Highlights

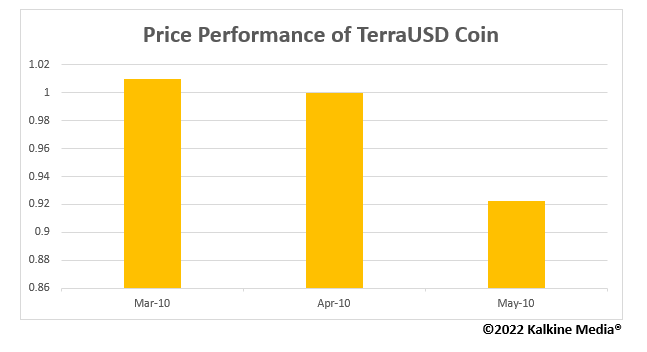

- As of writing, the TerraUSD (UST) was down by about eight per cent to US$ 0.9226 per token.

- On Monday, the Luna Foundation Guard (LFG), which supports the LUNA crypto and TerraUSD, said that it would defend the stability of UST.

- LFG will lend US$ 750 million worth of Bitcoin to trading firms, and another US$ 750 million in UST will be lent out to buy more Bitcoin.

The cryptocurrency market investors are in a panic mode as it continues to decline rapidly, and the prices of almost all the cryptocurrencies fell significantly on Tuesday, May 10.

One cryptocurrency has caught the attention of crypto trades as its value slipped, something which was unexpected. We are talking about TerraUSD crypto, a stablecoin that has slipped from the intended US$ 1 peg.

Also Read: Bitcoin SV (BSV) crypto records surge in price and volume. What's next?

Stablecoins are virtual currencies pegged to fiat money like a dollar or cryptocurrency. Terraform labs created TerraUSD or UST in 2018, and it tracks the value of the dollar.

How is TerraUSD faring?

As of writing, the TerraUSD (UST) was down by about eight per cent to US$ 0.9226 per token. On Monday, the stablecoin had reportedly dropped below 70 cents for the first time, an indicator that holders are fleeing the token amid a crashing crypto market.

At 7 AM EST, the global crypto market cap had declined to US$ 1.46 trillion after falling three per cent over the last 24 hours.

Tether and USDC stablecoins are known to keep cash and other assets in reserve to back their tokens. However, the TerraUSD token stabilizes the prices through an algorithm and a sister token named LUNA.

Also Read: Zilliqa (ZIL) crypto soars amid a rising market. Here's why

Crypto traders could be keeping an eye on the UST token to see if it can maintain its peg to the US dollar. If this doesn't happen, people may consider it a significant risk in the crypto market.

The price of Bitcoin fell below US$ 30,000 for the first time since July 2021 on Tuesday. However, it later recovered to US$ 31,963 per token at the time of writing.

Bottom line

The declining price of Bitcoin is sending investors into a panic mode, and the instability of the TerraUSD stablecoin could be partially responsible for it.

On Monday, the Luna Foundation Guard (LFG), which supports the LUNA crypto and TerraUSD, said that it would defend the stability of UST.

LFG will lend US$ 750 million worth of Bitcoin to trading firms, and another US$ 750 million in UST will be lent out to buy more Bitcoin.

Some analysts believe that the UST's Bitcoin underpinning could further negatively affect the price of the cryptocurrency. The crypto market is full of uncertainties. Hence, you could closely watch the developments and form a decision once the storm settles.

Also Read: ANKR crypto price is down and volume is up 18%. What's next for Ankr?

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.