Highlights

- The cost of living has been gravely affected by rising inflation and skyrocketing oil prices.

- The Morrison government recently introduced a fuel excise cut to reduce price pressures on households.

- The full effects of the tax cut might be realised in two weeks’ time due to a delayed response from retailers.

Petrol prices have taken a dangerous leap amidst the Russia-Ukraine war. The cost of living has been gravely affected by soaring inflation levels seen due to supply-chain constraints. However, as cheaper fuel becomes a distant reality, the Australian government has stepped in at the eleventh hour and cut the fuel excise tax. But the question remains, how long can the tax cut help Aussies get cheaper fuel?

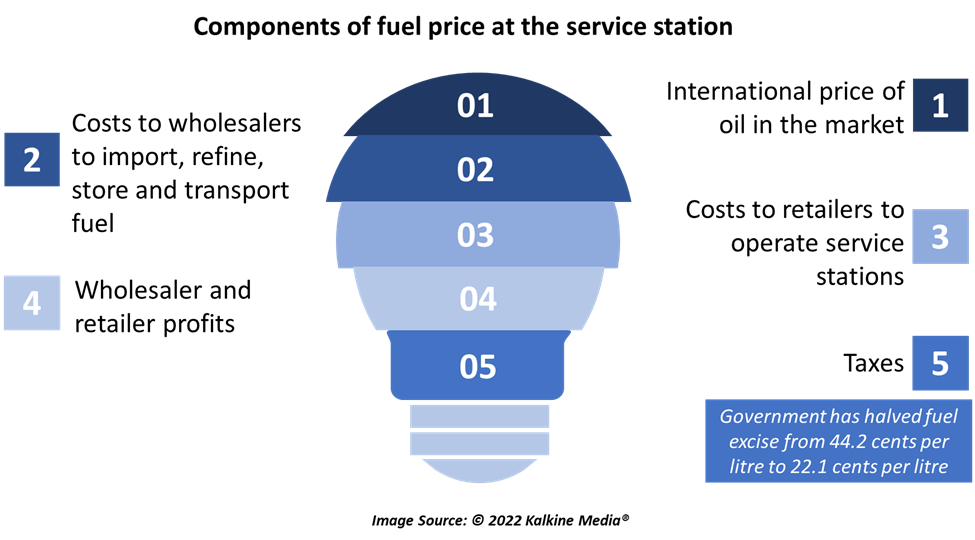

Petrol prices have been slashed across the country, thanks to a fuel excise cut in half in the budget announcement. The fuel excise has been reduced to 22.1 cents per litre from 44.2 cents per litre. The cut has been implemented on both diesel and petrol.

A reduction in fuel excise is directly targeted at providing more flexibility to households in managing expenses. While the tax cut comes well-placed before the elections, it would certainly ease the cost of living for Australians. However, PM Scott Morrison has placed a 6-month limit on the tax cut for now.

ALSO READ: Why interest rate hike is a threat to Australia’s booming housing market?

Who will benefit from fuel excise cut?

Essentially, a fuel excise cut does not represent a direct cut in the household’s expenditure on fuel. The excise tax is built into the price paid by motorists at the service stations. This is precisely why the full effects of a cut could take some time to show.

Meanwhile, households might see reluctance from some service stations in passing on the tax cut, making it appear as though fuel prices have not changed. In his announcement, Treasurer Josh Frydenberg stated that it might take two weeks before the tax cut is passed on to consumers.

Retailers could be hesitant to immediately pass on the lower prices as they might have bought their existing stock at higher prices. To offer lower prices, retailers might first clear their more expensive stock and prevent losses. If and when retailers purchase oil at a cheaper rate, they would be able to pass on lower prices to consumers.

When Will Australia’s Petrol Prices Come Down?

What happens if fuel excise cuts are not passed on?

The Australian Competition and Consumer Commission (ACCC) ensures that these excise cuts reach the consumers as early as possible. ACCC’s Chair, Gina Cass-Gottlieb, stated that the commission expects fuel retailers will pass the cut as existing petrol stock levels are used up.

If the retailers fail to pass on lower prices to consumers, they could face prosecution by the ACCC. The ACCC has planned to impose full force of the law on those retailers who do not abide by the rules.

Which Countries Are Still Buying Russian Crude Oil?

Additionally, ACCC will not tolerate false and misleading statements about fuel prices, taking appropriate enforcement action against the wrongdoers. Thus, it is crucial for consumers to be aware of the ongoing prices while staying mindful of the tax cut announcements. Those who wish to gain further information can visit ACCC’s website.

ALSO READ: Australians borrow more via BNPL, payday lenders as living costs spike

Bottom line

Oil prices, which are the threshold for fuel prices, have been on an incline even before the Russia-Ukraine war. However, the war has exacerbated the ongoing price hike. While Australia is not a direct importer of oil from Russia, it has been getting impacted by rising oil prices worldwide.

The government-introduced measures could provide some relief to households, but at the cost of lower investment. Meanwhile, as fuel prices show any signs of decline, a surge in demand might bring the prices back up. In a way, the sanctions on Russian oil have transformed into a long-term ordeal that might need intensive policy reforms.

DO NOT MISS: Australia Budget 2022: How much paternity leave are fathers entitled to?