Artificial Intelligence in Insurance Market Research Report Information By, Technology, Enterprise Size, End Users, Application, and Region

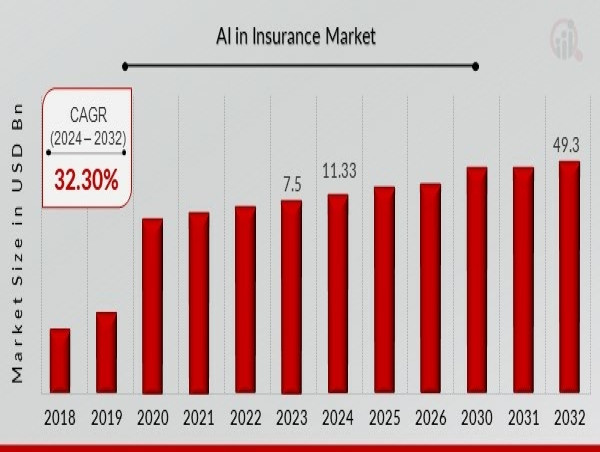

AZ, UNITED STATES, March 10, 2025 /EINPresswire.com/ -- The AI in Insurance Market has experienced significant growth in recent years and is poised for substantial expansion over the coming decade. In 2023, the market size was valued at USD 7.5 billion and is projected to grow from USD 11.33 billion in 2024 to an impressive USD 49.3 billion by 2032, reflecting a strong compound annual growth rate (CAGR) of 32.30% during the forecast period (2024–2032). The growth is primarily driven by advancements in AI-driven automation, the increasing adoption of data analytics in underwriting, and the rising demand for personalized insurance solutions.

Key Drivers of Market Growth

Enhanced Risk Assessment & Underwriting

AI enables insurers to leverage big data and machine learning algorithms to assess risks with greater accuracy. Predictive analytics and automated underwriting processes help insurers improve decision-making, reduce fraudulent claims, and optimize pricing models.

Claims Processing & Fraud Detection

AI-powered automation streamlines claims processing by enabling real-time data analysis and reducing manual intervention. Machine learning models help identify fraudulent claims by analyzing patterns and detecting anomalies, significantly reducing financial losses for insurers.

Personalized Customer Experience

AI-driven chatbots and virtual assistants enhance customer interactions by providing instant policy recommendations, answering queries, and offering seamless claims assistance. Insurers are utilizing AI to tailor insurance policies based on individual customer preferences and behaviors.

Operational Efficiency & Cost Reduction

AI adoption in insurance leads to increased operational efficiency by automating routine tasks, reducing paperwork, and improving workflow management. This results in lower administrative costs and improved customer service capabilities.

Growing Integration of IoT & Telematics

The rising adoption of IoT devices and telematics in auto and health insurance is fueling AI applications. Insurers leverage real-time data from connected devices to assess driving behavior, monitor health conditions, and offer customized premium rates based on risk profiles.

Regulatory Compliance & Risk Management

AI enhances regulatory compliance by automating documentation processes and ensuring adherence to industry regulations. AI-powered risk management solutions help insurers predict potential liabilities and mitigate risks effectively.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/8465

Key Companies in the AI in Insurance Market Include:

• Applied Systems

• Cape Analytics

• OpenText Corporation

• IBM Corporation

• Oracle Corporation

• Pegasystems Inc

• Quantemplate

• Microsoft Corporation

• Salesforce, Inc

• SAP SE

• SAS Institute Inc

• Shift Technology

• SimpleFinance

• Slice Insurance Technologies

• Vertafore, Inc

• Zego

• Zurich Insurance Group Ltd

Browse In-Depth Market Research Report – https://www.marketresearchfuture.com/reports/ai-in-insurance-market-8465

Market Segmentation

To provide a comprehensive analysis, the AI in Insurance Market is segmented based on technology, application, deployment mode, and region.

1. By Technology

• Machine Learning (ML): Enhances predictive analytics, underwriting, and fraud detection.

• Natural Language Processing (NLP): Powers AI-driven chatbots, customer support, and document processing.

• Computer Vision: Used for image and video analysis in claims processing.

• Robotic Process Automation (RPA): Automates routine insurance tasks to enhance operational efficiency.

2. By Application

• Claims Processing: AI automates claims validation and settlement, reducing processing time.

• Fraud Detection & Prevention: Advanced algorithms detect fraudulent claims and financial irregularities.

• Underwriting & Risk Management: AI-driven analytics optimize risk assessment and policy pricing.

• Customer Service & Support: AI chatbots and virtual assistants enhance policyholder experience.

• Policy Administration & Management: Automates policy issuance, renewals, and compliance tracking.

3. By Deployment Mode

• On-Premises: Preferred by large enterprises for enhanced data security.

• Cloud-Based: Offers scalability, flexibility, and cost-effectiveness for insurers.

4. By Region

• North America: Leading market driven by AI innovation and early adoption in the insurance industry.

• Europe: Rapid growth due to stringent regulations and demand for AI-driven risk assessment.

• Asia-Pacific: Increasing AI adoption in emerging economies like China, India, and Japan.

• Rest of the World (RoW): Gradual adoption with growing investments in AI-based insurance solutions.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=8465

The global AI in Insurance Market is set to witness remarkable growth, driven by technological advancements, increasing demand for automated processes, and enhanced customer experience. As AI continues to transform the insurance landscape, the industry will see improved efficiency, reduced costs, and greater accuracy in risk assessment. Ensuring data security, regulatory compliance, and ethical AI practices will be crucial for the sustainable growth of AI-driven insurance solutions.

Related Report –

agriculture equipment finance market

https://www.marketresearchfuture.com/reports/agriculture-equipment-finance-market-24331

anti money laundering solutions market

https://www.marketresearchfuture.com/reports/anti-money-laundering-solutions-market-24771

asset management it solution market

https://www.marketresearchfuture.com/reports/asset-management-it-solution-market-29809

augmented reality in bfsi market

https://www.marketresearchfuture.com/reports/augmented-reality-in-bfsi-market-31277

b2c legal service market https://www.marketresearchfuture.com/reports/b2c-legal-service-market-42525

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()