|

- SFO1 is Adyen's first proprietary multimedia countertop terminal

- Adyen is the first PSP to launch Klarna's BNPL in-store solution worldwide and initiates global roll out of Alipay+

- Tap To Pay on Android now available in Europe, UAE, Hong Kong, Malaysia, Australia and New Zealand, enabling businesses in these regions to cost-effectively scale

AMSTERDAM, Sept. 26, 2024 /PRNewswire/ -- Adyen, the financial technology platform of choice for leading businesses, has today announced major advancement in the in-person payments (IPP) landscape, underscoring its commitment to innovation with industry defining solutions. This comprehensive update not only enhances the payment experience for both merchants and customers but also reinforces Adyen's position as a leading force in payment technology.

"Adyen offers an industry-leading in-person payment solution, with one of the widest product portfolios in the market, ranging from mobile solutions to countertop terminals, catering to any business need—all powered by our single tech stack. This product update is a testament to our ambition in the unified commerce space," commented Derk Busser, VP Product - Payment Channels, at Adyen. "We see our customers still highly value in-person touchpoints and we are continuing to differentiate ourselves within the payments industry to be the market leader in omnichannel solutions. We're committed to revolutionize how the shoppers of today and tomorrow experience 'the store'."

Unlimited branding opportunities with SFO1 countertop terminal

Today, Adyen proudly unveils the SFO1, its proprietary multimedia countertop Android terminal. With an 8 inch touch screen, SFO1 enhances the payment experience by integrating functions of traditional terminals with customer-facing displays. This innovation marks a new chapter in transforming the in-person payment experience.

"The SFO1 will fundamentally change the way brands interact with customers at the point of purchase," added Busser. "Rich video content allows fashion retailers to showcase next season's collection on stunning screens while offering shoppers the chance to sign up for loyalty programs to receive discounts or early access to the clothing shown. We are pushing the boundaries of innovation, ensuring that merchants can provide cutting-edge, customizable in-store checkout experiences."

SFO1 allows enterprise and platform businesses to maintain consistent brand presence and engage customers dynamically, by seamlessly integrating with their point of sale (POS) systems or partners, while reducing counter clutter and costs.

"We're excited to partner with Adyen on integrating the SFO1 terminal," said Amber Hovious, VP Partnerships at Teamwork Commerce. "As a leading POS & OMS software company, Teamwork Commerce knows how important it is to deliver cutting-edge customer experiences. The SFO1 device offers a great way to create engaging in-store experiences for shoppers, while also helping to streamline operations."

SFO1 will be available in the U.S. and Europe by the end of 2024.

Global first launch of Klarna in-store and extensive rollout of Alipay+

Adyen is breaking new ground as the first global PSP to launch Klarna's in-store solution worldwide and initiates the global rollout of Alipay+ on its terminals. This move fulfills Adyen's promise to unified commerce merchants by delivering a consistent payment experience both in-store and online. With the growing popularity of buy-now-pay-later (BNPL) services—projected to reach $3.98 trillion by 20301—and the dominance of digital payment solutions like Alipay+, Adyen's integration allows merchants to reach a broader global audience. By enabling Klarna and Alipay+ in-store, Adyen empowers retailers to cater to Gen Z shoppers and global travelers, mostly from Asia, offering the flexibility to choose their preferred payment method regardless of the shopping channel.

Tap To Pay on Android in new regions

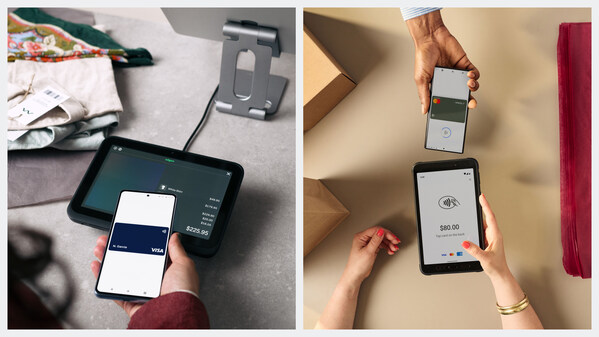

As the demand for contactless payments continues to soar, the introduction of Tap to Pay technology offers a game-changing opportunity for businesses of all sizes. Adyen was the first to introduce Tap to Pay solutions on a global scale and it is now expanding its Tap To Pay on Android capabilities into Europe, the UAE, Hong Kong, Malaysia, Australia and New Zealand.

Adyen's Tap to Pay on Android solution transforms any NFC-enabled Android device into a secure payment terminal, eliminating the need for traditional POS hardware. This reduces upfront costs for merchants and offers greater flexibility in accepting payments—whether in-store, at pop-up events, or on-the-go. As a leader in the industry, Adyen is also one of the first to offer both a comprehensive SDK and a payments app, balancing robust control with ease of integration.

Boilerplate

Adyen (ADYEN:AMS) is the financial technology platform of choice for leading companies. By providing end-to-end payments capabilities, data-driven insights, and financial products in a single global solution, Adyen helps businesses achieve their ambitions faster. With offices around the world, Adyen works with the likes of Meta, Uber, H&M, eBay, and Microsoft.

Adyen continuously improves and expands its product offering as part of its ordinary course of business. New products and features are announced via press releases and product updates on the company's website.

1 Buy Now Pay Later Market Outlook, Allied Market Research– 2030