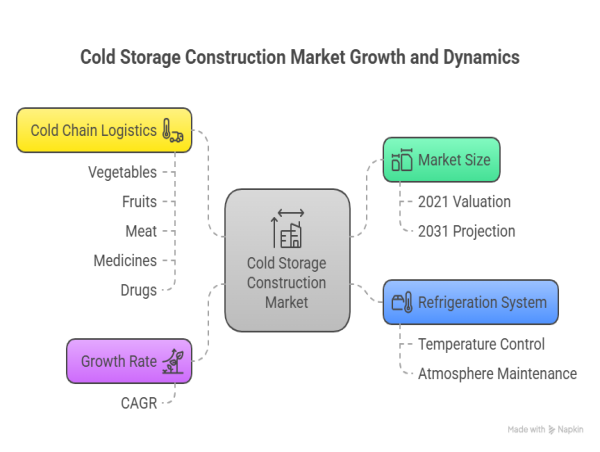

Growth of market is connected to the cold chain. Cold chain logistics solutions are widely used to transport store vegetables, fruits, meat, medicines, drugs

WILMINGTON, DE, UNITED STATES, June 23, 2025 /EINPresswire.com/ -- Market Overview

The global 𝐜𝐨𝐥𝐝 𝐬𝐭𝐨𝐫𝐚𝐠𝐞 𝐜𝐨𝐧𝐬𝐭𝐫𝐮𝐜𝐭𝐢𝐨𝐧 𝐦𝐚𝐫𝐤𝐞𝐭, valued at $9.1 billion in 2021, is projected to reach $26.2 billion by 2031, registering a robust compound annual growth rate (CAGR) of 10.6% from 2022 to 2031, according to a comprehensive report by Allied Market Research. Cold storage facilities, designed to preserve perishable goods like food and pharmaceuticals, maintain precise temperature and humidity levels to ensure product integrity. These specialized warehouses cater to businesses of all scales, offering secure storage, processing, packaging, and transportation capabilities for temperature-sensitive products.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲@ https://www.alliedmarketresearch.com/request-sample/A13486

Cold storage construction has become a critical infrastructure component across industries, driven by increasing global demand for perishable goods and stringent regulations governing their storage. These facilities not only store goods but also serve as hubs for logistics and distribution, enabling seamless supply chain operations. The market’s growth is fueled by evolving consumer preferences, advancements in refrigeration technology, and the need for sustainable storage solutions.

Market Drivers

The demand for cold storage construction is propelled by multiple industries, including retail food, pharmaceuticals, breweries, wineries, chemicals, and hospitality. The retail food sector, in particular, relies heavily on cold storage to meet consumer demand for fresh and frozen products. Similarly, the pharmaceutical industry requires temperature-controlled environments to store vaccines, biologics, and other sensitive medical products. Breweries and wineries use cold storage to preserve beverages, while chemical and processing industries depend on these facilities to maintain the stability of raw materials and finished products. The hospitality sector also leverages cold storage to ensure the availability of fresh ingredients for hotels, restaurants, and catering services.

The versatility of cold storage types further supports market growth. Facilities are tailored to specific needs, such as bulk cold stores for large-scale storage, multi-purpose cold stores for diverse products, small cold stores for localized operations, frozen food stores for long-term preservation, mini-unit cold stores for compact requirements, and controlled atmosphere cold stores for specialized applications like fruit preservation. This customization enables businesses to optimize storage based on product type, quantity, and duration, creating significant opportunities for market expansion.

Regional Insights

In 2021, the Asia-Pacific region dominated the global cold storage construction market, accounting for the largest share due to its strong economic growth, rapid urbanization, and vast population base. Countries like China, India, and Japan are investing heavily in cold storage infrastructure to support their burgeoning food and pharmaceutical sectors. The region’s economic policies prioritize construction as a driver of growth, further boosting the market. For instance, government initiatives to enhance food security and reduce post-harvest losses have spurred investments in cold storage facilities across Asia-Pacific.

Other regions, including North America and Europe, also contribute significantly to the market, driven by advanced supply chains and stringent food safety regulations. However, Asia-Pacific is expected to maintain its lead and register the highest growth rate during the forecast period, fueled by increasing consumer demand and infrastructure development.

