Get Ahead with Our Report: Request Your Sample Now!

https://www.futuremarketinsights.com/reports/sample/rep-gb-15903

Industry Dynamics and Opportunities

The Automotive Connectivity landscape is characterized by intense collaboration between telecom operators, semiconductor firms, and OEMs to build seamless ecosystems that integrate hardware, software, and cloud platforms. Electrification and autonomous driving initiatives are fueling demand for high-bandwidth, secure data links that enable real-time mapping, sensor fusion, and vehicle-to-infrastructure (V2I) coordination. Meanwhile, subscription-based connectivity services—ranging from concierge navigation to predictive maintenance alerts—are emerging as recurring-revenue streams for automakers seeking to offset shrinking margins on vehicle sales. In emerging markets, partnerships with local network providers and tier-2 fleet operators are unlocking new use cases, such as usage-based insurance and public-transit integration, thereby broadening the addressable market.

Looking forward, opportunities abound in the harmonization of global connectivity standards and the rollout of multi-access edge computing (MEC) to decentralize processing and enhance service quality. Investments in cybersecurity frameworks, including hardware-rooted trust and over-the-air (OTA) encryption, are critical to addressing consumer privacy concerns and regulatory mandates. Additionally, convergence between smart-city initiatives and connected-vehicle infrastructure is expected to spur deployments of roadside units (RSUs) and digital twins, creating new revenue streams for telecom operators and infrastructure providers.

Key Takeaways for the Automotive connectivity market

In summary, the Automotive Connectivity market is set to:

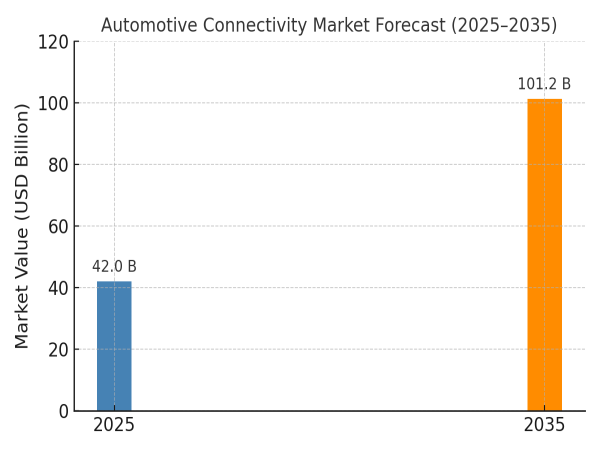

• Exhibit robust value growth from USD 42.0 billion in 2025 to USD 101.2 billion by 2035 at a 9.2% CAGR, driven by 5G adoption, V2X safety mandates, and consumer demand for digital services.

• Generate recurring revenues through subscription models for infotainment, remote diagnostics, and software updates, enhancing OEM customer lifetime value.

• Benefit from regional expansion in Asia Pacific and Latin America as network coverage and vehicle electrification accelerate.

• Demand stringent cybersecurity measures and compliance frameworks to secure data flows and protect user privacy.

• Leverage multi-access edge computing and cloud-native architectures to deliver ultra-low-latency connectivity solutions.

Emerging Trends in the Global Market

Among the most transformative trends are the integration of cellular vehicle-to-everything (C-V2X) alongside Dedicated Short-Range Communications (DSRC) for redundancy and safety-critical communications; the rise of software-defined vehicles that rely on continuous OTA updates to enhance ADAS capabilities; the deployment of blockchain-based identity management systems to secure cross-domain data sharing; the shift toward consumer-centric digital showrooms and remote test drives enabled by augmented and virtual reality over 5G networks; and the emergence of vehicle-centric edge analytics platforms that process sensor data locally to reduce cloud bandwidth and latency.

Significant Developments in Global Sector: Trends and Opportunities in the Market

Recent strategic collaborations have demonstrated the market’s momentum: a leading OEM announced a global agreement with a major telecom operator to deploy 5G-enabled connected services across its vehicle lineup, while a semiconductor giant unveiled a dedicated connectivity chipset boasting integrated GNSS, Wi-Fi 6, and C-V2X support. Technology consortia are standardizing service APIs to facilitate cross-OEM interoperability, and regional governments are funding smart-highway pilot projects to test predictive traffic management with connected buses and trucks. These initiatives present opportunities for investors to back private-public partnerships, scale edge-computing infrastructure, and develop data-analytics platforms that monetize telematics and usage insights.

Detailed Market Study: Full Report and Analysis

https://www.futuremarketinsights.com/reports/automotive-connectivity-market

Recent Developments in the Market

Over the past year, several key breakthroughs have shaped the competitive landscape: a prominent Tier-1 supplier launched a modular connectivity unit supporting both 4G LTE and 5G NR in a single form factor, reducing vehicle integration complexity; a telematics provider introduced an AI-driven predictive maintenance service that leverages real-time sensor analytics to forecast component failures with 85% accuracy; an automotive software startup secured Series B funding to expand its cloud-native backend for managing over-the-air updates to 10 million vehicles; and an alliance of ride-hail fleets partnered with a mapping vendor to co-develop high-definition maps for Level 3 automated driving trials in urban centers.

Competition Outlook

Competition in the Automotive Connectivity market is intensifying as global technology leaders, telecom incumbents, and agile startups vie for dominance. Key players include Qualcomm Technologies, Inc.; Harman International (a Samsung company); NXP Semiconductors N.V.; Ericsson AB; and Bosch Mobility Solutions.

Key Segmentations

Market segmentation spans connectivity type (cellular LTE, 5G NR, DSRC, Wi-Fi), service layer (infotainment, telematics, V2X safety applications, OTA software management), application (passenger vehicles, commercial trucks, two-wheelers), and region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa). Success will depend on forging ecosystem partnerships, securing spectrum access, innovating in edge-to-cloud architectures, and ensuring robust data security and privacy compliance—factors that will determine who leads the next wave of automotive digital transformation.

Automotive Smart & Connected Technologies Industry Analysis Reports

Railway System Market Forecast and Outlook from 2025 to 2035

https://www.futuremarketinsights.com/reports/railway-system-market

Flight Tracking System Market Outlook from 2025 to 2035

https://www.futuremarketinsights.com/reports/flight-tracking-system-market

Off-Highway Vehicle Telematics Market Forecast and Outlook from 2025 to 2035

https://www.futuremarketinsights.com/reports/ohv-telematics-market

Odometer Market Forecast and Outlook from 2025 to 2035

https://www.futuremarketinsights.com/reports/odometer-market

APAC Automotive Telematics Market Outlook 2025 to 2035

https://www.futuremarketinsights.com/reports/asia-pacific-automotive-telematics-market

Ankush Nikam

Future Market Insights, Inc.

+91 90966 84197

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()