Cyber Insurance Market Research Report Information By, Service, Organization Size, End-user, and Region

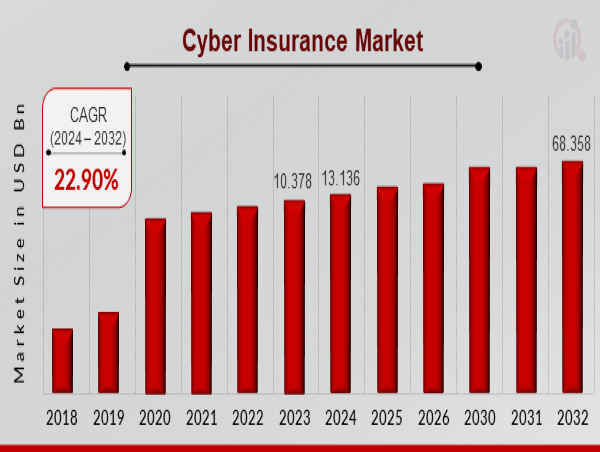

OR, UNITED STATES, March 10, 2025 /EINPresswire.com/ -- Cyber Insurance Market Size was valued at USD 10.37 Billion in 2023. The Cyber Insurance Market size is projected to grow from USD 13.13 Billion in 2024 to USD 68.35 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 22.90% during the forecast period (2024 - 2032).

Key Drivers of Market Growth

Rising Cybersecurity Threats and Data Breaches

The increasing frequency of cyberattacks, ransomware incidents, and data breaches is driving the demand for cyber insurance coverage.

Stringent Regulatory Compliance Requirements

Governments and regulatory bodies worldwide are mandating businesses to adopt cybersecurity measures and ensure financial protection through cyber insurance.

Growing Adoption of Digital Transformation

The expansion of cloud computing, IoT, and AI-driven solutions has increased the attack surface for cybercriminals, propelling the need for cyber insurance.

Increasing Awareness Among SMEs

Small and medium enterprises (SMEs) are recognizing the importance of cyber insurance as they become prime targets for cyber threats.

Expanding Cyber Risk Management Services

Cyber insurers are integrating risk assessment, incident response, and cybersecurity consultation services to enhance policyholder protection.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/8635

Key Companies in the Cyber Insurance Market Include:

• Tata Consultancy Services Limited (India)

• Guy Carpenter and Company LLC. (U.S.)

• At-Bay Inc. (U.S.)

• Lloyds Bank PLC (U.K.)

• Cisco Systems Inc. (U.S.)

• AXA SA (France)

• Chubb Limited (Switzerland)

• Apple Inc. (U.S.)

• Zurich Insurance Group (Switzerland)

• Beazley Group PLC (U.K.)

• Lockton Companies (U.S.)

• American International Group Inc. (U.S.)

Browse In-Depth Market Research Report – https://www.marketresearchfuture.com/reports/cyber-insurance-market-8635

Market Segmentation

To provide a comprehensive analysis, the Cyber Insurance Market is segmented based on coverage type, enterprise size, industry vertical, and region.

1. By Coverage Type

• First-Party Coverage: Covers direct losses, including data breaches, business interruption, and extortion.

• Third-Party Coverage: Protects against liability claims from customers, partners, and regulatory penalties.

2. By Enterprise Size

• Small & Medium Enterprises (SMEs): Increasing adoption of cyber insurance due to rising cyber threats.

• Large Enterprises: Higher policy adoption for comprehensive cybersecurity risk management.

3. By Industry Vertical

• BFSI (Banking, Financial Services, and Insurance): High demand due to sensitive financial data exposure.

• Healthcare: Critical protection against ransomware and patient data breaches.

• IT & Telecom: Coverage for cloud security risks and intellectual property protection.

• Retail & E-commerce: Protects against online fraud, data theft, and payment breaches.

• Government & Public Sector: Safeguarding national security and citizen data.

4. By Region

• North America: Dominates the market with high cyber insurance adoption.

• Europe: Strong growth driven by GDPR compliance and cybersecurity investments.

• Asia-Pacific: Rapid expansion due to digitalization and increasing cyber risks.

• Rest of the World (RoW): Gradual adoption with growing cybersecurity concerns.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=8635

The global Cyber Insurance Market is set to witness rapid growth, driven by rising cyber threats, regulatory mandates, and the digital transformation of businesses. As cyber risks evolve, insurers are continuously enhancing policy offerings to provide comprehensive coverage and risk mitigation solutions.

Related Report –

digital transformation in bfsi market

https://www.marketresearchfuture.com/reports/digital-transformation-in-bfsi-market-29558

discount brokerage market

https://www.marketresearchfuture.com/reports/discount-brokerage-market-42530

entertainment insurance market

https://www.marketresearchfuture.com/reports/entertainment-insurance-market-24116

equity indexed life insurance market

https://www.marketresearchfuture.com/reports/equity-indexed-life-insurance-market-24126

equity management software market

https://www.marketresearchfuture.com/reports/equity-management-software-market-33003

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()