Highlights:

- The YFI crypto is the native token of yearn.finance.

- finance uses various custom technologies to function as an aggregator for DeFi protocols.

- YFI crypto has many trading pairs for cryptocurrencies, stablecoins, and fiat money.

The cryptocurrency market has dipped significantly once again as extreme volatility continues. On Monday, the valuation of the digital currencies decreased by 3.4 per cent to US$ 1.01 trillion, which has sent the price of Bitcoin and major altcoins in negative territory.

At 3 AM EST, Bitcoin was down by 3.5 per cent in the last 24 hours, and Ethereum (ETH) tumbled 5.6 per cent to US$ 1,523.65 per token.

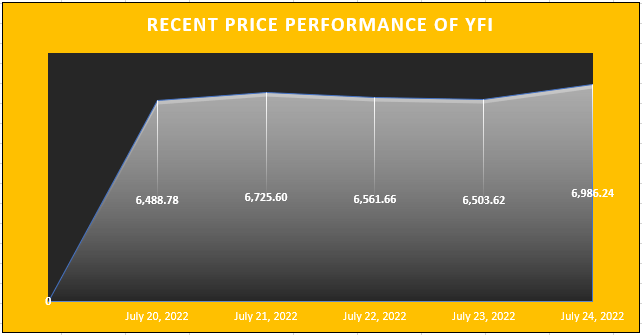

It appears that due to the declining trend in the market, the YFI crypto took a hit and dipped three per cent to US$ 6,599.74 apiece. Let's find out more about the cryptocurrency:

What is YFI crypto?

The YFI crypto is the native token of yearn.finance, decentralized finance (DeFi) investor aggregator service. The protocol uses automation to enable investors to maximize yield farming earnings.

The objective of building the yearn.finance was to make the DeFi infrastructure simpler for investors as everybody is not tech savvy, and some people prefer to communicate less formally than serious traders.

YFI crypto has many trading pairs for cryptocurrencies, stablecoins, and fiat money. Also, it is a freely tradable token. Binance, OKEx, and Huobi Global are significant exchanges that trade YFI.

©2022 Kalkine Media®

On July 22, yearn.finance took potshots at traditional financial institutions through a series of tweets, and it gained traction among crypto enthusiasts. However, that did not translate into positive investors' attention.

Let's take a look:

Source: Twitter @iearnfinance (yearn.finance)

Bottom line

Yearn.finance uses various custom technologies to function as an aggregator for DeFi protocols like Curve, Compound, and Aave, providing cryptocurrency investors with the maximum yield possible.

However, due to the rising interest rates, the high annual percentage yields (APYs) of the cryptocurrencies have almost vanished. Hence, the YFI crypto could fail to attract investors.

Yearn expanded the concept of DeFi legos and the capacity of a team to permissionless construct a protocol on top of the smart contracts of other projects to provide value.

It would be worth observing how the cryptocurrency fares in future, and investors must exercise caution before investing in any digital asset due to the current market conditions.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.