Automotive tensioners are a crucial component in engines that utilize chains to drive components like the camshaft and crankshaft. Its primary function is to maintain the optimal tension on the chain by ensuring proper timing and preventing issues like excessive wear and tear on the chain and sprockets, engine noise from chain slap and timing chain failure, which can lead to significant engine damage.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 - https://www.alliedmarketresearch.com/request-sample/A323254

𝐀𝐮𝐭𝐨𝐦𝐨𝐭𝐢𝐯𝐞 𝐓𝐞𝐧𝐬𝐢𝐨𝐧𝐞𝐫 𝐌𝐚𝐫𝐤𝐞𝐭 𝐃𝐲𝐧𝐚𝐦𝐢𝐜𝐬

𝐆𝐫𝐨𝐰𝐭𝐡 𝐃𝐫𝐢𝐯𝐞𝐫𝐬 :

⚫ Rising Vehicle Production & Aftermarket Demand

⚫ Stringent Emission Norms and Fuel Efficiency Goals

⚫ Engine Downsizing & Turbocharging Trends

⚫ Increased Adoption of Automatic Tensioners

𝐑𝐞𝐬𝐭𝐫𝐚𝐢𝐧𝐭𝐬:

⚫ Fluctuations in Raw Material Prices

⚫ Growing Popularity of Electric Vehicles (EVs)

𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬:

⚫ Hybrid Vehicle Segment Growth

⚫ Technological Advancements in Tensioner Design

⚫ Emerging Aftermarket Potential in Developing Economies

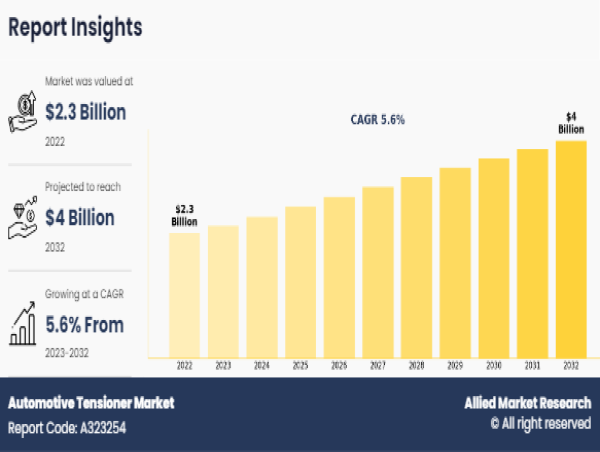

The global automotive tensioner market forecast has seen strong growth due to increasing production and sales of automobiles, growing inclination towards lightweight vehicles, and increasing emission regulations around the globe. Expansion in emerging markets and increasing research and development are expected to create a growth opportunity for the industry. Factors such as regular maintenance & component failure and increasing inclination towards EV are anticipated to hinder the market growth rate during the forecast period.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/A323254

Additionally, in many luxury and supercars, manufacturers are focusing on the development of automotive tensioners with sensors and actuators that can adjust the tension between the chain/belt to enhance the vehicle performance in real time, thus reducing the wear and tear of the component. The growing research and development in automatic tensioning adjustment are one of the major growth opportunities for the companies operating in the market. This technology enhancement not only helps in increasing vehicle safety but also enhances the overall performance and age of tensioners. Moreover, advancements in the manufacturing sector, such as the increased use of precision and additive manufacturing, have enabled manufacturers to customize automotive tensioners for high-end vehicle applications.

The automotive tensioner market share is segregated on the basis of type, system type, vehicle type and region. Based on type, the market is segmented into hydraulic-operated systems and damping structures. On the basis of system type, the market is bifurcated into dual-arm tensioner systems, conventional belt tensioner systems, and automatic belt tensioner systems. By vehicle type, the market is segmented into passenger cars and commercial vehicles. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA.

𝐓𝐡𝐞 𝐇𝐲𝐝𝐫𝐚𝐮𝐥𝐢𝐜𝐚𝐥𝐥𝐲 𝐎𝐩𝐞𝐫𝐚𝐭𝐞𝐝 𝐒𝐲𝐬𝐭𝐞𝐦 𝐒𝐞𝐠𝐦𝐞𝐧𝐭 𝐭𝐨 𝐌𝐚𝐢𝐧𝐭𝐚𝐢𝐧 𝐢𝐭𝐬 𝐋𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩 𝐒𝐭𝐚𝐭𝐮𝐬 𝐓𝐡𝐫𝐨𝐮𝐠𝐡𝐨𝐮𝐭 𝐭𝐡𝐞 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐏𝐞𝐫𝐢𝐨𝐝

𝐁𝐲 𝐭𝐲𝐩𝐞, the hydraulically operated system segment held the highest market share in 2022, and is estimated to maintain its leadership status with a CAGR of 5.9% throughout the forecast period 2023 to 2032, as hydraulically operated systems offer precise control and are commonly used in modern engines with variable valve timing systems. Moreover, advantages of these systems are that they provide precise and consistent chain tension throughout varying engine operating conditions, and also offer superior wear protection for chains and adapt to chain elongation over time.

