Summary

- Labour has unveiled its long-awaited new top tax rate of 39% for people earning more than $180,000 a year, which would only affect 2% of Kiwis.

- The new rate is expected to add to annual revenue of $550 million a year, which will be used to fund health, education and pay down coronavirus debt.

- The new tax will cost $23 per week for an individual earning $200k but will make a huge difference to the nation’s capability to sustain investments required for the economy to rebound.

- Labour also plans to work with OECD on the issue of MNCs not paying their share of tax, and is preparing to implement Digital Service Tax, which applies to digital platforms.

Jacinda Ardern’s ruling labour party has proposed a new higher tax rate of 39% on income earned over $180,000 implying that only 2% of the taxpayers would in reality pay it, while others would keep paying taxes at the same rate as before.

The party has pledged no new taxes or any further tax increase in the next term if it is re-elected. She has asserted that the new top tax rate given by her party is the best for New Zealand and would generate NZ$550 million in revenue in a year. The funds would be expended on health, education and pay down COVID-19 debt.

Grant Robertson, the Labour finance spokesperson, stated that the new tax policy is to maintain investment in crucial services, while keeping tax rates the same for 98% of the people. He also stated that the policy indicated to people that the Labour government wants to attain a balance, as NZ recovers from a once in a century shock induced by COVID-19, drawing a line on the debt and not making cuts to important services.

ALSO READ: How are New Zealand's Businesses and Economy coping with new COVID-19 cases?

He stated that the COVID-19 borrowing was done to finance emergency measures like the wage subsidy that safeguarded about 1.7 million jobs and aided in the survival of businesses and workers amid virus-induced lockdown. However, he asserted on the requirement to not run more debt than needed for the country’s recovery.

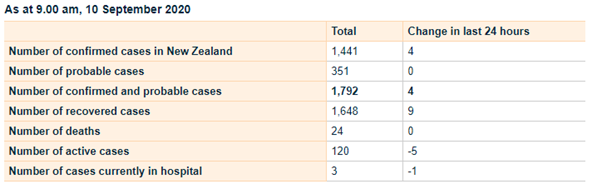

In New Zealand, coronavirus has infected about 1,792 kiwis and led to 24 deaths, as on 10 September.

Life had returned to normal for New Zealanders when another outbreak in Auckland disrupted the coronavirus free flow of 102 days in the country. Auckland is at an Alert level of 2.5, which restricts gatherings to not more than ten people, while other parts of the country are at Alert level 2. The restrictions are due to be reviewed in mid-September.

Interesting Read; NZ Economic Charter: Three Silver Linings in the COVID-19 Cloud

Source: Ministry of Health, NZ

The tax that Kiwis will pay

The new tax rate would cost $23 per week for an individual earning NZ$200k, but it will make an enormous difference to the capability of the nation to sustain investments required for the economy to rebound.

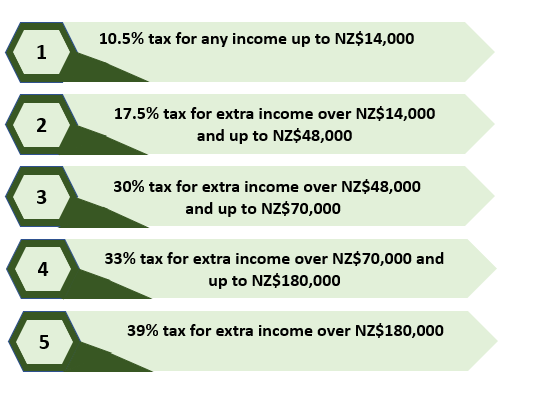

The highest tax rate in NZ is 33% on each dollar of income exceeding NZ$70,000, while the lowest tax bracket is 10.5% on income of up to NZ$4,000. The median income of NZ stands at $52,000, at which the effective tax rate is about 18% as only people with income between NZ$48,000- NZ$70,000 are taxed at that rate.

Labour opted $180,000 as the benchmark because it includes the top 2% of the earners in NZ and matches the top income tax rate of Australia.

The new tax thresholds under the re-elected government will look as mentioned below:

Stuart Nash, Labour’s revenue spokesperson, stated that the 39% tax rate of NZ matched well with rates in Australia, which pays a much higher rate of 47% for Australians earning over A$180,000. He also added that NZ needed more stability in the tax system. However, the new top tax bracket means that NZ still stays in the bottom third of the 36 OECD nations, when it is goes to a top tax rate.

He asserted that it is well known by the Labour that the economies of Australia, Canada and the UK have had witnessed a solid growth when high earners were charged with tax rates of more than 39%.

NZ previously had a 39% tax bracket under Helen Clark’s Labour government on income over $60,000, and it definitely did not stop GDP from growing at annual rates of 3% and 4%. Mr Nash publicised the economic accomplishments of the Clark government as a justification to be more hopeful about the new tax bracket.

The broader regime for more fairness in taxes

The Labour party is also working with OECD to seek an answer for issues like MNCs not paying their share of tax. Mr Robertson asserted that the Labour would keep working on securing an agreement internationally for a broad regime for MNCs to pay their fair share of tax. However, he also noted that their own rules must also be put in place to prepare the country and to ensure fairness if that agreement was not reached.

He stated that the Labour would be prepared to implement a Digital Services Tax (DST), which is expected to raise between $30 million and $80 million of revenue in a year. Revenue earned by digital companies like Amazon, Google and Facebook can be taxed through DST, strengthening the worldwide endeavours to bring tech giants under the tax web.

GOOD READ: Coronavirus Crisis Raises Debate On Changing Tax Laws For Foreign Tech Companies

As per Mr Robertson, the revenue policy of the Labour is to manage the books maturely as the planet wrestles with COVID-19 and the consequent economic plunge. NZ is not exempted from the ravaging impact of coronavirus, which the world is facing at present. Hence, $14 billion has been saved in the COVID Fund to help the country in sailing through the second wave if it arrives.