Highlights

- Privacy-enhancing public blockchain Aleph Zero (AZERO) crypto is one of the unique tokens which offers solutions to enterprises catering to Web3 and DeFi.

- Launched in November 2021, the 2805-ranked AZERO crypto was witnessing a dip on Tuesday as it was down over 6.48% at 7:30 AM (GMT +1), according to CoinMarketCap.

- The Aleph Zero protocol on 23 August, was enjoying a volume gain of over 22.95% at the time of writing.

Privacy-enhancing public blockchain Aleph Zero (AZERO) crypto is one of the unique tokens which offers solutions to enterprises catering to Web3 and DeFi. AZERO crypto aims to target the issues related to speed, scalability and security that plague the DLT technology.

Operating both as a public and private ledger, the AZERO crypto depends on the Proof-of-Stake consensus and aims to allow the developers to further develop on the Zero-knowledge Proofs (ZKPs) and secure Multi-Party Computation (sMPC).

Launched in November 2021, the 2805-ranked AZERO crypto was witnessing a dip on Tuesday as it was down over 6.48% at 7:30 AM (GMT +1), according to CoinMarketCap.

Reason for AZERO’s dip

The exact reason for AZERO crypto’s dip is hard to establish considering it was one of the cryptos which managed to register gains over the past week or so. Though it has witnessed a few reds on the way, its performance in August has been more or less consistent. But, ever since US Federal Reserve released the minutes of its July meeting, AZERO crypto too has taken a hit.

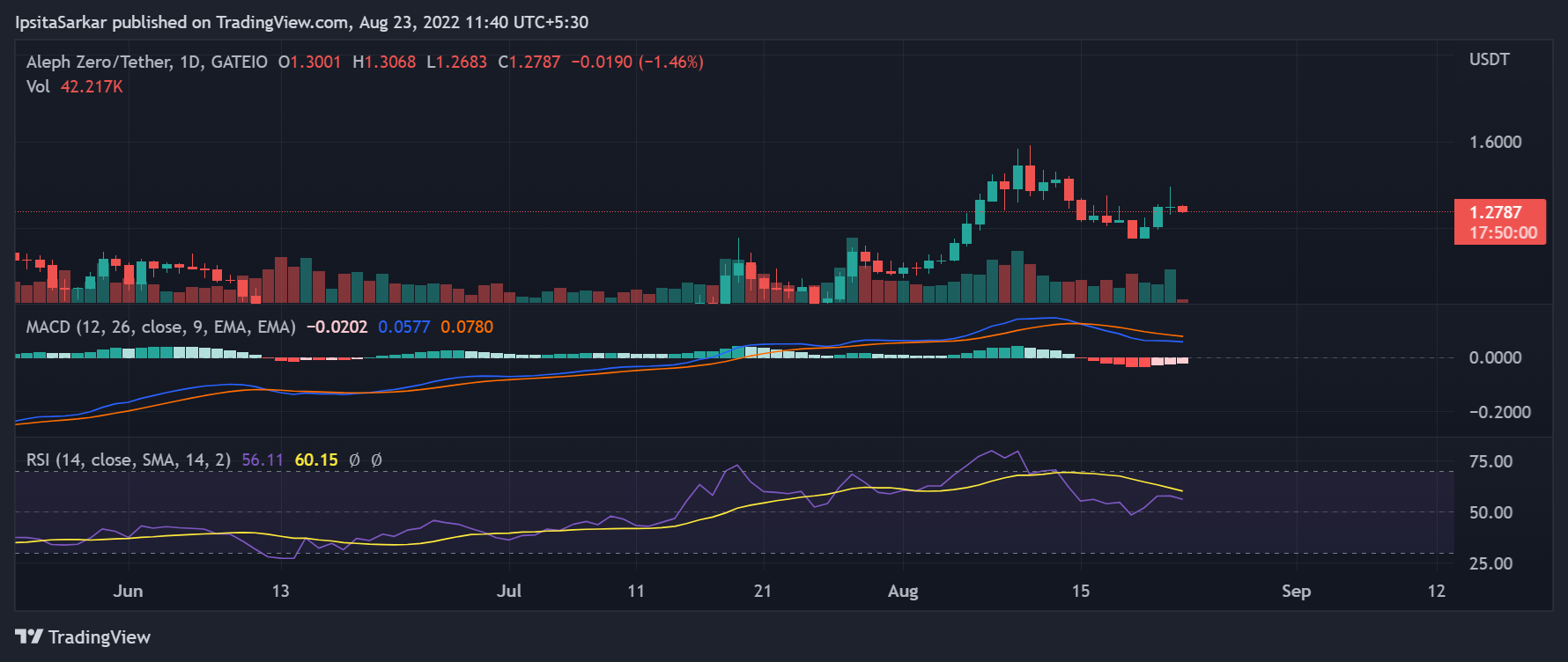

In fact, if one were to look at the charts, it would reveal that the MACD line, despite it being below the signal line had managed to maintain a consistent run.

Image credit: Trading View

In fact, even though the RSI of the token during the intraday trading session was at 56.11 indicating that would indicate that it was still keeping market participants interested in the token.

Price and performance

The Aleph Zero protocol on 23 August was trading at US$1.28 with a trading volume of US$24,05,009 over a day, according to CoinMarketCap. The Aleph Zero crypto had a market cap of US $98,049,355 with a total supply of 299,999,720 AZERO coins. The AZERO crypto, despite being down, was enjoying a volume gain of over 22.95% at the time of writing.

Aleph Zero’s fall indicates how volatile the crypto markets can be and why market participants need to do proper market research before they make critical investment decisions.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instruments or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete, or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.