Summary

- Adelaide’s Central and Hills areas have emerged as the most liveable metropolitan locations of Australia in Ipsos Life in Australia 2020 survey.

- Murray region in NSW is ranked as the topmost liveable regional location.

- Australian top priorities for life in the city include feeling safe, affordability of decent housing and high-quality health service.

- Home Property Value Index released by CoreLogic for October indicated that Adelaide across all the capital cities of Australia witnessed maximum MOM increase in the housing index.

In Ipsos Life in Australia 2020 survey, Central and Hills areas have emerged as the most liveable metropolitan locations of Australia. Adelaide has gained the top spot as the most liveable city and was the only metropolitan location in Australia that attracted above-average rating across all 16-liveability metrics. Significantly, ‘Liveability Index’ for Adelaide’s Central and Hills areas was recorded to be 71.5

COVID-19 pandemic and its ripple effect appear to have touched upon a plethora of aspects, gyrating the psychological focus of Australians as unemployment and economic issues continue to worry millions.

ALSO READ: Australian Economic Recovery Witnesses Robust Demand in Essential Services Sectors

Meanwhile, Murray region in NSW is ranked as the topmost liveable regional location, with the Liveability Index ranking of 70.4.

Ipsos Public Affairs Director Stuart Clark commented that the pandemic had impacted Australians’ priorities during the pandemic. At the same time, fundamental values sought by people for a place to live has remained unchanged.

ALSO READ: RBA says Australia might already be out of recession

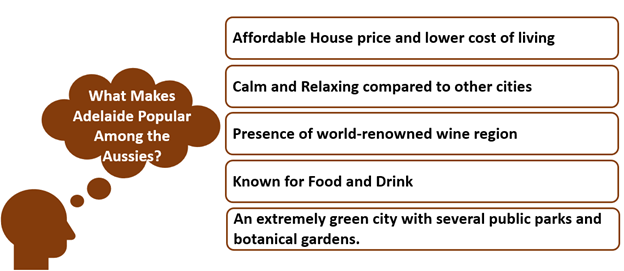

Factors Impacting the Choice of Australians

Concerns regarding the financial stability and health security remained rampant with the shutdown of many business activities during the lockdown. At the same time, a good number of transitions have been catalysed by the pandemic scenario, bringing a significant shift in the lifestyle and behaviour of people.

Ipsos survey considered 16 primary metrics to evaluate the preferences of the people as they evaluate the life quality associated with different locations in the Land Down Under.

The survey identified three key metrics which were the top priority for Australians concerning both metropolitan and regional areas. Top metrics include:

- Feeling Safe

- Affordability of Decent Housing

- High-Quality Health Service

Access to the natural environment was another essential element of consideration for both Australians. While ‘reliable & efficient public transport’ was another critical factor for metropolitan Australian, ‘good job prospects’ qualified as one of the deciding criteria for regional Australia.

Adelaide’s Property Price Resonating its Popularity

The recent CoreLogic data for the housing values points out that Adelaide’s popularity as the most liveable city seems to impact the ongoing house price movements. Home Property Value Index released by CoreLogic for October indicated that of all the capital cities of Australia, Adelaide witnessed maximum percentage increase (month-on-month) in the housing index.

Adelaide housing index rose by 1.17% in October MoM and was trailed by Perth and Brisbane, showing a growth of 0.58%. Meanwhile, Sydney witnessed the highest year-on-year increase in its housing value.

ALSO READ: House prices rise for the first time since COVID-19, CoreLogic Index Back in Green

Kalkine Image

Australia’s housing market has endured severe headwinds of COVID-19 pandemic, with the property bubble continuing despite economic contractions. Meanwhile, the record-low interest rates are facilitating the investments in the Australian properties. They have seen a significant rise in the demand with the relaxation of COVID-19 restrictions.

Home Property Value Index released for October indicated rise in the Monthly index for five capital city aggregate by 0.21%. Every state except Melbourne witnessed an uptick in the housing values indicating the growing confidence of investors in the Australian property market. The repercussions of the severe Victorian lockdown, however, have continued to impact the recovery of the property prices in Melbourne.

Australian Property Bucking COVID-19 trends

Despite the Australian economy remaining battered by the COVID-19 implication, the Australian property market has survived the storm. As per the CoreLogic data, the last week of October saw the clearance of 77% for 1757 homes taken for auction. The statistics indicate an increase in the number of scheduled auctions by 23% compared to the previous week. Meanwhile, the clearance rate recorded was highest ever since the week ending 1 March before the pandemic lockdown.

Canberra, Sydney and Adelaide saw the highest clearance rate. As the restrictions in Melbourne started to relax, the city saw a significant rise in the number of auctions.

A number of factors together seem to fuel the price movement of the Australian property Space amidst the pandemic uncertainty still gripping the globe.

ALSO READ: Commonwealth Bank Of Australia (ASX:CBA) Cuts Fixed Rate Mortgages & Business Loans, Variable Rates Unchanged

RBA Strategic Moves

RBA’s rate cuts and quantitative easing programs are expected to support the upward price trajectory for the Australian property spaces. The series of cuts in the lending rates have allowed the investors to fulfil their housing dreams at a significantly low cost of borrowing. While the central bank is ensuring the constant flow of money in the economy, the investors are making full use of the opportunity to avail the lucrative prospects.

Government Support

The Australian Government, through its $680 million HomeBuilder scheme, appears to offer the much-needed support to the Australian property space. First Home Loan Deposit scheme and first-home buyers grants apart from other tax benefits provide significant support, while inflating the Australian property bubble.

Economic Recovery

Australian consumer confidence for November jumped a 7-year high, signalling optimism among the Aussies about the economic recovery of the country. The Westpac-Melbourne Institute index of consumer sentiment continues on a growth curve for the third consecutive month. Significantly, the index rose by 2.5% further in November to 107.7 points.

At the same time, ongoing federal and state measures promise new hope for the Australia economy. The pandemic situation appears to be in control which seems to be fuelling positive momentum to economic reboot.

READ MORE: Australians’ consumer sentiment soars to 7-year high as COVID-19 fears fade

Opening of Borders

The relaxation of pandemic restrictions has been one of the most significant developments that are boosting the pre-Christmas fervour in the Australian property market. Victoria and NSW borders have been reopened while the phased implementation of the AU-NZ travel bubble has already begun. Australia is looking forward to welcome its international students to boost the property and rental markets.

READ MORE: Australia Marks Gradual Virus Control, Set to Fly Back Increasing Number of Stranded Citizens

Bottomline

Australia has a long list of fantastic cities, each offering a unique experience to its dwellers. Right from the hustle and bustle of Sydney offering myriads of job opportunities to the calm escape provided by Brisbane, Australia as a whole offers a rich feel. The choice of the city has always depended on objectives, climate preferences, psychological factors and of course, budget. However, the implications of COVID-19 seem to have reshuffled many priorities while some core factors yet remain unmoved. It would be interesting to witness to what extent and how long such transitions would continue to dominate Aussies’ preferences as they choose the most liveable city.