𝐓𝐡𝐞 𝐀𝐮𝐭𝐨𝐦𝐚𝐭𝐢𝐜 𝐁𝐞𝐥𝐭 𝐓𝐞𝐧𝐬𝐢𝐨𝐧𝐞𝐫 𝐒𝐞𝐠𝐦𝐞𝐧𝐭 𝐭𝐨 𝐌𝐚𝐢𝐧𝐭𝐚𝐢𝐧 𝐢𝐭𝐬 𝐋𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩 𝐒𝐭𝐚𝐭𝐮𝐬 𝐓𝐡𝐫𝐨𝐮𝐠𝐡𝐨𝐮𝐭 𝐭𝐡𝐞 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐏𝐞𝐫𝐢𝐨𝐝

𝐁𝐲 𝐬𝐲𝐬𝐭𝐞𝐦 𝐭𝐲𝐩𝐞, the conventional belt tensioner system held the highest market share in 2022 and is estimated to maintain its leadership status throughout the forecast period as conventional belt tensioners have a simpler design and require lower maintenance costs apart from regular inspection; this reduces the overall complexity of the system and lowers the possibility of component failure. However, the automatic belt tensioner segment is projected to manifest the highest CAGR of 6.5% from 2023 to 2032, owing to the automatic tensioner does not requiring manual adjustment. This enhances their convenience for vehicle owners and technicians. They also ensure constant and ideal belt tension throughout time, automatic tensioners lower the possibility of belt slippage, early wear and tear, and component damage. This increased dependability resulted in better engine longevity and overall improved performance.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐟𝐨𝐫 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐚𝐭 - https://www.alliedmarketresearch.com/request-for-customization/A323254

𝐓𝐡𝐞 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 𝐕𝐞𝐡𝐢𝐜𝐥𝐞 𝐒𝐞𝐠𝐦𝐞𝐧𝐭 𝐭𝐨 𝐌𝐚𝐢𝐧𝐭𝐚𝐢𝐧 𝐢𝐭𝐬 𝐋𝐞𝐚𝐝 𝐏𝐨𝐬𝐢𝐭𝐢𝐨𝐧 𝐃𝐮𝐫𝐢𝐧𝐠 𝐭𝐡𝐞 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐏𝐞𝐫𝐢𝐨𝐝

𝐁𝐲 𝐯𝐞𝐡𝐢𝐜𝐥𝐞 𝐭𝐲𝐩𝐞, the passenger car segment accounted for the largest share in 2022 and is estimated to maintain its leadership status throughout the forecast period owing to the higher production volume of passenger cars. Similarly, the increased demand for fuel-efficient engines with features such as variable valve timing requires proper tensioning, which further creates the demand for automotive tensioners from the passenger car segment. However, the commercial vehicle segment is expected to portray the largest CAGR of 6.3% from 2023 to 2032 due to increasing investments in infrastructure development and the logistics sector, leading to a rise in demand for commercial vehicles. Moreover, strict emission regulations are driving the adoption of advanced engines in commercial vehicles, which often utilize timing chains and require efficient chain tensioners.

𝐀𝐬𝐢𝐚-𝐏𝐚𝐜𝐢𝐟𝐢𝐜 𝐢𝐬 𝐄𝐱𝐩𝐞𝐜𝐭𝐞𝐝 𝐭𝐨 𝐃𝐨𝐦𝐢𝐧𝐚𝐭𝐞 𝐭𝐡𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐢𝐧 𝟐𝟎𝟑𝟐

𝐁𝐲 𝐫𝐞𝐠𝐢𝐨𝐧, North America held the highest market share in terms of revenue in 2022, owing to rise in environmental concerns and increase in investments in the automobile sector. The Environmental Protection Agency (EPA) is implementing strict pollution restrictions and are pressuring automakers to implement cutting-edge technology that increases fuel economy and lower pollutants. However, the Asia-Pacific region is expected to witness the fastest CAGR of 7.3% from 2023 to 2032, owing to the growing population in the region, which is driving the demand for automobiles. In addition, the region's economic growth has resulted in a growing middle class with more disposable income, which leads to a rise in automobile ownership and maintenance demand, including the replacement of parts such as tensioners.

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰: https://www.alliedmarketresearch.com/automotive-tensioner-market/purchase-options

𝐋𝐢𝐬𝐭 𝐨𝐟 𝐊𝐞𝐲 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐢𝐧 𝐀𝐮𝐭𝐨𝐦𝐨𝐭𝐢𝐯𝐞 𝐓𝐞𝐧𝐬𝐢𝐨𝐧𝐞𝐫 𝐌𝐚𝐫𝐤𝐞𝐭:

NTN Corporation

ALT America Inc

Litens Automotive Group

Dayco Incorporated

Gates Corporation

KMC Automotive Transmission Co., Ltd

GMB Corporation

Zhejiang Renchi Auto Parts Co., Ltd.

Muhr and Bender KG

CR product limited.

The report provides a detailed analysis of these key players in the global automotive tensioner market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

David Correa

Allied Market Research

+ 1800-792-5285

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()