global fintech technologies market, and is projected to continue its lead in terms of revenue during the forecast period. However, the securities segment is estimated to witness the highest CAGR of 23.2% from 2021 to 2030.

Based on region, North America held the largest share in 2020, accounting for more than one-third of the total share, and is estimated to maintain its dominant share in terms of revenue by 2030. However, Asia-Pacific is projected to portray the largest CAGR of 22.1% during the forecast period.

List of companies profiled of the global fintech technologies market analyzed in the research include Blockstream Corporation Inc., Bankable, Cisco Systems Inc., Circle Internet Financial Limited, IBM Corporation, Microsoft, Goldman Sachs, Oracle, NVIDIA Corporation, and Tata Consultancy Services Limited. These market players have adhered to several strategies including partnership, expansion, collaboration, joint ventures, and others to prove their flair in the industry.

Key Benefits For Stakeholders

The study provides in-depth analysis of the global fintech technologies market share along with current trends and future estimations to illustrate the imminent investment pockets.

Information about key drivers, restrains, and opportunities and their impact analysis on the global fintech technologies market size are provided in the report.

Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the fintech technologies market.

An extensive analysis of the key segments of the industry helps to understand the fintech technologies market trends.

The quantitative analysis of the global fintech technologies market forecast from 2021 to 2030 is provided to determine the market potential.

Buy Now@ https://www.alliedmarketresearch.com/checkout-final/90d81bec0955d5f8bfe4e8365b3591c5

Fintech Technologies Market Key Segments

By Deployment Mode

On-premise

Cloud

By Application

Payment & Fund Transfer

Loans

Insurance & Personal Finance

Wealth Management

Others

By Technology

Application Programming Interface (API)

Artificial Intelligence (AI)

Blockchain

Robotic Process Automation

Data Analytics

Others

By End User

Banking

Insurance

Securities

Others

By Region

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Netherlands

Rest of Europe

Asia-Pacific

China

India

Japan

Singapore

Australia

Rest of Asia-Pacific

LAMEA

Latin America

Middle East

Africa

Get Detailed COVID-19 Impact Analysis on the Fintech Technologies Market: https://www.alliedmarketresearch.com/request-for-customization/5024

Related Reports:

Buy Now Pay Later Market https://www.alliedmarketresearch.com/buy-now-pay-later-market-A12528

Business Travel Accident Insurance Market https://www.alliedmarketresearch.com/business-travel-accident-insurance-market-A119319

Equity Indexed Life Insurance Market https://www.alliedmarketresearch.com/equity-indexed-life-insurance-market-A223007

Blockchain in Insurance Market https://www.alliedmarketresearch.com/blockchain-in-insurance-market-A11767

B2B Payments Market https://www.alliedmarketresearch.com/b2b-payments-market-A08183

BFSI Crisis Management Market https://www.alliedmarketresearch.com/bfsi-crisis-management-market-A11105

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

David Correa

Allied Market Research

+1 800-792-5285

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn