Summary

- Property market across Australia is reeling under the pressure of COVID-19 but has remained relatively resilient, with house prices expected to rise because of the virus’ impact.

- Nationally, residential prices fell by 1.8% in the June quarter, but still increased 6.2% in the year to June, as per ABS.

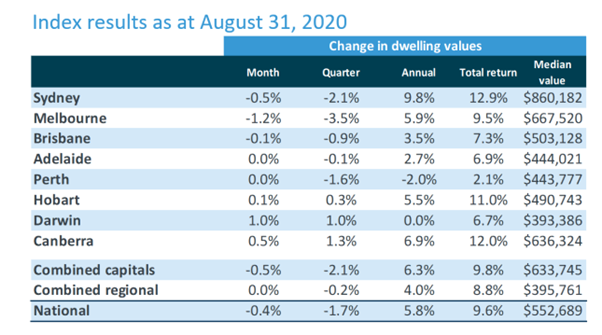

- CoreLogic home value index recorded a 0.4% fall in August, but the regional market continued to outpace their capital city counterparts.

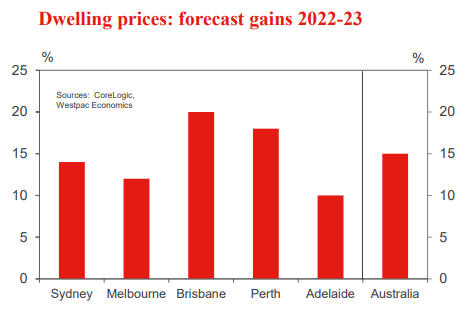

- Westpac has predicted a 5% fall in house prices from April 2020 to June 2021 before a rise of 15% in the following two years.

- Some capital cities are anticipated to boom by as much as 20%, fuelled by low-interest rates and easily available credit.

Australian property markets have taken a hit due to COVID-19 crisis, but house prices are expected to shoot up in future, as a result of the same.

Residential property prices declined 1.8% nationally for the June quarter led by a fall in Sydney and Melbourne property markets, which witnessed a drop of 2.2% and 2.3% respectively, as per the figures released by ABS on 15 September.

Andrew Tomadini, Head of Price Statistics, ABS, stated that the number of residential property transactions plunged significantly in 8 capital cities during the June quarter due to COVID-19 impact on the property market.

Canberra was the only capital city to avoid the price fall where property prices rose 0.8% in the June quarter.

ALSO READ: House Prices: Is Revival for Property Stocks set to be seen ahead?

However, he also noted that residential prices rose 6.2% in the year to June with an annual rise in all capital cities except Perth and Darwin.

Differing trends across Australian cities

The CoreLogic home value index showed that the housing values fell by 0.4% in August, which was the fourth consecutive month of coronavirus induced falls, but the rate of decline has dropped in the last 2 months, as 5 of the 8 capital cities logged stable or increasing values through August.

ALSO READ: What next in Property Space: House prices tumbled 0.4 per cent in August

Property market consultant’s Head of Research stated that the Melbourne housing market was the major lag on the results, where home values dropped by 1.2% in August, the biggest decline amongst the capital cities.

He added that the drop in the home values in Melbourne exhibited the effect of a relatively severe outbreak in Melbourne city compared to other capital cities, as well as a bigger demand-side impact coming from the halted overseas migration.

Source: CoreLogic, dated: 1 September 2020

Nonetheless, other capital cities posted better conditions compared to July as the falling rate of home values improved across Sydney and Brisbane, whereas home values remained stable or displayed a slight increase in the rest of the capital cities.

Further, regional markets have also persisted in outstripping their capital city equivalents across the largest states. As per property market consultant’s Head of Research, most of the regional markets were able to avert the fall in demand caused by the temporary halt in migration.

He also stated that a varied outcome for housing markets is expected ahead across Australia, based on how well the epidemic is managed, and how much is the region dependent on overseas migration as a source of housing demand.

Westpac expects housing prices to boom in 2021

Low-interest rates, government support, loan repayment holidays to distressed borrowers and a steady economy have led banks to be more optimistic on the Australian housing market.

DO READ: How is COVID-19 Second-Wave Scenario Impacting Businesses and Households?

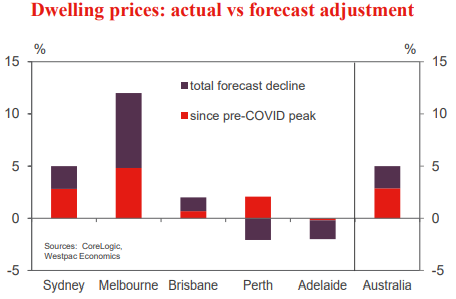

As per Westpac, residential property prices are anticipated to witness a 5% correction between April 2020 and June 2021 before a 15% surge across the following 2 years.

A few months ago, Westpac had projected that the national house prices will drop by 10% and recover a little more than 8% by 2022.

ALSO READ: Lens Through Property Market Players: LEP and CDP

However, Westpac economists have now improved their expectations citing market buoyancy. Westpac, Chief Economist, Bill Evans, and Senior Economist, Mathew Hassan had forecasted that national prices will ultimately fall 5% or 2.3% more to June.

They have now projected a more modest drop, with a fall in prices of 12% in Melbourne, 5% in Sydney and 2% in Brisbane, while prices in Adelaide are expected to lift 2%.

Source: Westpac’s ANZ Weekly, dated 18 September 2020

In its update for the week commencing on 21 September, Westpac has forecasted that prices will stabilise due to a substantial lift from lower interest rates. Both economists have stated that lower fixed rates have caught borrower’s attention to the assumption that there is not much to lose.

The bank expects prices to increase by 15% or about 7.5% per year over 2021-2023. Various factors like lower interest rates, fiscal and regulatory support, improved affordability, and a bolstering economy will support the recovery.

ALSO READ: How is the needle moving on Australia Property Space Amidst Recessionary Pressures?

Prices are expected to jump by 14% in Sydney, 12% in Melbourne, 20% in Brisbane, followed by 18% in Perth and 10% in Adelaide. Westpac Economists observed that affordability could be modestly worse than the long- term averages for Australia, as a whole on the basis of the increases, with benefits enjoyed by smaller states dwindling.

Source: Westpac’s ANZ Weekly, dated 18 September 2020

Other major lenders have also upgraded their outlook, with Commonwealth bank now anticipating 6% fall in prices in the next 6 months from the earlier prediction of a 10% fall.

However, ANZ still expects prices to fall by a greater 15%.

RBA’s take on the property market

RBA Board’s minutes of September 1 meeting also showed the members take on the national property market. They noted that even though prices had fallen in Sydney and Melbourne, the cumulative drop in the national property market has been less severe than experienced 2 years before, when the market corrected in 2018.

DO READ: Housing Sales And Prices Rising, But Can They Be Sustained?

However, the Board added that the rental markets have remained weak as rental supply was improved by short-term and holiday rentals being carried onto the long-term rental market, while the rental demand stayed low due to lower flow of new migrants and a drop in the rate of household formation.