𝐄𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠@ https://www.alliedmarketresearch.com/purchase-enquiry/A13486

Impact of COVID-19

The COVID-19 pandemic posed significant challenges to the cold storage construction market. Lockdowns and restrictions in countries like China, the U.S., and India disrupted manufacturing and construction activities, leading to temporary halts in business operations. Supply chain disruptions, including shortages of raw materials and labor, further constrained market growth. The inability to procure essential components for refrigeration systems and insulation materials impacted project timelines and costs.

However, the pandemic also underscored the importance of cold storage, particularly for vaccine distribution and food supply chains. As economies reopened and vaccines became widely available, the market began to recover. The resumption of construction activities, coupled with increased investments in cold storage to address supply chain vulnerabilities, has set the stage for robust growth in the post-pandemic era.

Competitive Landscape

The cold storage construction market is highly competitive, with major players adopting strategies like acquisitions and business expansions to strengthen their market position. A notable example is Lineage Logistics Holdings, LLC, the world’s largest temperature-controlled industrial REIT and logistics provider, which acquired Cold Storage Nelson Limited in New Zealand. This acquisition enhanced Lineage’s global cold storage portfolio and aligned with its commitment to sustainability, reinforcing its leadership in the market.

Other key players are focusing on innovation, integrating energy-efficient technologies and sustainable materials into their projects. These efforts not only improve operational efficiency but also address growing environmental concerns, positioning companies to meet regulatory requirements and consumer expectations.

𝐔𝐩𝐝𝐚𝐭𝐞 𝐎𝐧 𝐃𝐞𝐦𝐚𝐧𝐝@ https://www.alliedmarketresearch.com/request-for-customization/A13486

Market Segmentation

The cold storage construction market is segmented by storage type and end-user industry. In 2021, production stores, used for processing and storing goods during manufacturing, dominated the market in terms of revenue and are expected to grow at a significant CAGR through 2031. These facilities are critical for industries requiring integrated storage and production capabilities.

By end-user, the food and beverage sector led the market in 2021, driven by rising demand for perishable goods and the expansion of retail chains. The pharmaceutical and healthcare sector is also a key contributor, with increasing needs for temperature-controlled storage for vaccines and biologics. Other industries, such as chemicals and hospitality, are expected to witness steady growth, further diversifying the market.

Key Trends and Opportunities

Several trends are shaping the cold storage construction market. The adoption of automation and IoT-enabled refrigeration systems is enhancing operational efficiency and reducing energy consumption. These technologies allow real-time monitoring of temperature and humidity, ensuring compliance with regulatory standards. Additionally, the shift toward sustainable construction practices, such as using eco-friendly insulation materials and renewable energy sources, is gaining traction.

The rise of e-commerce and online grocery delivery has also created new opportunities for cold storage construction. Retailers are investing in last-mile delivery infrastructure, including smaller, urban cold storage facilities to meet consumer demand for fresh and frozen products. This trend is particularly pronounced in densely populated regions like Asia-Pacific and North America.

Challenges

Despite its growth potential, the cold storage construction market faces challenges. High initial investment costs for advanced refrigeration systems and insulated structures can deter small and medium-sized enterprises. Additionally, the complexity of maintaining consistent temperature and humidity levels requires skilled labor and ongoing maintenance, adding to operational costs. Regulatory compliance, particularly in pharmaceuticals and food safety, also demands significant investments in technology and expertise.

Forecast Analysis (2022–2031)

The cold storage construction market is poised for substantial growth through 2031, driven by increasing demand across industries and regions. The report provides a detailed forecast, analyzing key segments and market dynamics. Asia-Pacific is expected to lead in growth rate, supported by infrastructure investments and rising consumer demand. The food and beverage sector will remain the largest end-user, while production stores will continue to dominate by storage type.

Technological advancements, such as energy-efficient refrigeration and automation, will play a pivotal role in shaping the market. Companies that prioritize sustainability and innovation are likely to gain a competitive edge. Furthermore, the recovery from COVID-19 disruptions and the growing emphasis on supply chain resilience will drive investments in cold storage infrastructure, ensuring long-term market expansion.

The global cold storage construction market is on a robust growth trajectory, with a projected value of $26.2 billion by 2031. Driven by demand from diverse industries like food and pharmaceuticals, beverages, and supported by regional economic growth and technological advancements, the market offers significant opportunities for stakeholders. While challenges like high costs and regulatory compliance persist, strategic investments in sustainable and innovative solutions will enable companies to capitalize on capitalize on the market’s potential. The Asia-Pacific region, in particular, in particular, will remain a key growth driver, underpinned by its economic dynamism and infrastructure development.

David Correa

Allied Market Research

+ 1800-792-5285

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()