Highlights

- The growth in Australian property values is losing steam, with capital cities recording a sharp slowdown.

- Sydney posted the first-ever decline of 0.1% in property values since September 2020.

- Sydney and Melbourne have observed advertised housing stock returning to more normal levels.

The Australian housing market has continued to remain red-hot during the COVID-19 era, with prices moving haywire amidst strong demand and supply crunch. And it has not been welcome news for several aspiring first-time homebuyers who could no longer afford property despite record-low interest rates.

But there is good news for these homebuyers as property prices are finally taking a breather. And fortunately, they can still harness the benefit of record-low interest rates, which continues to prevail at the same level.

Why Are First-Time Homebuyers Fuming At Australia’s Property Boom?

The recent statistics from the property consultant CoreLogic reveal that growth in Australian property values is losing steam, with capital cities recording a sharp slowdown. The property consultant’s National Home Value Index surged by 0.6% in February, which is the lowest monthly growth reading since October 2020.

Slowdown in capital cities

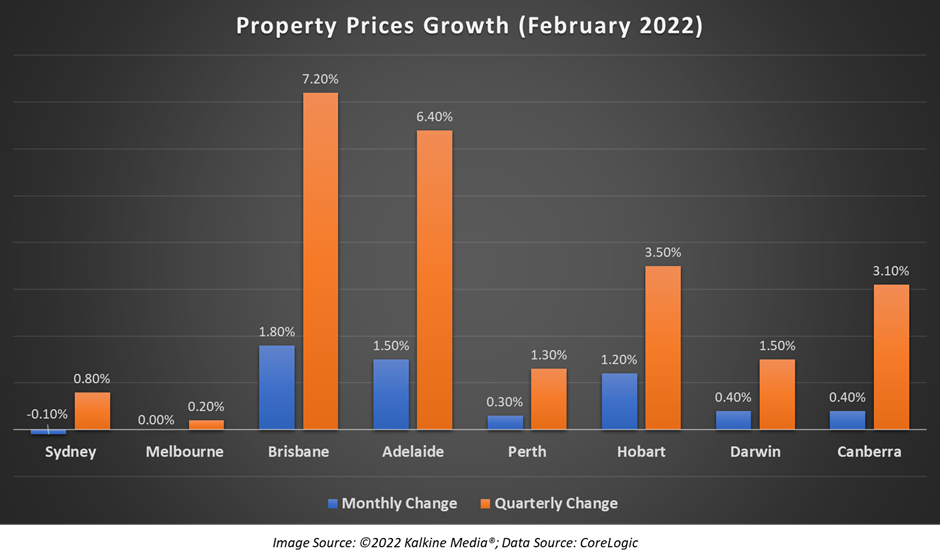

Almost every capital city is recording a slowing trend in value growth, with Sydney demonstrating the sharpest slowdown. In February, Sydney posted the first-ever decline of 0.1% in property values since September 2020, with Melbourne housing values remaining unchanged over the month.

While property prices eased in these capital cities, smaller capitals – Adelaide, Brisbane, and Hobart – recorded a decent increase in housing values. Property values rose by 1.5% in Adelaide, 1.8% in Brisbane and 1.2% in Hobart in February 2022.

It is worth noting that although property values are generally rising, the pace of growth has trended downwards since April 2021. This is because fixed-term mortgage rates started to face upwards pressure, housing affordability became more stretched, and fiscal support began to expire since April last year.

Meanwhile, the possibility for weaker consumer sentiment amidst tighter monetary policy set-up and rising global uncertainty has made downside risk for property markets more pronounced in recent months.

Change in advertised supply

The advertised inventory levels help describe the divergence in property growth trends. The total number of properties advertised for sale was about 13.3% lower than the same period a year ago across Australia. This shows an ongoing shortage of available housing to purchase at the macro-level.

Also Read: How can housing become more affordable in Australia?

Notably, advertised supply levels are gradually normalising after standing close to 25% below the previous years’ level prior to 2021. Sydney and Melbourne have observed advertised housing stock returning to more normal levels. However, Australian capitals are continuing to see extremely low inventory.

Image Description: Housing supply yet to catch up with housing demand

Interestingly, cities where property values are rising more rapidly are showing a clear lack of available properties to purchase. For instance, total listings across Adelaide and Brisbane remain more than 40% below the previous five-year average and more than 20% lower than a year ago.

Good Read: Is an interest rate hike necessary to control Australia’s property boom?

Key factors to watch

Rising mortgage rates and a mix of affordability challenges can be credited for the changing dynamics in the property market. Fears loom that consumer sentiment could weaken due to Russia’s invasion of Ukraine, triggering a fresh wave of global uncertainty.

However, significant easing in social distancing restrictions and the rollout of vaccinations is resulting in increased foot traffic across capital cities. As Aussies cautiously emerge from social distancing, there is expected to be a shift in household spending and a slowdown in savings that might have turned towards a deposit.

Looking forward, certain upsides in the housing market can be watched out for. Reopening of domestic and international borders could support housing demand in the months ahead. While home buying demand may not revive immediately, the entry of foreign visitors and students could drive stronger rental demand.

Interesting Read: How can Australia’s international border reopening revamp the job market?

Higher wages growth and improving economic conditions are anticipated to keep a floor under property demand and distressed housing sales to a minimum.